Global Sustainable Energy Markets, Term Paper Example

The Australian Case for global sustainable energy markets

Exigencies in the global energy market in the past nine years have been in part to the energy sector’s convergence with the environmental securities markets, and the carbon market in particular. In response to climate change legislation of the Kyoto Protocol and its subsequent accords, Australia’s framework for recommended GHG emissions regulations has resulted in new models of economic and legal practice. Climate change has become a workshop for the planet. The recent Conference of the Parties (COP/15) to the United Nations Framework Convention on Climate Change (UNFCCC) in Copenhagen, December 2009, concluded in a regime of strategic planning in finance, technology, operations, law and policy.

According to the Australian Government’s Department of Climate Change and Energy Efficiency, Australia ‘monitors and accounts for its greenhouse gas emissions from land based sectors in its national inventory through the Australian Greenhouse Emissions Information System (AGEIS) which accounts for the methane and nitrous oxide emissions from livestock and crop production, while the National Carbon Accounting System (NCAS) is currently designed toward accountability of carbon emissions from agriculture, deforestation and forestry. Now hosting the Sixth Annual Climate Change and Business Conference 2010, Australia has consecutively shown its commitment to a global market respondent to privatization of the energy market, and competent governance of those shifts through apt structural adjustment of the nation’s energy policy.

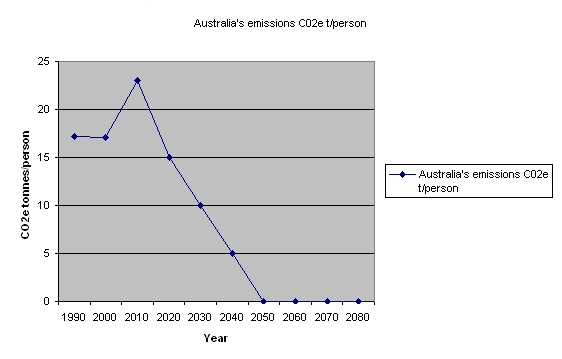

Figure 1

Figure 1: Australia’s Kyoto Protocol Emissions Reductions Goals 2050

Much of what goes into legislative policy intended for the ‘public good.’ Investment in environmental mitigation in the business community is typically responsive to regulatory compliance or venture capital promise. The globalization of natural resources and attendant policies has resulted in a dictatorship of the energy sector as the foremost priority within international governance. This is not to say that real political transformations amongst states have not also contributed to this new regime of power. For instance, since the collapse of the former Soviet Bloc countries, Eastern European energy resource management has been one of the core economic interests of international energy holdings vested in the transition from state to privatized incorporation. The structural adjustment policies of the 1990s, which led to privatization policies in second world economies are still affecting the administrative capacity behind energy resource distribution to populations dependent upon those forces of negotiation between international energy management stakeholders, and sometime corrupted or underdeveloped legal and regulatory capacity in those states.

In Australia, the widely acceptable practice of retraction of central authority toward intense regulation of the industry by way of law rather than volunteerism was extended to states, which now determine the regulatory relationship between energy and consumer market (Australian Government’s Department of Climate Change and Energy Efficiency, 2010). Comparatively, Australia has done much in terms of promoting advancements in energy innovation as well, with an eye on technology and proximity to the Asian market, Australia is well poised to participate fully and competitively in the new global energy market (Australian Competition and Consumer Commission, 2010).

The global picture outside the region also reveals distinctions. For instance, it is in comparison with the dense regulatory structure of the United States that we can see what Australia is, and what it is not, in terms of party to international policy. Without such as radical window of comparison, in a parallel common law setting, we might not see the business, legal and political culture(s) at work in two distinct economies of scale. In the United States, where the energy industry has been the intense focus of scrutiny in response to high level hazard incidents, such as the Three Mile Island case. Amid reconfiguration of nuclear power as part of a matrix of alternative, ‘clean air’ energy options, there is a significant push toward advancement of regulatory competence.

The essay focuses on the impact of the climate change regime on energy relationships, and particularly as the development of GHG emissions reductions measures influence the direction of legislative policy and its impact on market exchange. Throughout the analysis of Australia’s energy market with international developments, the query examines economic interests in the realms of international law and policy, and provides new information about the capacity of regions and national governments to provide offsets or fix levies, tariffs or taxes to alternative and traditional energy trade partnerships through articulation of agreements contracted through international emissions securities protocols. The overarching scope of those discussions is then reconsidered in the context of national regulatory legislation and attendant enforcement of those statutes as is understood through the two national interpretations of the ‘environmental commons.’

Ethics and corporate responsibility can only be approached from a legal perspective. Since the fall of companies such as Enron, we have witnessed a shift in corporate self-representation as companies attempt to shore up responses to regulatory and political pressures that may threaten by way of external factors such as environmental advocacy. Social responsibility and sustainability are now almost uttered on a single breath, as corporations positioned in the energy securities market and other high risk incidence segments attempt to ‘mitigate’ through identity management and strategic planning to the best effect possible.

While not positioned in lieu of policy application and adherence, the entire culture of the energy business has changed at almost light speed since the twentieth century, and the influx of policy as an informational moniker for the generation of new capital markets now seemingly exceeds actual activities and risk assessment models employed by the scientists whom monitor the outcomes to pollution. In short, the energy market and its regulatory regime are not surprisingly far more influenced by regimes of environmental concern than they once were. Coupled with a climate of privatization seeded during the era of structural adjustment in the 1990s, the landscape of energy and its liberal exchange amongst stakeholders in the global market has surpassed all preconceived ideas about the potential of alternative energy and energy technologies, and the efficacy of scientific inputs instigating innovation and power.

As we turn toward analysis of the new energy regime and its impact on financial options and financial risk assessment and management, a currency in scientific exchange emerges as capitalization of the market increasingly becomes integrated into environmental and energy securities, and those instruments converge with the national and regional development strategies of international financial institutions in the form of CDM (Clean Development Mechanism). The inculcation of GHG emissions reductions measures into the protocol of disaster mitigation has also promoted a site of convergence for scientific risk management applications and financial risk management applications through initiatives like UN-Spider which provides “universal access to all countries and all relevant international and regional organizations to all types of space-based information and services relevant to disaster management to support the full disaster management cycle by being a gateway to space information for disaster management support.” On December 14, 2006, the U.N. General Assembly established the United Nations Platform for Space-based Information for Disaster Management and Emergency Response (UN-SPIDER). Although designated as international ‘space policy’ the articulation of those programs as they are understood by both energy and space scientists is, albeit necessarily, ‘earth science’ in focus.

Somewhat opaque within inquires projected at incorporation of financial risk models into energy industry risk assessment planning at every stage, and intensively in engineering is the standard of allocation for budgetary contribution and accountability toward mitigation standards within manufacturing, as the potentialities of pollutant costs made by human error can randomly increase the probability of risk. In industries like nuclear power and petroleum, there is a high propensity for explosive or leakage, with rather dangerous and expensive outcomes. Underlying this discussion is the impact of ‘risk’ as it is understood through the evolving rubric of the climate change regime by way of compliance measures developed by standards organizations and states involved in that current decision making. The robustness of national energy markets is destined to be affected, and with it the business of secondary responsibility to monitoring and resource management. The foregoing discussion looks first to Australia’s energy market and regulatory regime in the context of the interconnected legislative processes developed through COP/15, and also to the global securities market.

Electricity is making increasing in roads into the domestic market in Australia as GHG emissions legislation informs business decision by energy retailer conglomerates. As with most liberal market economies, Australia’s national energy industries are largely, if not all, privately owned interests subject to state regulation. With the exception of smaller renewable energy ventures, almost all of Australia’s energy retailers extend investment into global markets, with international market securitization, and at least one additional national market included within their ‘home market’ division. On the international front, Australia’s primary energy derivative comes from natural gas resources. Securitization of this national commodity continues to benefit from the capitalization of environmental offset projects, as the resource is employed and refined to meet Kyoto Protocol standards.

A decade ago in the 1990s Australia’s gas market underwent deregulation. Deregulation was the direct result of state legislative mandate, and not subject to national oversight. Hence, deregulation initially turned up piece-meal interpretations of policy, and was blamed for a decrease in variables on the Australian domestic gas market. At that time, Australia’s natural gas reserves were more than doubled from 19.4 trillion cubic feet (Tcf) in 1998 to 44.6 (Tcf) in 1999, with supply increases outpacing demand domestically. New liquefied natural gas (LNG) and gas-to-liquids (GTL) facilities, pipelines, and industrial plants now sell ample supplies of the energy resource to international markets (Australian Government’s Department of Climate Change and Energy Efficiency, 2010).

Legislative reform of the natural gas industries with a ‘free and fair trade in natural gas’ platform in 1994 set the tone for consensus throughout the Commonwealth and all states and territories in 1997. The preemptive legislation merely allowed states to foster growth through application of regional rules, and was passed by all the state legislatures by the end of 1999. Reformation of regulatory restriction in the industry opened the door for the creation of a ‘national pipeline access’ regime designed to promote market expansion, attract new investment in gas infrastructure and support exploration and development. Companies with operations located in the Timor Sea and North West Shelf were proving the ‘cluster development’ risk mitigation toward reduction of cost and safety restrictions, and especially as the strategy could be put into use in stranded fields by sharing infrastructure, power, and feedstocks (Australia Daily, 2010).

While supply and demand on the international market are the two general catalysts for Australia’s influence in this sector, the impacts of the climate change regime and the current global economic crisis have added two additional factors to the exchange of this natural resource. The climate change regime is the third factor impacting the global energy markets. A fossil fuel, natural gas is highly effective as a generator of volume baseload electricity; with an approximately 50% reduction to the greenhouse emissions that might otherwise be present if the other inexpensive option, coal, was employed. A perfect transition fuel, natural gas increases ready supply of electricity, thus optimizing the chances of immediacy in lowering the carbon footprint. Despite a downturn in demand due to the general economy in Australia, funding for this ‘energy suite’ as proposed by the government will be incumbent for the implementation of ‘upstream developments, processing facilities and infrastructure’ (Australian Competition and Consumer Commission 2010). Reporting on energy development by the major corporations indicates that while companies are inclined to curtail spending in terms of budgetary projections, those strategies do not yet include plans of deferment or cancellation of gas developments in response to a drop in revenues and fiscal instability in the market.

In 2009 the Australian Government allocated $4.5 billion toward the support of clean and new energy technologies. This decision included the expansion of the renewable energy target toward realization of the 20 percent generation share of the entire market by 2020 (i.e. an increase from 20 terawatt hours to 60 terawatt hours). Tensions to existing stratification within the otherwise deregulated environment, stand to ‘crowd out’ gas fired generation, according to the Australian Treasury.

Globalization has promulgated new frameworks of responsive planning in order to meet the accelerated expansion of innovation, resource management, and performance, as well as market price and investment capitalization. As post COP/15 activities accelerate, we will see new international cap-and-trade proposals reinterpreted by individual U.S. states toward use. This includes the instrumentation of carbon market securitization as potential mechanism for mitigation and economic growth. If effectively changing strategies is predicated upon two basic principles of late-capitalist production: 1) product; and 2) portfolio; coherency and timeframe provide the axis between the internal and external factors that contribute to the realization of core competencies as profit.

If Australia’s energy market is one of laissez-faire market driven deregulation, by comparison the United States is a quagmire of regulatory restrictions marked by a landscape of complexity that was until very recently largely under the preemptive jurisdiction and administrative oversight of the central authority of the Federal government. The shift toward privatized holdings of energy companies is, however, parallel to the Australian case, yet with secession of state control due to the high level of risk existing in the country’s more diversified and populated environment. As one of the global market’s largest economies of scale, the convergence of market and state in a common law context make national energy markets like the United States’ a critical site of query for Australia, in that not only trade relations, but mechanistic opportunism within the legal regime provide insight into alternative directions that Australia’s energy industries might confront in the far off future. The United States is a big broken piggy bank short changing itself on energy consumption by way of the very measures intended to adequately if not competently regulate this excess. A dirty (not to mention dangerous) CO2 (and other toxins) makes certain that a virtual pig pen accompanies this, and the truth of this assertion can be revealed through the breakdown of the U.S. energy market reveals that the nation is still largely reliant upon coal to produce 52% of total electricity. Nuclear power is secondary, at 20% of the generation; with natural gas 18%. Hydropower and renewable energy sources generate 6% and oil at 4%, respectively.

Alternative energy sources fall under this rubric of decision making. The environmental securities market and especially the carbon trading market with its CDM offsets have become inextricably linked to the entrepreneurial schema of financiers, investors, policy makers and related scientific interests. For many, the economic outcomes of alternative energy sources have led to decision making across the board: as better models toward re-articulation of the planet through environmental finance reflects baseline laissez-faire assumptions about free market economy for the betterment of the planet can only lead to further democratic opportunities and avenues toward total global sustainability. Australia is a strong case for exemplary work on those larger objectives – with quite distinct financial and operations management strategies, not to mention regulatory practices toward achieving them.

Australia’s Competitive Energy Market Landscape

KEY: Best of Group. Companies listed are Top Competitors. www.hoovers.com

| Key Numbers | Origin Energy | AGL Energy | International Power | Santos Ltd | ||

| Annual Sales ($ mil.) | 12,424.7 | 0.0 | 5,838.5 | 1,958.7 | — | — |

| Employees | 4,198 | 0 | 3,936 | 2,500 | — | — |

| Market Cap ($ mil.) | 12,734.5 | — | — | — | — | — |

| Profitability | Origin Energy | AGL Energy | International Power | Santos Ltd | Industry2 | Market3 |

| Gross Profit Margin | — | — | 26.06% | 48.49% | 25.68% | 28.77% |

| Pre-Tax Profit Margin | 4.99% | 14.91% | 20.27% | 91.72% | 10.87% | 8.48% |

| Net Profit Margin | 44.94% | 10.76% | 14.71% | 59.75% | 8.74% | 5.53% |

| Return on Equity | 98.6% | 11.4% | 15.3% | 41.3% | 20.2% | 10.1% |

| Return on Assets | 40.0% | 5.6% | 4.1% | 17.5% | 9.6% | 1.5% |

| Return on Invested Capital | 95.9% | 8.7% | 15.3% | 25.3% | 15.4% | 4.4% |

| Valuation | Origin Energy | AGL Energy | International Power | Santos Ltd | Industry2 | Market3 |

| Price/Sales Ratio | 0.83 | — | — | — | 0.76 | 3.23 |

| Price/Earnings Ratio | 1.84 | — | — | 5.37 | 12.56 | 23.70 |

| Price/Book Ratio | 1.27 | — | — | — | 1.72 | 6.27 |

| Price/Cash Flow Ratio | 15.02 | — | — | — | 7.61 | 20.08 |

| Operations | Origin Energy | AGL Energy | International Power | Santos Ltd | Industry2 | Market3 |

| Days of Sales Outstanding | 32.32 | 75.13 | 65.10 | 56.68 | 41.95 | 34.66 |

| Inventory Turnover | — | — | 16.4 | 5.4 | 12.1 | 8.1 |

| Days Cost of Goods Sold in Inventory | — | — | 22 | 67 | 30 | 45 |

| Asset Turnover | 0.9 | 0.5 | 0.3 | 0.3 | 1.1 | 0.3 |

| Net Receivables Turnover Flow | 11.3 | 4.9 | 5.6 | 6.4 | 8.7 | 10.5 |

| Effective Tax Rate | — | 31.8% | 22.6% | 34.9% | — | 37.9% |

| Financial | Origin Energy | AGL Energy | International Power | Santos Ltd | Industry2 | Market3 |

| Current Ratio | 2.24 | 0.46 | 1.76 | 1.84 | 1.13 | 1.33 |

| Quick Ratio | 2.2 | 0.4 | 1.3 | 1.6 | 0.8 | 1.2 |

| Leverage Ratio | 2.21 | 2.20 | 3.81 | 2.52 | 2.17 | 7.13 |

| Total Debt/Equity | 0.37 | 0.82 | 1.83 | 0.63 | 0.33 | 1.37 |

| Interest Coverage | — | — | — | — | 16.15 | 17.33 |

| Per Share Data ($) | Origin Energy | AGL Energy | International Power | Santos Ltd | Industry2 | Market3 |

| Revenue Per Share | 17.49 | — | — | — | 71.53 | 7.60 |

| Fully Diluted Earnings Per Share from Total Operations |

— | — | 0.24 | 1.94 | 6.27 | 1.08 |

| Dividends Per Share | 0.38 | 0.00 | 0.05 | 0.35 | 1.09 | 0.25 |

| Cash Flow Per Share | 0.96 | — | — | — | 7.16 | 1.22 |

| Working Capital Per Share | 3.76 | — | — | — | 2.09 | 0.64 |

| Long-Term Debt Per Share | — | — | — | — | 7.82 | 4.06 |

| Book Value Per Share | 11.36 | — | — | — | 31.75 | 3.91 |

| Total Assets Per Share | 25.10 | — | — | — | 68.46 | 27.90 |

| Growth | Origin Energy | AGL Energy | International Power | Santos Ltd | Industry2 | Market3 |

| 12-Month Revenue Growth | 85.8% | (23.6%) | 33.7% | (9.2%) | (31.0%) | 31.9% |

| 12-Month Net Income Growth | 1,243.4% | (46.1%) | 44.5% | 202.9% | (33.0%) | (27.7%) |

| 12-Month EPS Growth | 1,241.1% | (46.1%) | 41.6% | 207.7% | (34.4%) | (50.0%) |

| 12-Month Dividend Growth | 65.2% | — | 80.0% | 9.6% | (13.2%) | — |

| 36-Month Revenue Growth | 37.4% | (3.2%) | 44.7% | 2.7% | (2.0%) | 14.3% |

| 36-Month Net Income Growth | 175.5% | 15.7% | — | 27.9% | (15.8%) | (5.6%) |

| 36-Month EPS Growth | 166.1% | 14.1% | — | 29.1% | (14.6%) | (14.7%) |

| 36-Month Dividend Growth | 30.8% | — | — | 8.5% | 23.5% | — |

References

Alexander, I. and Harris, C. (2005). The Regulation of Investment in Utilities: Concepts and Applications. Washington, D.C.: The World Bank.

Armstrong, M. et al. (1999). Regulatory Reform: Economic Analysis and British Experience. Cambridge, MA: The MIT Press.

Australia Daily (2010). Retrieved from: http://wn.com/australia

Australian Competition and Consumer Commission (2010). Retrieved from: http://www.accc.gov.au/content/index.phtml/itemId/142

Australian Government’s Department of Climate Change and Energy Efficiency (2010). Retrieved from: http://www.climatechange.gov.au/

Brown, A. C. (2006). Handbook for Evaluating Infrastructure Regulatory Systems. Washington, DC: The World Bank.

Crew, M. and Parker, D. (2008). International Handbook on Economic Regulation. Northhampton, MA: Elgar.

Cleaner Nuclear Technologies for a Better Future: IAEA International Conference Highlights Innovative Fast Reactor Research (2009). International Atomic Energy Association. Retrieved from: http://www.iaea.org/NewsCenter/News/2009/fr09.html

Fumagalli, E. et al. (2007). Service Quality Regulation in Electricity Distribution and Retail. Berlin, Germany, and New York, New York, NY: Springer.

Gómez-Ibáñez, J. (2003). Regulating Infrastructure: Monopoly, Contracts, and Discretion. Cambridge, MA: Harvard University Press.

Hunt, S. (2002). Making Competition Work in Electricity. New York: Wiley & Sons.

International Convention on Oil Pollution Preparedness, Response and Co-operation (OPRC). United Nations IMO. Retrieved from: http://www.imo.org/Conventions/mainframe.asp?topic_id=256&doc_id=661

Laffont, J. (2005). Regulation in Developing Countries. Cambridge, UK: Cambridge University Press.

Lesser, J.A., and Giacchino, L.R. (2007). Fundamentals of Energy Regulation. Arlington, VA: Public Utilities Reports.

Lévêque, François, ed. (2007). Competitive Electricity Markets and Sustainability. Northhampton, MA: Elgar.

Mitchell, B., and Vogelsang, I. (1991). Telecommunications Pricing: Theory and Practice. Cambridge, U.K.: Cambridge University Press.

Newbery, D. M (1999). Privatization, Restructuring, and Regulation of Network Industries. Cambridge, MA: MIT Press.

Oil and Gas Development – Offshore, (2000). International Finance Corporation Environmental Health and Safety guidelines. Retrieved from: http://www.ifc.org/ifcext/enviro.nsf/AttachmentsByTitle/gui_offshoreOG/$FILE/offshoreoil.pdf

Origin Energy (2010). Hoovers. Retrieved from: http://www.hoovers.com

Pardina, M. et al. (2008). Accounting for Infrastructure Regulation: An Introduction. Washington, D.C.: The World Bank.

Viscusi, W. K. et al. (2000). Economics of Regulation and Antitrust. Cambridge, MA: MIT Press.

Rosenbaum, W.A. (2000). Environmental Politics and Policy. Washington D.C.: CQ Press.

United Nations Framework Convention on Climate Change, 2009. Available at: http://unfccc.int/2860.php

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee