All papers examples

All papers examples

Disciplines

- MLA

- APA

- Master's

- Undergraduate

- High School

- PhD

- Harvard

- Biology

- Art

- Drama

- Movies

- Theatre

- Painting

- Music

- Architecture

- Dance

- Design

- History

- American History

- Asian History

- Literature

- Antique Literature

- American Literature

- Asian Literature

- Classic English Literature

- World Literature

- Creative Writing

- English

- Linguistics

- Law

- Criminal Justice

- Legal Issues

- Ethics

- Philosophy

- Religion

- Theology

- Anthropology

- Archaeology

- Economics

- Tourism

- Political Science

- World Affairs

- Psychology

- Sociology

- African-American Studies

- East European Studies

- Latin-American Studies

- Native-American Studies

- West European Studies

- Family and Consumer Science

- Social Issues

- Women and Gender Studies

- Social Work

- Natural Sciences

- Anatomy

- Zoology

- Ecology

- Chemistry

- Pharmacology

- Earth science

- Geography

- Geology

- Astronomy

- Physics

- Agriculture

- Agricultural Studies

- Computer Science

- Internet

- IT Management

- Web Design

- Mathematics

- Business

- Accounting

- Finance

- Investments

- Logistics

- Trade

- Management

- Marketing

- Engineering and Technology

- Engineering

- Technology

- Aeronautics

- Aviation

- Medicine and Health

- Alternative Medicine

- Healthcare

- Nursing

- Nutrition

- Communications and Media

- Advertising

- Communication Strategies

- Journalism

- Public Relations

- Education

- Educational Theories

- Pedagogy

- Teacher's Career

- Statistics

- Chicago/Turabian

- Nature

- Company Analysis

- Sport

- Paintings

- E-commerce

- Holocaust

- Education Theories

- Fashion

- Shakespeare

- Canadian Studies

- Science

- Food Safety

- Relation of Global Warming and Extreme Weather Condition

Paper Types

- Movie Review

- Essay

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- GCSE Coursework

- Grant Proposal

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- Essay

- GCSE Coursework

- Grant Proposal

- Interview

- Lab Report

- Literature Review

- Marketing Plan

- Math Problem

- Movie Analysis

- Movie Review

- Multiple Choice Quiz

- Online Quiz

- Outline

- Personal Statement

- Poem

- Power Point Presentation

- Power Point Presentation With Speaker Notes

- Questionnaire

- Quiz

- Reaction Paper

- Research Paper

- Research Proposal

- Resume

- Speech

- Statistics problem

- SWOT analysis

- Term Paper

- Thesis Paper

- Accounting

- Advertising

- Aeronautics

- African-American Studies

- Agricultural Studies

- Agriculture

- Alternative Medicine

- American History

- American Literature

- Anatomy

- Anthropology

- Antique Literature

- APA

- Archaeology

- Architecture

- Art

- Asian History

- Asian Literature

- Astronomy

- Aviation

- Biology

- Business

- Canadian Studies

- Chemistry

- Chicago/Turabian

- Classic English Literature

- Communication Strategies

- Communications and Media

- Company Analysis

- Computer Science

- Creative Writing

- Criminal Justice

- Dance

- Design

- Drama

- E-commerce

- Earth science

- East European Studies

- Ecology

- Economics

- Education

- Education Theories

- Educational Theories

- Engineering

- Engineering and Technology

- English

- Ethics

- Family and Consumer Science

- Fashion

- Finance

- Food Safety

- Geography

- Geology

- Harvard

- Healthcare

- High School

- History

- Holocaust

- Internet

- Investments

- IT Management

- Journalism

- Latin-American Studies

- Law

- Legal Issues

- Linguistics

- Literature

- Logistics

- Management

- Marketing

- Master's

- Mathematics

- Medicine and Health

- MLA

- Movies

- Music

- Native-American Studies

- Natural Sciences

- Nature

- Nursing

- Nutrition

- Painting

- Paintings

- Pedagogy

- Pharmacology

- PhD

- Philosophy

- Physics

- Political Science

- Psychology

- Public Relations

- Relation of Global Warming and Extreme Weather Condition

- Religion

- Science

- Shakespeare

- Social Issues

- Social Work

- Sociology

- Sport

- Statistics

- Teacher's Career

- Technology

- Theatre

- Theology

- Tourism

- Trade

- Undergraduate

- Web Design

- West European Studies

- Women and Gender Studies

- World Affairs

- World Literature

- Zoology

Analysis of the 2007 Financial Crisis, Term Paper Example

Hire a Writer for Custom Term Paper

Use 10% Off Discount: "custom10" in 1 Click 👇

You are free to use it as an inspiration or a source for your own work.

2007 Financial Crisis

The 2007 financial crisis is considered by many economists to be the worst economic crisis since the Great Depression of the 1930s. There were many factors that contributed towards the Great Depression though the depression was initially triggered by the stock market collapse. Similarly, the recent financial crisis has occurred due to many factors though the initial trigger was pulled by the collapse of the subprime mortgage market (Paletta, Ng, & Hilsenrath, 2008). The roots of the subprime mortgage crisis could be traced back to the policies adopted by the Fed under the pressure of the U.S. Government.

Following the 2011 recession, Congress’ primary concerns were maximum employment and price stability since there were concerns of deflation. Acting upon the mandate given by the Congress, the Fed brought interest rates to a very low level (Bernanke, 2010). Fed’s objective in lowering interest rates is to encourage consumption by both businesses and individual customers since lower interest rates make it cheaper for businesses and consumers to borrow. Businesses borrow in order to replace assets or expand operations while consumers borrow to support their consumption lifestyles. As a result, the demand for money went up.

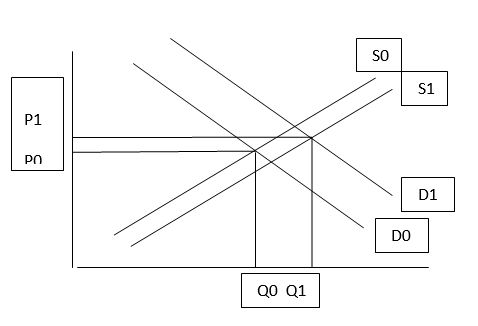

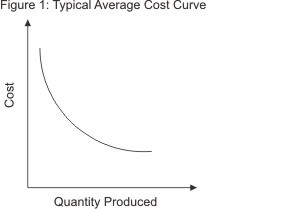

Lower interest rates also mean lower profit potential for businesses from lending out money. Thus, one of the solutions to lower margins is economies of scale and this is how financial firms and mortgage suppliers responded to low interest rates. They made it easier for consumers to borrow mortgage loans and consumers responded by increasing their demand for of homes and the result was an appreciation in average home prices. According to the laws of supply and demand, an excessive demand over supply results in higher prices.

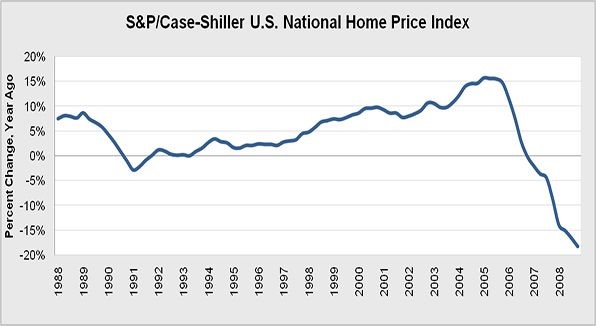

The demand for housing also increased because of consumers’ optimistic expectations regarding the future. The continuous appreciation in housing prices gave many consumers a confidence that they are making a sound investment in the future that will pay off in the long run. Thus, any price they pay is worth and they also became more willing to pay premium prices due to easy availability of credit. The consumers’ expectations were also enforced by the historical trend in housing values. As we see in the chart (Project America)below, the housing prices continued to move upwards since 1991 and their 15-year run only came to an end with the 2007 financial crisis.

The construction industry also responded by increasing its construction activities but the rise in demand outpaced the rate at which the new houses could be built. The rise in demand leads to higher prices while an increase in supply leads to lower prices but in this case, since the increase in demand was greater than the increase in supply, the overall result was still an increase in the average prices of the houses. But the higher demand for homes was not the only factor that contributed towards higher prices.

The money supply and interest rates have a negative relationship. Lower interest rates mean the money supply has increased in the economy. An increased money supply also leads to higher prices because more money is now chasing a particular quantity of goods and services. Thus, the rise in the home prices also occurred due to the increased money supply as a result of low interest rates which encouraged both businesses and individuals to borrow more. Another factor that contributed towards higher home prices in the U.S. was high rate of foreign investment. The U.S. received large capital inflows from both Asia and Europe and large capital inflows usually have a positive relationship with housing prices (Bernanke, 2010) because they increase money supply and demand for investments in the economy.

The mortgage providers and financial institutions provided generous loans to consumers because of the potential to both reduce costs and increase overall profitability. Low interest rates meant that the lenders could only generate attractive profits through volume. In addition, increasing volume also resulted in lower average costs due to economies of scale. Fixed costs do not vary with production levels, thus, higher sales volume result in declining average costs, leading to higher profits per consumer. As we observe in the chart below (MindTools) that as production level increases, the average unit cost goes down because fixed cost is spread over more and more units.

But as the housing market collapsed, prices took a deep dive because supply of houses greatly exceeded the demand. The supply increased due to numerous reasons such as loan defaults by mortgage borrowers who were a poor credit-risk in the first place and on-going construction projects that suddenly saw prospective buyers delaying or cancelling purchase plans. The buyers cancelled plans because they suddenly became afraid regarding the future and also they realized that housing prices were overvalued in the first place. The demand for housing as well as other goods and services also fell down because companies cancelled their investment plans and many consumers lost their jobs, faced declining incomes, or became more concerned about their employment security. Not surprisingly, the overall effect was a net decline in aggregate demand in the economy. Christina Romer, Head of President Obama’s Council of Economic Advisors, claimed in a talk on the state of the economy that the persistent shortfall in aggregate demand is what has been preventing the unemployment rate from declining and government should continue to focus on programs that stimulate demand (The Economist, 2010).

The aggregate demand also fell down because companies found out that their mortgage portfolios and other assets were worth less than their book values. They responded by cutting costs wherever they could, including layoffs of a significant percentage of their workforce. The layoffs were particularly widespread in certain industries such as manufacturing and construction that produce big-ticket products and services. It also became difficult for consumers to borrow money from the banks and other financial institutions since lending institutions became more conservative in their credit policies. At the same time, most of the consumers saw a decline in their net worth due to falling housing prices and values of other investments such as stocks which further forced them to reduce their consumption expenditure.

The U.S. government has taken a variety of measures to recover from the financial crisis and many of these measures are the result of lessons learnt from Roosevelt’s Administration response to the Great Depression. First of all, the Fed continues to maintain interest rates at historically low levels and the rates are not expected to rise until at least 2014 (Censky, 2012). The goal is to encourage borrowing by both the businesses and the individual consumers. The Fed hopes that the businesses will borrow to make capital investments as well as hire more workers which should help bring down unemployment rate. Similarly, consumer borrowing as well as low unemployment level may encourage consumers to resume their consumption lifestyles and help increase aggregate demand in the economy.

The U.S. government also tried to encourage consumption through Economic Stimulus Program of 2008 which resulted in the government sending over $100 billion cash to individuals and families in order to encourage them to increase their consumption. But the program failed to achieve its objectives because the people didn’t spend money the way the government hoped. Similarly, the rising oil prices between August 2007 and July 2008 (Taylor, 2008) also discouraged consumption activities such as purchase of vehicles as well as left consumers with little disposable income by increasing cost of living. The rise in oil prices also increased businesses’ production costs, thus, slowed down the recovery process.

The U.S. government also intervened directly in the economy in order to restore public confidence in the markets as well as help certain industries to get back on their feet. One of the most controversial steps by the government was the Troubled Asset Relief Program (TARP) which involved bailing out banks that were at the verge of collapse and whose failure would have damaged the financial system beyond repair as well as crushed public confidence in the government’s ability to manage the economy. It is also possible that the failures of institutions like Goldman Sachs and Morgan Stanley would have triggered a series of bank runs. In addition, the government also bailed out the auto industry in order to help the local automakers become competitive again as well as add jobs to the economy. The auto industry bailout has been somewhat of a success and has added more than 231,000 jobs since June 2009 (The Department of the Treasury, 2012).

There are several lessons that could be learned from the recent financial crisis. First of all, Efficient Market Theory may have certain shortcomings because the Great Depression as well as the recent financial crisis has shown that markets are not always capable of monitoring themselves and the participants do not always act in a logical manner. The greed through booms and panic through crisis shows that people are influenced by emotions as well as groupthink. The recent financial crisis also shows that the moral hazard of ‘too big to fail’ is real and does result in companies taking higher risk. The recent financial crisis has yet again shown that some form of government intervention in economic affairs in inevitable because the financial system could have collapsed had the government not bailed out several large firms and the government’s aid to the auto sector has paid off. Another important lesson from the recent financial crisis is that the interest policy is a double-edged sword because even though it does encourage consumption and helps lower unemployment rate but could also lead to speculation and out-of-control inflation if kept low longer than necessary.

The 2007 financial crisis occurred because the easy access to money led to speculation in the housing market. In addition, the housing prices also reached record levels due to higher amount of money chasing the same supply of real estate and moreover, the overall sentiment was positive regarding the future of the economy. But as the housing market collapsed, businesses scaled back investment plans and even laid off workers. The consumers also responded by scaling back their consumption habits because they were less certain about their future and the access to credit also became harder than before. The government responded by keeping interest rates low to encourage consumption as well as directly intervening in the economy to prevent collapse as well as certain economic sectors to regain their foothold.

References

Bernanke, B. S. (2010, September 2). Causes of the Recent Financial and Economic Crisis. Retrieved July 28, 2012, from http://www.federalreserve.gov/newsevents/testimony/bernanke20100902a.htm

Censky, A. (2012, January 25). Fed to keep rates low until 2014. Retrieved July 28, 2012, from http://money.cnn.com/2012/01/25/news/economy/fed_rates_bernanke/index.htm

MindTools. (n.d.). Achieving Economies of Scale. Retrieved July 29, 2012, from http://www.mindtools.com/pages/article/newSTR_63.htm

Paletta, D., Ng, S., & Hilsenrath, J. (2008, September 18). Worst Crisis Since ’30s, With No End Yet in Sight. Retrieved July 24, 2011, from http://online.wsj.com/article/SB122169431617549947.html

Project America. (n.d.). Housing: U.S. Home Price Index. Retrieved July 28, 2012, from http://www.project.org/info.php?recordID=445

Taylor, J. B. (2008, November). The Financial Crisis and the Policy Responses: An Empirical Analysis of What Went Wrong. Retrieved July 29, 2012, from http://www.stanford.edu/~johntayl/FCPR.pdf

The Department of the Treasury. (2012, April). The Financial Crisis Response in Charts. Retrieved July 28, 2012, from http://www.treasury.gov/resource-center/data-chart-center/Documents/20120413_FinancialCrisisResponse.pdf

The Economist. (2010, April 19). Is it the aggregate demand? Retrieved July 28, 2012, from http://www.economist.com/blogs/freeexchange/2010/04/recovery_1

Stuck with your Term Paper?

Get in touch with one of our experts for instant help!

Time is precious

don’t waste it!

writing help!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee