Accounting Software and Models, Statistics Problem Example

Introduction to Mothercare PLC

Mothercare plc functions as a wholesaler and retailer of services and products for mothers, babies, mothers-to-be, and children. The company has been selling its products under the brands of Mothercare and Early Learning Centre. The company provides maternity and children’s clothing, home furnishing products, and furniture, as well nursery products, pushchairs, car and travel products, care and safety products, the bedroom products of kids, gifts and toys, feeding, clothing, and changing and bathing products. The company also running retail franchises in the Middle East, Europe, Africa, and the Far East. Mothercare plc has been doing the business through catalogues, retail stores, and the Internet. At present, Mothercare plc had 1115 retail stores in the world and 609 retail stores in the United Kingdom. Further, the company operates and owns Gurgle.com, which is a social-networking site for the parents.

The brand of Mothercare plc has international appeal and become successful in providing a “one-stop shop” shopping place in 53 countries, which have been connected to its international catalogue and internet business, presents a huge range of products.

The range of products is pride for Mothercare in becoming a specialist retailer, offering such items that are innovative, safe and relevant to those parents who have been facing the ever-changing necessities in raising their children and assisting them to meet the aspirations and needs of their children, internationally.

The brand of Early Learning Centre also has a strong tradition. It was initially established as a business of mail-order, which was offering d books and toys with educational content; afterward, Early Learning Centre expanded its reach into the United Kingdom and oversees stores. It also has a multi-channel system providing customers the option to shop in-store, on the internet or with the help of seasonal catalogues. The Early Learning Centre offers eight toys and games major categories, mainly from birth to six years old. Both Early Learning Centre and Mothercare source products around the world.

The group manages the products sourcing with the help of three major sourcing offices, one each in Hong Kong, Shanghai and Bangalore. These offices are the medium for exclusive and innovative development of product. Product sourced from the major markets is then combined and shipped to the retail stores of Mothercare in the world market through a dedicated supply chain established to be both environment and costly efficient.

Finally, the Gurgle.com which is networking service website offering support and a lot of information to those users who are registered on all parenting aspects and also providing the opportunity to new mothers in sharing their experiences.

Background

Mothercare plc started its first store in the year 1961 in Surrey. Originally, the business dealt in nursery furniture, pushchairs and maternity clothing, but it afterward extended its range of products.

The mail-order business was started in 1962. Mothercare plc first turned out as a public company in 1972 and in 1982, Mothercare consolidated its business with a retailer chain named as Habitat in order to form Habitat Mothercare plc. In 1984, Mothercare started to extend its business in the worldwide markets by entering into franchise systems with selected franchisees in chosen countries. Habitat Mothercare plc, in 1986, merged with another retail stores chain named as British Home Stores plc. Throughout the 1990s the consolidated group was rationalized. Mothercare plc turned out as a single brand and the name of the holding company was changed to Mothercare plc.

In the end of first half of 2007, the group purchased the Chelsea Stores Holdings Limited which is now the owner of the Early Learning Centre (ELC) brand.

ELC was established in 1974 initially as a business of mail order that was offering books and toys with educational content. The first retail store ELC opened later in the same year. ELC was acquired by John Menzies plc in 1985 who continued to extend the estate and ELC appeared as a renowned high street brand. ELC, in September 2001, went through the management buyout, during which ELC smooth its operations, shut down non-profitable items and stores and expanded its sourcing operation in Asia.

Current Position

At present, the Mothercare group has had great challenges concerning to the international operations to provide profit growth and strong sales and the United Kingdom observing flat sales in a complex trading market together with a downward trend in profitability.

The sales of the Group increased by 3.6% from £766.4 million in 2010 to £793.6 million and group profit before tax reduced to £8.8 million from £32.5 million. The group of Mothercare at operating level remains cash generative and was a free of debt in the end of year with net cash of £15.3 million. In May 2011, the group refinanced, increasing and committed facilities of the bank from £40 million to £80 million expanded to the period of 2014 on improved terms, which involves a decrease in an interest rate from 1.7% to 1.4% above LIBOR. This increased facility that is additional to an uncommitted £10 million overdraft, provides the group further opportunities to finance the next stages of Mothercare growth strategy. Concerning to the overall group performance and the sound underlying cash flows from operations generated from International market, in particular.

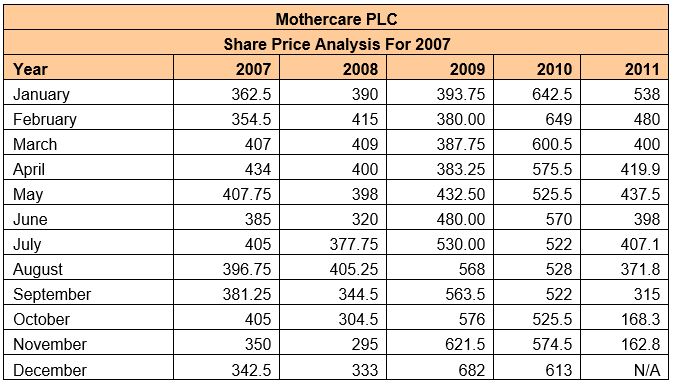

Share Price Analysis

The share price of the Mothercare plc has been showing a mix trend. The price of a share increased in 2006 to 374p because of the good business, and then it dropped down to 342.5p in 2007. The reason was this reduction in share price was the economic crunch that affects the whole industry and even the world markets. The effects of these economic crises remain in 2008 and reduce the share price to 333p. As in 2009, the world market recovered from economic crises this also affects the share price of Mothercare plc and the increased to 682p. But, when in 2010, the group shows a low performance, and its profits decreased that ultimately result into the low price of a share that again dropped to 613p. As stated above, the year of 2011 for Mothercare is a complex in terms of international market where the competition arises in the industry. This year also proved as expensive in terms of cost of sales that also reduces the profit. Moreover, the tax charge in this year also high that again becomes the reason of reduction in profits. All these factors badly contribute in reducing the price of a share in this year 2011, the share price drop down to 162.8 p.

Ratio Analysis

Liquidity Ratios

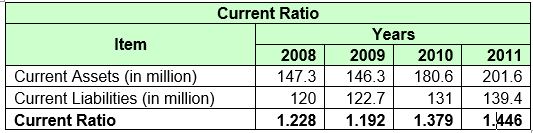

Current Ratio

Current ratio measures the short-term liquidity position of a business organization. This ratio is negatively associated with the profitability of the organization. It can be computed as follow:

Current Ratio = Current Assets / Current Liabilities

Explanation

The current ratio of Mothercare plc is 1.446 in 2011, which means that the Mothercare plc can meet its current liabilities when fall. Over the years, the current ratio remains above from the standard. The graph also providing a view of good mix concerning to the current asset and current liabilities at Mothercare plc. The graph and table show that there is a little change in the current asset ratio but overall the position is very good.

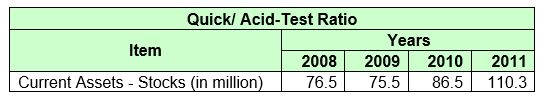

Acid-Test/Quick Ratio

Quick ratio measures the short-term liquidity position, where the firm is able to settle its short-term debts, if the slow moving items removed from the current assets like Inventory, and Prepaid. Compute the acid-test / quick ratio as follow:

Acid Test Ratio = Current Assets – Inventories / Current Liabilities

Explanation

The above graph and table show that quick or acid-test ratio in 2011 is 0.791 times, which is increased with a minor change from the ratio of 2010. However, the figures of both years are presenting that company’s current assets cannot meet the current liabilities of Mothercare plc. The reason is that Mothercare plc has been maintaining a huge amount in shape inventories or stock. That needs to be maintained properly if the company wants to meet it current liabilities with more liquid assets. In order to manage the stock value, Mothercare plc needs to adopt a good stock control method. For this purpose, Mothercare plc can adopt the Just-In-Time (JIT) stock control system. This would help Mothercare plc in maintaining the stock to the sufficient level that would ensure that the company can meet its current liabilities with its more liquid assets.

Profitability Ratios

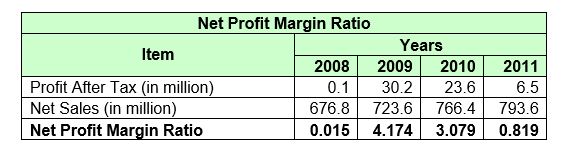

Net Profit Margin Ratio

Net Profit Margin shows what percent of sales revenues is left after expenses related to operations and the effects of financing and taxes. Net Profit Margin measures the Net profit generated by each GBP of sales.

Net Profit Margin = Net Profits / Net Sales x 100

Explanation

The net profit margin ratio of Mothercare plc has been revealing that company is in a serious trouble because its profits badly decreased in 2011 to 6.5 million, which was 23.6 million in 2010. The main reason for this huge decrease in profits is due to the increase in cost of sales. In 2011, the cost of sales increases approximately 8.5% from the cost of sales in 2010. This decline in profits ultimately results into the reduction in the price of per share.

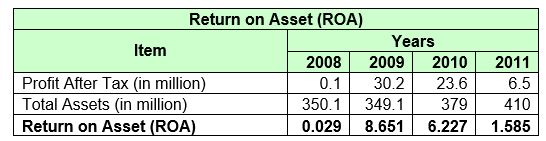

Return on Asset (ROA)

Return on assets measures the firm’s ability to utilize its assets to create profits. Compute the return on assets as follow:

Return on Assets = Profit After Tax / Total Assets x 100

Explanation

The return on asset ration of Mothercare plc presenting that the asset of the company is not properly generating the profits for the company. In 2009, this ratio was 8.651%, which means that the assets of Mothercare plc are generating 8.651% of the total profits earned in 2009. Similarly, the ratio drop down to 6.227% in 2010 because of reduction in profit and increase costs and taxes. Again, in 2011, the return on asset drops down to 1.585%, which means that the assets of Mothercare plc are generating only 1.585% of the total profit. The main reason for this huge reduction is the increase in total assets and decrease in net profits because of increase cost of sales. In order, to create a favorable situation the company must invest such assets that help in generating the profits.

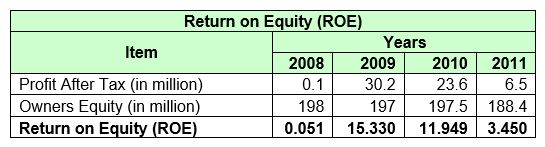

Return on Equity (ROE)

Return on Equity measure is measure to know that how much profit generated with the shareholders’ equity. Compute the return on equity as follow:

Return on Equity = Profit After Tax / Shareholders’ Equity x 100

Explanation

The return on equity of mother care also presents the downward or negative trend. In 2009, this ratio was good but in 2010, it dropped down from 15.330 to 11.494. In 2011, because of low profits this ratio drop down to 3.45 which means that the equity of the company is helping in generating only 3.45% of the total profits of the company. This is a dangerous situation that company needs to make better by investing such activities that help in generating the profits.

Gearing Ratios

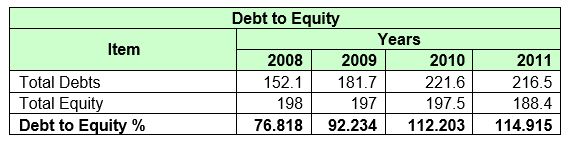

Debt-to-Equity Ratio

It is a measure of a company’s financial leverage calculated by dividing its total liabilities by stockholders’ equity. It indicates what proportion of equity and debt the company is using to finance its assets.

Debt to Equity Ratio = Total Debts / Total Equity

Explanation

The debt to equity ratio of Mothercare plc has been increasing over the year. The debts in relation to equity in 2008 were 76% of total equity, but the ratio increased to 114.915% in 2011. This indicates that the company is more financed by debts than the shareholders’ equity. This is, however, bad situation indicating that company need to pay more interest costs that ultimately contribute in reducing the profits of Mothercare plc. Mothercare can reduce this ratio by issuing more shares so that the amount can be collected to finance the business.

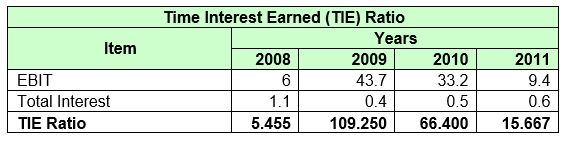

Time Interest Earned (TIE) Ratio

Time interest earned ratio (TIE), also known as an interest coverage ratio, indicates how well a company can cover its interest payments on a pretax basis. The larger the time interest earned, the more capable the company is at paying the interest on its debt.

TIE Ratio = EBIT / Total Interest

Explanation

The time interest earned ratio of Mothercare plc in 2011 is presenting that company can meet it interest cost approximately 16 times from its operating profits. This ratio was five times in 2008 and increased to 109 times in 2009. However, this ratio decreased to 66 times in 2010. However, still the company is in strong position of paying its interest cost from its operating profits, but this is an alarming situation for Mothercare plc that the ability that company has in 2009 of paying its interest 109 times decreased to 16 times.

Investor Ratios

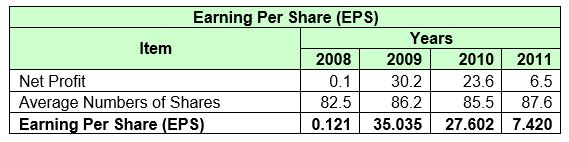

Earning Per Share (EPS)

Earning per share (EPS) presents the portion of a company’s profit allocated to each outstanding share of ordinary stock. It can be computed with the following formula;

EPS = Net Profit for Equity Shareholders / Average Number of Shares

Explanation

The Earning per share (EPS) has been showing an adverse situation that company prevails. EPS of Mothercare plc has badly fallen down from 35.05p per share in 2009 reach to 7.420p per share 2011. This is because of the increase in the cost of sales that reduces the company’s profit and ultimately reduces the earning per share.

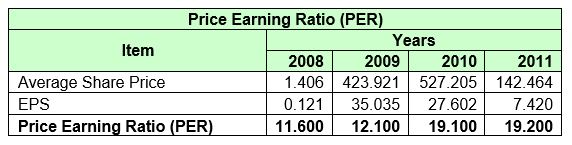

Price Earning Ratio (PER)

The P/E ratio is a vital ratio for investors. Basically, it gives us an indication of the confidence that investors have in the future prosperity of the business. A P/E ratio of 1 shows very little confidence in that business whereas a P/E ratio of 20 expresses a great deal of optimism about the future of a business.

PER = Current Market Share Price / EPS

Explanation

This ratio increased from 2008 to 2011. In the first two years it almost remains same, i.e11.60 and 12.10 respectively. In 2009 and 2010, it reached to 19.10 and 19.20 per share. This increase providing that the company is attractive for the investors who can expect more profits from the company.

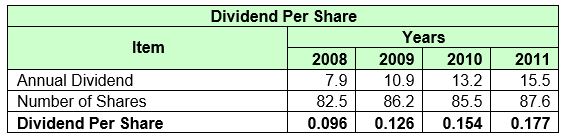

Dividend Per Share

Dividend Per Share = Annual Dividend / Number of Issued Shares

Explanation

The dividend per share of Mothercare plc in 2008 was 9 6p and it increased in 2009 to 12.6p per share. Again, in 2009 with a great increase reached to 15.4p per share. And in 2011, the company distributed dividend of 17.7p per share. It presents that company is good in paying dividend its shareholders per year, which can be attractive situation for the investors to invest in the company.

Activity Ratios

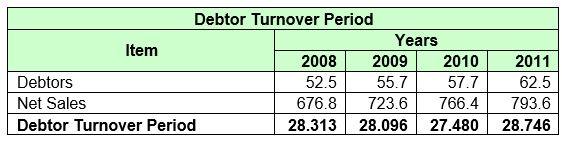

Debtor Turnover Period

Debtor turnover ratio indicates how long, on average, people take to pay a firm for their purchases. Generally, the higher the ratio, the more efficient is the management of debtors.

Debtors Turnover Period = Debtors / Net Sales x 365

Explanation

The debtor turnover period of Mothercare plc approximately remains same in the four-year period from 2008 to 2011. In the year 2008 and 2009, it was 28 or 29 days approximately, but in 2010, the debtor turnover period reached to 27 days but again in 2011 the debtors take 28 or 29 days in making payments against credit sales. In comparison to the creditor turnover period, debtor turnover period is less, which means that Mothercare plc receive the payments from customers before making the payments to the creditors, which is a good sign for the company growth.

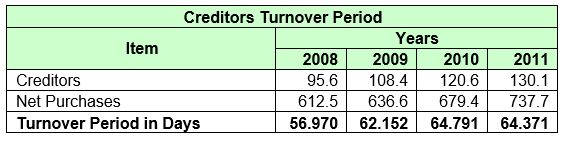

Creditors Turnover Period

This ratio indicates the speed with which trade creditors/suppliers are paid. A low turnover ratio reflects liberal credit terms granted by suppliers, while a high ratio indicates settlement to creditors rapidly.

Creditors Turnover Period = Creditors / Net Purchases x 365

Explanation

The creditor turnover period increased from 57 days in 2008 to 65 days in 2010. It decreased with little change in 2011 and reached to 64 days. All this indicates that the Mothercare plc is taking 64 days in 2011, which was 57 days in 2008. However, this is a good sign that the payment period to creditors is increasing over the time. By paying late to the creditors, Mothercare can invest this amount in some other investments with the high rate of return.

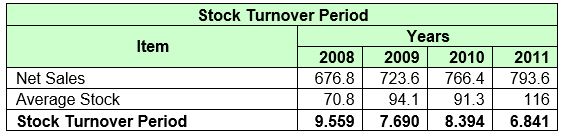

Stock Turnover Period

Inventory turnover ratio shows how many times inventory of a Mothercare replaced over a year. It can be calculated by;

Stock Turnover Period = Net Sales / Average Stock

Explanation

The stock turnover ratio of the Mothercare plc has been decreased from the year 2008 to the year 2011. This indicates that company is less efficient in converting the stock into sales over the years. In 2008, the stock turnover was 9.559 times; it reduced to 7.690 times. In 2010, it shows a little increase and reached to 8.394, but again in the year 2011; it dropped down to 6.841. This means that Mothercare coverts the stock into sales only 6.841 times, while it was in 2008 was 9.559 times. In this way, the company is investing more into stock that is obviously invested on zero percent rate of return. An efficient inventory control system can help the company in turning the stock into sales more times.

SWOT Analysis

Strengths

Mothercare plc is a UK based specialist retailer of unique products for mothers, mothers to be and children up to the age of eight. It is also the strength of company that Mothercare plc had 1115 retail stores in the world and 609 retail stores in the United Kingdom. Further, the company operates and owns Gurgle.com, which is a social-networking site for the parents. The customers of the Mothercare plc are loyal to them that are helping in creating more sales. Through an effective communication system, the company has been handling the customers from all over the world.

All the employees of company are involved in the delivery of its strategy. Mothercare plc frequently discusses with all its employees its corporate objectives, performance as well as the economic environments in which the Company trades through its business sectors.

Mothercare plc believes that by trying to achieve a high standard of corporate governance in all the actions performed by the group, the group’s reputation and performance will be enhanced.

Weaknesses

It has been observed that, company is adopted the Upselling strategy, which means the company is only selling the expensive products in order to generate more sales and ultimately, the more profits. This strategy may be suitable to customers with more earning, but it is less attractive to the low-income people, and hence they cannot buy the products of Mothercare plc. Another weakness of the Mothercare plc is that the company is only marketing through the web only. The other sources like TV commercials, ads in magazines and news papers can also help in generating more sales and profits to the company.

Opportunities

As Mothercare plc marketing its products only through the web, so there are more opportunities to cover the market share from International markets. Recently, Mothercare opens a fourth store in Australia, so there are more chances to generate profits from such a diverse location.

Threats

Likewise, the opportunities, Mothercare plc also have some threats in conducting the business. The main threat is the competition from other retail stores that are offering both the products that are Upselling and cross-selling nature. Hence, there is a chance that the competitors may grab the big market share in the future. Mothercare also has some threats concerning to the external changes in government, politics and tax policies.

Conclusion

In conclusion, it is clear from the above discussion that Mothercare plc has been suffering from a very dangerous situation. This is mainly because of the increase in cost and competition among rival companies. Mothercare plc needs to do something in order to come out from this horrible situation where the company is unable to pay its even current liabilities. The company needs to take some innovative steps in introducing more and innovative products with the changing needs of parents and their children which will obviously help in generating more profits. Mothercare plc must adopt such procedures that help in reducing its cost of sales that eventually rises in this year. Such products or business units must be shut-down after proper evaluation in order to reduce costs. In short, Mothercare plc needs to take some serious steps to get out of this worse situation.

References

Berry A and Jarvis R. (2005). Accounting in a Business Context, 4th Edition. London Cengage Learning.

Drury C. (2009). Management Accounting for Business. London: Cengage Learning EMEA, 2009.

Lumby S and Jones C. (2000). The Fundamentals of Investment Appraisal. London: Thomson Learning, 2000.

http://www.mothercareplc.com/

http://www.hl.co.uk/shares/shares-search-results/m/mothercare-plc-ordinary-50p/research

http://www.mothercareplc.com/download/Mothercare_AR2011_A.pdf

http://www.mothercareplc.com/download/Mothercare_AR10.pdf

http://www.mothercareplc.com/download/Mothercare_AR09_Complete.pdf

www.mothercareplc.com/download/report_2008.pdf

http://www.londonstockexchange.com/exchange/prices/stocks/summary/fundamentals.html?fourWayKey=GB0009067447GBGBXSTMM

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee