Impacts of Fraud in the UK Financial System, Dissertation Example

Introduction

Background

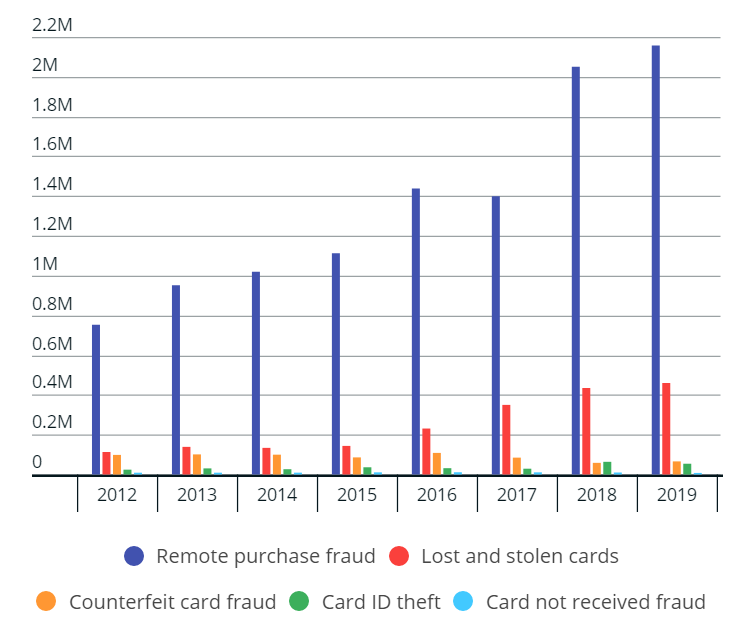

With advent of technology in the contemporary world, E-banking innovation has dominated the financial activity in the United Kingdom. Despite the innovation being convenient and embraced by everyone, it has continued to be costly both to the customers and banks. Scammers and criminals have taken advantage of the same technology to move ahead of the financial institutions to fraudulently access customer details as third parties outside the financial sector. Therefore, internet banking fraud is conducted by criminals when they breach and access customer’s details and make unauthorized transfers by typically tricking clients of financial institutions into revealing critical information through phone calls, emails and tests. According to the data released by the UK finance early 2020, it was evident that internet banking fraud had soared by 40% in 2019 from the previous year indicating that banks are running at more than £ 1m a day in losses as presented in Figure 1. During the first 6 months of 2019, scammers alone stole £616m from UK bank customers. Of this, £207.5m was lost to criminals that duped people into authorizing payments to accounts controlled by scammers.

Figure 1: Fraud in the UK from 2013-2019

Fraudulent banking is the leading cause of fraud in the UK, according to Financial Fraud Action (FFA, 2017, 3). Due to its prevalence, banking fraud is a targeted concern for the banking industry and governing authorities (FFA, 2017, 1). The impact of fraud on the financial institution includes a surge in insurance costs, depletion of available capital, and consumer confidence in the banking industry (Akelolo, 2012, 11). The banking industry relies on consumer confidence to grow internally and acquire consumers of financial institutions (Frost Bank, 2018). Fraud reduces the regular capital that a bank has for consumer needs, available loans, deposits, withdrawals, and increases costs while reducing earnings (Frost Bank, 2018).

The research paper seeks to investigate how fraud occurs in financial institutions, analyse the perception of UK citizens on financial institutions about financial fraud, analyse the effect of fraud on some of the institutions which have had a history of financial fraud, and examine the behavior of financial institutions when there are limited flow and circulation of money. To achieve this the study identifies the underlying theories that explain the complicated interactions of fraud in the UK economy using secondary data to explore the inputs, outputs, and models of banking fraud that occurs within banks, such as from bank employees and executives, external of banks such as fraudulent theft of bank accounts against consumers, and create a forensic financial model of fraud specific to the UK banking industry. The following first discusses the background, rationale, justification, and objectives of research into fraud within the UK banking industry. This is then followed by a succinct literature review that examines fraud theory, which includes the scale of fraud, models of fraud, equity theory of fraud, and accounting theory of fraud. These theories are then used as the underlying examination of the case study of banking fraud in the UK financial industry. The study used secondary data derived UK financial fraud data.

TransUnion UK (2018, p 1) describes the history of fraud typology and how it has evolved throughout history. Historically, fraud has been committed through acts of paper forgery as identity theft, forged cheques, cash bribery, and money laundering. The digital age opened new methods for perpetrators to commit acts of fraud, using technology communications through mobile apps, social media, and websites to convince victims to give money and information (TransUnion, 2018, p 2).

The British Bankers’ Association (BBA, 2015, p 1) examines future financial crime risks to be a major challenge faced by the UK national financial industry and the global financial industry. Fraud can be committed at the highest levels of banking and government, including bribery, coercion, collusion, tax fraud, money laundering, and other illegal methods that misappropriate money (BBA, 2015, p 2). Fraud is one of the main fundraising methods of terrorism next to the illicit drug trade, and both have some relation to one another, often using fraudulent methods of banking to purchase, fund, or otherwise support both terrorism and illicit drugs (BBA, 2015, 3). The history of financial fraud in the UK that relates to illegal trades is not new and has used many different methods from theft, fraud, money laundering, and in particular hiding accounts in banks to hide from banking authorities, often which involve persons inside the banking industry receiving bribes (Mastercard, 2019, p 1). The Financial Crime Association (FCA, 2014, 1) describes financial fraud as increasing with technological challenges to include individual fraud, for example, a person committing fraud by claiming to be a bank agent and gaining bank access, as well as bribery and corruption (FCA, 2014, 2). The UK Finance Organization (UK Finance, 2019, 1) represents a collective voice in the UK banking and financing industry, and supports banks using technology to build consumer history profiles that will help identify fraud and corruption by ‘flagging’ and ‘sanctioning’ money, purchases, and bank exchanges that are out of character for the consumer, which supports consumer confidence.

Rationale and Justification

The Daily Mail reported in 2019 that in 2018 victims of fraudulent banking scams lost £207.5m in the first half of 2018 (Murray, 2019, 1-3). Nearly 60,000 authorized payment scams and cheque fraud rose nearly 70% in 2019 from 2018, many of which were conducted through social engineering. Victims of bank fraud have little recourse, often the authorities are unable to investigate small fraud claims due to lack of resources. The BBA (2015, 5) describes that victims also include hidden internal victims that may not know they are being victimized by corporate banking imitation, bribery, or other fraud involving executives, which has not been researched or prosecuted.

Statement of the Problem

Despite financial fraud being rampant in UK, it has significantly remained under-researched and under-prosecuted (Becker et al., 2018, 110). The bank industry, government authorities, prosecutors, have all been accused of not being committed to reducing, prosecuting, and preventing fraudulent activities, creating a serious loss of consumer confidence (Becker et al., 2018, 110; Toms, 2015, 23; Murray, 2018, 1-3). This has resulted into a dearth of academic information available on the efficacy and effect of fraudulent activity in the UK banking industry (Becker, et al, 2018, 110; Murray, 2018, 1-3). Furthermore, it still remains unclear how financial fraud is conducted in the UK, the conduct of financial institutions in the UK to financial Fraud, how the UK citizens perceive financial institutions, and the exact effect of fraud on the UK financial system. This paper therefore, aims at filling and addressing these knowledge gaps by focusing on four objectives.

Research Objectives

- To investigate how fraud occurs in financial institutions

- To analyse the perception of UK citizens on financial institutions about financial fraud

- To analyse the effect of fraud on some of the institutions which have had a history of financial fraud

- To examine the behaviour of financial institutions when there are limited flow and circulation of money

Research Question

- How does fraud occur in the UK financial institutions?

- What is the perception of UK citizens on financial institutions about financial fraud?

- What is effect of fraud on some of the institutions which have had a history of financial fraud

- What is the behaviour of financial institutions when there are limited flow and circulation of money

Chapter Two

Literature Review

Fraud Incidence

Fraud is a financial crime or financial abuse that is often assumed to be universally understood but does not have unifying legal precedence or definition (IMF, 2019). Fraud can be committed by persons of high social standing and income or low social standing and income and is generally associated with the illegitimate transfer of funds or property from one entity to another (IMF, 2019). In the global financial industry, fraud is deception for illicit profit and can include a variety of misconducts, such as breach of trust, insider trading, embezzlement, tax evasion, cyber theft, identity theft, money laundering, credit and banking fraud or theft, and a wide variety of other criminal activities that take funds or property from its rightful owner using some form of trickery and device (IMF, 2019).

Fraud has different definitions around the globe and can include different concepts based on regions. Financial theorists, criminal behaviorists, and economists have created several theories about fraud, which include fraud triangle, fraud diamond, and fraud facilitation. These theories help to better understand the nature of fraud as its root cause and how it evolves, whereas most definitions and policies on fraud define the action and outcomes.

Fraud Facilitation

Reurink (2018) conducted a meta-analysis of the most prevalent fraud theoretical models to describe the “empirical universe of financial fraud” that facilitates the incidences of fraud (p 1293). Reurink (2018) found that fraudulent behavior contained different forms of action relegated to the context of financial market activities and the sociocultural economies within which such behaviors and activities occur. Certain economic behaviors facilitate fraud within identified market structures, meaning that in some regions one type of fraud is more common than another type of fraud (Reurink, 2018). This may be why email fraud seems to be associated with Nigeria, product fraud with China, money laundering and insider trading with Westernized nations (Canada, US, UK). Reurink (2018, p 1296) found three major types of fraud that occur, false financial disclosure, financial scams, and financial mis-selling. Disclosure would include evasion and laundering; scams include coercion, pressure, and blackmail; mis-selling includes identity, product, and credit card theft.

Globally, fraud is on the rise and it is imperative that scholarship develops a strong understanding of the root cause of fraud. The occurrence of financial fraud includes four major theoretical concepts of facilitation, according to Reurik (2018) the prevalence of fraud scholarship falls under these four theoretical assumptions: incentive structures; gullible participants; rapid technology; and, secrecy in trading models. These concepts vary in characterization by market structure, regulations, regional size, regional economies, and other specifics that change how people think about their financial status and banking industry. Newly modernized nations with new wealth or new economies tend to be at the highest risks, but traditional market economies such as the UK also find increased fraud facilitation and risk.

“The development of new fundamental conflicts of interest and perverse incentive structures in the financial industry” (Reurink, 2018, p 1299) helps create the prevalence of the incidence of fraud. Data fraud, for example, occurs regularly and in complex financial environments (George, 2016). Serious attention must be given to the prevention and detection of data fraud, which increases the need for ethical standards in information technology infrastructures and conflicts of interest between financiers, lenders, and banks (George, 2016). Corner (2017) notes that fraud in the context of conflicts of interest is to be expected as bankers and financial markets grow and change, the market structures are built upon conflicts of interest over the protection of consumers (Comer, 2017). Conflicts of interest in the financial fraud concept occur because of the relationships between the principle and the agent that are geared towards motivation by corporate or personal interests, thus allowing space for fraud risk in the accumulation of earnings through financial management (Suryandari, Yuesti, and Suryawan, 2019).

Reurink (2018, p 1300) secondly describes market conditions as consumer characteristics of “an influx of unsophisticated, gullible participants in the financial marketplace.” For example, fraudulent penny stocks meant to get consumers rich quickly are popular investment scams in Westernized nations (Baker, Nofsinger, and Puttonen, 2020). Consumers fall for financial fraud with certain mindsets of irrationality, greed, and gullibility (Baker, Nofsinger, and Puttonen, 2020). New markets, such as cryptocurrency, also create gullible and greedy consumers focusing on getting rich quick, often entering a market without the technical knowledge to protect themselves from cyber-theft or other cybercrimes and fraudulent market schemes that are rooted in new and emerging technologies (Semenihin and Kondrashin, 2018). While new markets open the doors for gullibility and fraudulent activities, elderly persons are often victimized by more traditional market schemes (Shao, et al, 2019). One reason for this is that the ability to avoid fraudulent pressures and behaviors is lessened by misunderstandings about complicated processes such as pensions, taxes, and banking systems (Shao, et al, 2019). The more legitimate the structure being used to commit fraud, such as cryptocurrency, penny stocks, cheques, and pensions, the easier it is for a criminal to facilitate fraud in the market on entering consumers (Shao, et al, 2019).

“The increasing complexity involved in financial market transactions as a result of rapid technological, legal, and financial innovation and an ever?widening menu of financial products” (Reurink, 2018, p 1301). Incidences of adverse fraud events in prevention and detection are increasing as information technology continues to grow and be a vast part of the corporate banking and financial industry (Halbouni, et al, 2016). While outsider attacks are common and result in stolen identities, accounts, funds, and other financial theft, internal attacks also occur (Halbouni, et al, 2016). Insider attacks may include lack of audit, consumer, dividend, and account protections, as well as simply not having the resources or tools to be able to establish strong information technology for the prevention of fraud (Suryanto, 2016). Globally, more than half of all fraud in the world occurs from technology-based frauds in regional, state, national, and international banking corporations in the financial industry, including computer fraud, web banks, ATM, credit and debit cards (Rambola & Varshney, 2018). The ability to dispute these fraudulent activities, however, is not clearly regulated in any nation by-laws that properly address information technology threats (Mason & Bohm, 2017). In the UK, and with many modern nations, the banking industry is considered responsible for securing its consumer welfare, and banking security as an issue for the banks (Mason & Bohm, 2017). Theoretically, the lack of regulatory interventions maintains open access for fraudsters (Mason & Bohm, 2017).

There is also “an increase in the use of justified secrecy in the form of mystification of trading models adopted by fund managers” (Reurink, 2018, p 1302). Internal investigation reports of banking models and financial secrecies in international markets found some disturbing networks of fraud, from privatization of law enforcement to help hide fraudulent practices to abuse of public funds and secrecy of trade models, the banking industry, its models, and fund managers tend towards unethical practices globally (Gottschalk, 2019). Other examples of models of fraud in the banking and corporate industries include slush fund abuses, shell entities, securities fraud (Pacini, Hopwood, and Young, 2019). These types of fraud exist in banking and financing because they allow for secrecy to disguise the owners, allow for complicate webs of ownership, and hide assets or launder funds for illicit groups including terrorists and drug traders (Pacini, Hopwood, and Young, 2019; Schjelderup, 2016).

Reurink’s (2018) fraud theories explain that fraud comes from market systems that support the conditions for fraud to exist. Victims of fraud are often convinced that fraud is a beneficial activity, and often through gullibility or fear are subjected to fraudulent activities. The main market conditions that support fraudulent activities are incentive structures; gullible participants; rapid technology; and, secrecy in trading models.

Types of fraud

Sanusi et al. explain that the assorted activities that banks engage in make them significantly vulnerable to fraud (107). Although banks have implemented several steps to reduce their susceptibility to fraudulent activities, they remain vulnerable due to the evolving nature of fraud tactics. Therefore, fraud in financial institutions occurs through several methods. According to Sanusi et al., the most common method through which fraud occurs in the banking industry is through money laundering (107). Money laundering refers to the unlawful process of hiding the origins of financial benefits that an individual or an entity has gained from illegal activities or entities. Financial institutions are largely vulnerable to money laundering due to their nature of core operations, which involves receiving and lending out money (monetary transactions).

In addition to this, Mangala, and Kumari explain that financial institutions are also highly susceptible to asset misappropriation as a form of fraud (52). Asset misappropriation is also known as employee fraud, and it involves the misuse, misallocation, or misrepresentation of the assets of a firm. This type of fraud may be hard to detect since the persons involved usually have complete control over the use and allocation of the assets. Therefore, employee fraud is one of the most common forms of fraud in financial institutions. However, Mangala, and Kumari explain that strong internal audit controls and systems are effective in unraveling or preventing asset misappropriation, misrepresentation, and misuse in an organization (56).

Another form in which fraud occurs in financial organizations is through the misrepresentation of the financial performance of the firm (Mangala, and Kumari, 52). This type of fraud is known as financial statement misrepresentation, and it involves the deliberate misstatement or manipulation of the financial reports of the company, including the overstatement of revenues, concealment of liabilities, and overstatement of assets. Mangala, and Kumari explain that the main force behind this type of fraud is the management of the firm attempting to present better performances than the actual one (52). Therefore, this type of fraud often involves the top management of the company.

The perception of UK citizens regarding financial fraud in financial institutions

Cohn et al. note that the numerous cases regarding fraud in financial institutions have eroded the trust and confidence of citizens in the financial industry (86). Therefore, the citizens of the UK typically perceive financial institutions to be dishonest. Furthermore, this mistrust by the citizens often extends to the employees who work in the financial industry, and particularly in banks. Furthermore, the findings of the study by Cohn et al. also note that the culture of the banking industry and the larger financial industry tend to promote dishonesty among the employees of these firms (87). The culture in this industry tends to lean towards materialistic aspects like the generation of revenues and profits of the firms and the growth of the market prices of the firms’ stocks. Moreover, the employees of the financial industries are also more focused on materialistic aspects like increasing their bonuses and potential for salary increments rather than on customer service and ethical practices. These factors have greatly contributed to the perception of UK citizens that financial institutions are prone to fraud and also aid in the same.

In addition to this, Sikka explains that various actions by the UK government to restrict measures of accountability in the financial sector have also contributed to the citizens’ perception that financial institutions are highly susceptible and engaged in fraudulent activities (3). According to this study, a pluralist culture plagues UK democracy such that the political players tend to advocate for measures of transparency and accountability publicly, but a persistent culture of secrecy riddles their actions. This factor has eroded the trust of the citizens in financial institutions, and they believe that financial institutions and banks, in particular, were largely responsible for various financial scandals in the country.

Theoretical framework

The knowledge of symptoms and causes of fraud is a cardinal factor in detecting and preventing fraud in financial institutions. Evidence abounds in literature that fraud fundamentally occurs due to lack of proper controls by financial institutions and inability of these institutions to detect and deter fraud. As argued by Frankel (2012), fraud is often ascribed to unethical financial decisions especially those in management positions and the complexity of information and technology. Therefore, financial fraud is in most cases warranted by the desire to achieve unhealthy goals and objectives, competition, criminal collaboration, and challenges in meeting financial targets (Omar & Rizuan, 2014). To this end, fraud has globally proved to be a multifaceted phenomenon that may not fit into certain frameworks but since it emanates from human behavior, it remains multidimensional, complex, and an intentional act that can be a consequent of a myriad of interactive factors (Hutchison, 2013; Lokanan, 2015). As a result, Fraud has been viewed from different theoretical perspectives including; rational choice, social behavioral, systems conflict, psychodynamic, social constructivist, and developmental perspective.

Rational choice perspective presumes that human beings behave in a manner that is geared towards accomplishing certain goals through trade-off of social resources by maximizing benefits at least cost. Social behavioral posits that an individual’s behavior is often shaped by interactions in their environment while system perspective perceives the behaviour exhibited by humans as mutual interactions among people in a linked system while conflict perspective presupposes that people tend to advance personal interests by exploiting others. Psychodynamic perspective argues that the behaviour exhibited by human beings is often motivated by innate forces such as emotion, needs, developmental perspective, and mental activity affirm that behaviour of human beings develops into phases that are age-graded through psychological, biological, and social factors.

Fraud Triangle theory

The theory of fraud-triangle through its operationalization, has attracted scholars such as Wolfe and Hermanson (2004); Dorminey et al. (2012); Lokanan (2015); and Ruakaew (2016), among others have expanded the fraud diamond theory by adding the element of capability that entails skills, ability and power as an attribute that is more than just pressure and rationalization. Other researchers like Lokanan (2015), have taken a different notch to propose fraud scale by replacing rationalization with personal integrity, since it is observable while Dorminey et al. (2012) felt that predators commit a fraud by seeking an opportunity that basically doesn’t require rationalization or pressure. The fraud triangle theory (Cressey, 1953 in Schuchter and Levi, 2016, p 108), describes three main conditions that must be met for fraud are present in each case of fraudulent activity: motive, rationalization, and opportunity

Motivation

A motive is attributed to the desire or needs to acquire money, and more recently to hoard or otherwise hide money to maintain its security and secrecy from governing agencies (Schuchter and Levi, 2016). Motive creates pressure for a person, corporation, or other groups to become involved and engage in fraudulent activities (Schuchter and Levi, 2016).

Rationalization

Which they can commit fraud without suffering from personal morality (Schuchter and Levi, 2016). For example, a terrorist organization laundering money through a bank may have an empathetic person inside the bank, or otherwise not find their activities wrong because they are supporting their beliefs.

Opportunity

A third component of the fraud triangle is opportunity, where the fraudster finds themselves in a situation that creates the correct conditions for which fraud can occur, such as poor internal banking controls, lack of audits, low information technology security, and poor or unclear regulations regarding fraudulent banking activities (Schuchter and Levi, 2016). Currently, there is a high rate of fraud from cybercrime in the banking industry which is being fueled significantly by opportunity as the banking and financial industry have difficulty keeping up with cybercrimes (Semenihin and Kondrashin, 2018).

Secondly, rationalization occurs, where the fraudster’s mindset creates a justification through

Chapter Three

Methodology

Research Methodology

The research focuses on fraud in the financial system as perpetuated against individuals and how it impacts the industry in the UK. The methodology part of the study entails an explanation of three main aspects the researcher will undertake to draw the conclusions and make recommendations. The three include critical literature review, data collection, and the analysis of the collected data. The review of the literature involved an evaluation of the previous studies that have highlighted major frauds and related topics as well as regression analysis. Other documents to be analyzed to facilitate the achievement of the first objective included reports from different security agencies and banks. On the collection of data, the researcher will examine the previous studies to facilitate the achievement of this objective. The studies to be considered under this question focus on the financial institution customers and how they perceive their banks as well as others. The third and fourth objectives were achieved through the use of a conceptual model found in the previous researches and develop a regression analysis (Aldohni, 2018, 265). The data for the third objective, which employd variables such as financial crash, was obtained from research and security agencies such as the FFA. From the data, the study established descriptive statistic where the relationship between the variables were created.

Research Design

The study examines fraud in the baking or financial sector in the United Kingdom, hence its focus on how this occurs and the impacts. For the study to achieve the intended purpose, a relevant design should be considered to include all critical aspects. This study will apply a systematic review of the literature about the topic of research to get the needed information. The systematic review or meta-analysis uses systematic methods to gather secondary data, evaluate studies critically, and analyse them either quantitatively or qualitatively (Peffers, Ken, et al., 45). The study design involves the formulation of defined research questions and responds through the empirical evidence based on the eligibility of specified criteria. The use of systematic review increases the relevancy and quality of the literature through the provision of the highest-quality evidence on the subject topic due to reduced biasness. A systematic review is relevant for this study because there has been an extensive study on fraud in the financial system, and most of them have been documented (Kothari, 23). The fraud is associated with multiple factors and impacts that the researcher needs to identify and analyse them to conclude. Thus, the study will employ the analytical method to evaluate the effect of fraud on UK financial systems based on existing literature.

Research Approach

The study examines the area that has been happening, considering the many cases of fraud in the banking sector. Therefore, the researcher will develop a hypothesis or hypotheses based on the studies already conducted previously (Harrison, Karen, and Nicholas, 34). In this case, a deductive approach will be used to test the application and impact of fraud to the financial system in the UK. The focus of the deductive method is to develop the hypothesis concerning the existing theory and creating a research strategy that can test the formulated hypothesis. This approach involves basing on a given path to reason, and as one considers the general application. In relevance to the current study, financial fraud has been documented by economic experts to help understand how this affects the sector.

studies critically, and analyse them either quantitatively or qualitatively (Peffers, Ken, et al., 45). The study design involves the formulation of defined research questions and responds through the empirical evidence based on the eligibility of specified criteria. The use of systematic review increases the relevancy and quality of the literature through the provision of the highest-quality evidence on the subject topic due to reduced biasness. A systematic review is relevant for this study because there has been an extensive study on fraud in the financial system, and most of them have been documented (Kothari, 23). The fraud is associated with multiple factors and impacts that the researcher needs to identify and analyse them to conclude. Thus, the study will employ the analytical method to evaluate the effect of fraud on UK financial systems based.

Research Expectations

The banking sector is a vital one in the global economic growth where all territories consider their financial stability or muscle to express their superiority and dominance. The research expects to find very high potential as well as the actual impact of the fraud on the financial systems. Some of those impacts include a lack of enough finances to support different projects started by the financial institutions (Great Britain Treasury, 45). Most of these effects have been identified to be part of the contributing factors to ad the economic performance of countries. As a result, it is also expected that the study will find issues like high-interest rates, low economic growth, and GDP as a result of financial fraud.

Ethical Considerations

The study is mainly involved in secondary data. There will be no interaction with people as online searches will be carried out on various journals as well as websites of the different agencies and financial institutions (Harrison, Karen, and Nicholas, 34). As a result, there will be no letter of consent as well as forms of participation that will be needed. The only requirement will be a Principle Investigator Certificate (PIC). However, the researcher should pay attention to the intellectual right of the materials to avoid misuse or copying the content without the owner’s approval.

Implications

The findings of this research will alert the government as well as financial institutions on the dangers of financial fraud. They can use the information to further the investigation on potential risks and therefore make necessary policies that will control fraud. Similarly, banks and other financial institutions will use the information to develop detection and preventive measures to avoid fraud.

Data Sources

The research will be based on a systematic review of the literature on the banking/financial sector, hence the use of secondary data. Data sources will, therefore, contain the materials or documents with relevant information, both qualitative and quantitative, on the financial aspect (Peffers, Ken, et al., 45). For qualitative data, previous researches will be established based on the topic they address. Therefore, these sources will include articles on the financial concept, including the many aspects that play a role in this sector, financial reports for companies, and government documents that examine the financial sector.

The topics must be related to fraud in the UK and have studies on the financial institutions as well as incorporate their effects on the customers.. Several types of research on the crisis will be identified to have divergent findings from different researchers. The quantitative data will be obtained from various agencies like the National Fraud Intelligence Bureau (NFIB) and FFA who have a list of frauds which occurs in different institutions, their nature and the extent of damage they cause on those institutions as well as the customers (Levi, Michael, and John, 237).

Data and data collection

Secondary data from the UK financial fraud was utilized in this survey. Data on 30 individuals and several financial institutions had been collected. The data was extracted from the site and entered into SPSS for analysis.

Analytical framework

The study used both quantitative and qualitative data. Different statistical approaches were utilized in analyzing the four objectives of the study. Both descriptive and inferential statistics were used. Descriptive statistics through tables, pie charts, percentages and frequencies and inferential statistics through Analysis of Variance (ANOVA) and regression analysis were used. The descriptive statistics were used to investigate how fraud occurs in the financial institutions, to analyse the perception of UK citizens on financial institutions about financial fraud, and to examine the behavior of financial institutions where there are limited flow and circulation of money. To analyse the effect of fraud on some of the institutions with the history of financial fraud, inferential statistics through Analysis of variance (ANOVA) through F- statistics and regression analysis were employed.

Chapter Four

Results and discussion

The research primarily focused on the impact of fraud on the financial system in the UK. The study purely used secondary data for analysis. To establish the effect of fraud on the financial system in the United Kingdom, a regression analysis was executed using Statistical Packages for Social Sciences software (SPSS) version 20. Pearson correlation and analysis of variance (ANOVA) were also conducted using a similar version of the SPSS software. Through the analysis, the study aimed at answering the research hypothesis formulated in the study.

Therefore, this section presents the analysis results and discussion in four major sections based on the study objectives. This includes; (1) investigating how fraud occurs in the financial institutions, (2) to analyse the perception of UK citizens on financial institutions about financial fraud, (3) to analyse the effect of fraud on some of the institutions with the history of financial fraud, and (4) to examine the behavior of financial institutions where there are limited flow and circulation of money. Descriptive statistics through frequencies, percentages, and F-tests were employed to investigate how fraud is executed in the financial institutions and analyse the perception of citizens on financial institutions. To analyse effect of fraud on financial institutions, a regression analysis was employed. Literature on previous findings, together with descriptive statistics, was employed in examining the behavior of financial institutions in instances where the flow and circulation of money in the economy is low.

How Fraud Occurs in Financial institutions

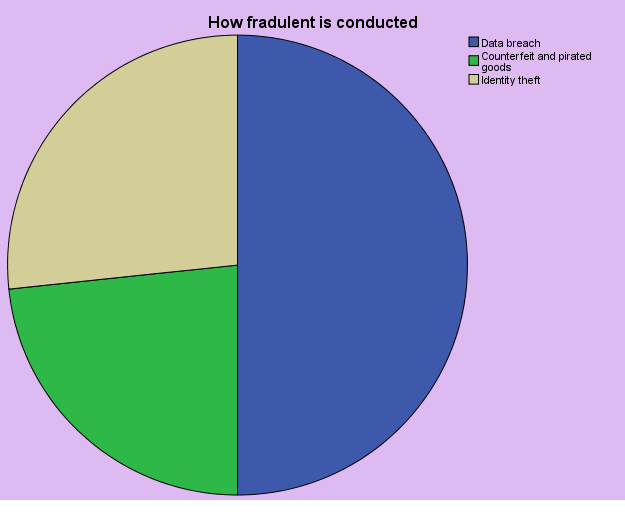

Fraud in the United Kingdom is increasingly being committed through a myriad of platforms. Upon reviewing literature, it was evident that unlike in the past, when financial fraud was occasionally committed via post, phone, or in person, fraudsters have transitioned their ways in line with the gradual transformation and advent of new technology (Agyemang-Mintah & Schadewitz, 2018). From the review of the national crime urgency by the government of the UK (https://www.nationalcrimeagency.gov.uk/), it was found that financial fraud in the UK majorly occurs through breach of data, Counterfeit or pirated goods, and or theft identity as presented in Table 2.

Data validation and pre-diagnostic test

Data

The normality of the data was testing using Kurtosis and skewness, as presented in Table 1. From the results, a kurtosis of -1.484 and a standard error of Kurtosis of 0.833 with a skew of 0.487 indicating that the data was symmetrical and okay for analysis.

Table 2: How fraudulent is conducted in the UK

| Variable | Frequency | Percent | Valid Percent | Cumulative Percent | |

| Data breach | 15 | 50.0 | 50.0 | 50.0 | |

| Counterfeit and pirated goods | 7 | 23.3 | 23.3 | 73.3 | |

| Identity theft | 8 | 26.7 | 26.7 | 100.0 | |

| Total | 30 | 100.0 | 100.0 | ||

From the analysis, it was explicit that data breach was the commonly used way through which fraudulent was conducted in the UK at 50%, followed by identity theft at 26.7% and trailed by counterfeit and pirated goods at 23.3% as indicated in Table 2. As reported by the National Crime Center of the UK (2020), data breaches continue to be a fundamental enabler of fraud. Through this method, criminals maliciously obtain personal and financial information of individuals, the public sector, and the private sector alike and use it in committing fraud (Makki et al., 2019). By harvesting financial information and personal details through data breaches, fraudsters damage businesses, and people by extorting them money. According to the Crime Survey of Wales and England, the 2016-2017 financial year alone reported fraud activities that amount to a loss of just about 3.5 million sterling pounds (Sivarajah, 2018).

Figure 2: Pie-chart on how fraud is conducted in UK

As presented in Figure 1, identity theft criminals are able to access sufficient information about an individual to facilitate them to commit fraud. Through cybercrime, criminals, as argued by Camillo (2017), utilize a myriad of techniques to steal details through social engineering and outright theft to harvest data. With this information, the criminals breach information from victims through impersonation, thereby accessing bank accounts and fraudulently claiming benefits or even obtaining genuine documents that they end up using them maliciously. Through this method, criminals mostly sent phishing emails, then trading data to further their interests.

The third way that was identified was through the use of counterfeit and pirated goods. In this way, fraudsters tend to reap monumental benefits from low or zero cost investments that in most cases make the UK government to lose significant revenue in taxes and businesses and individuals to lose profits while putting consumers at the danger of unsafe and poor quality goods. In the financial sector, criminals may engage in the printing of fake currencies that are overly harmful to the economy (Sivarajah, 2018). As acknowledged by the National Crime Center of the UK (2020), criminal groups in the UK continue to counterfeit £20 notes despite increased security features. However, enhanced security features have successfully reduced the problem with the new coins and the £5 note and £10 note polymer.

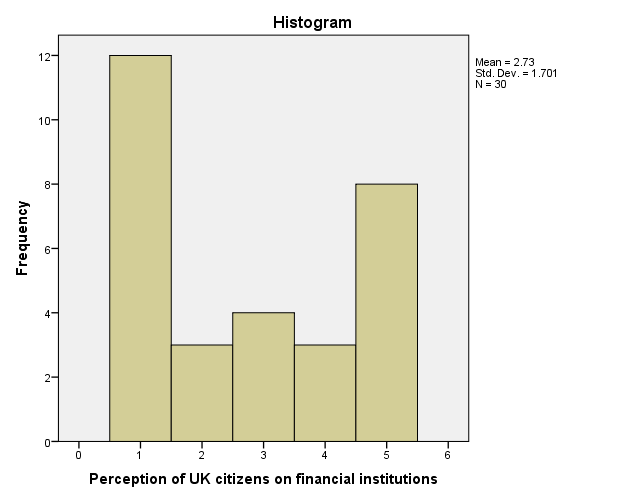

Perception of UK citizens on financial institutions about financial fraud

The perception of the UK citizens with regard to financial fraud on financial institutions was measured using a Likert scale consisting of five Likert items as posited by Kisiangani et al. (2019), to understand how citizens viewed the actions of financial institutions on financial fraud. For an extended period, financial and banking frauds have been a major cause of various economic consequences, including low customer belief and satisfaction in the systems, high rate of insurance costs, decreased in the available capital in the country’s economy, among other economic challenges (Sikka, 2017). Generally, most financial institutions need to have reliable customer confidence for their general operations, a situation that has continually been sidelined by the banking frauds experienced within the country (Toms, 2015). As a result, financial institutions are bestowed with the responsibility of making a raft of decisions in response to financial fraud instigated by fraudsters. The decisions undertaken by financial institutions could be effective or ineffective. Premised on the aftermath of the decisions, citizens develop perceptions.

Table 3: Perception of UK citizens on financial institutions

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Not responsive | 12 | 40.0 | 40.0 | 40.0 |

| Slightly responsive | 3 | 10.0 | 10.0 | 50.0 | |

| Don’t know | 4 | 13.3 | 13.3 | 63.3 | |

| Responsive | 3 | 10.0 | 10.0 | 73.3 | |

| Very responsive | 8 | 26.7 | 26.7 | 100.0 | |

| Total | 30 | 100.0 | 100.0 | ||

The perception of the citizens based on the responsiveness of financial institutions to financial fraud is summarized as presented in Table 3. The descriptive statistics indicate a mixed view or opinion from the citizens with regard to the response undertaken by financial institutions in the UK. The results pointy out that the majority of the citizens, approximately 40% felt that financial institutions in the UK were not responsive to financial fraud, followed by 26.7% feel that the financial institutions were very responsive to financial fraud. On the other hand, 20% of those enumerated equally felt that the financial institutions were at least responsive to instances of financial fraud. In comparison, 13.3% were not aware of the response actions undertaken by financial institutions. These divergent perceptions on financial institutions could be ascribed to the nationwide outcry by customers across the United Kingdom that financial institutions have not done enough to put financial fraud under control. By the end of 2018, the amount of money that was clawed back by banks and refunded to victims of financial fraud dropped from 21% to 19% by the end of the second quarter of 2018 indicating a lapse in the aggressiveness of financial institutions to assist victims to recover what they have lost to fraudsters.

Figure 3: Perception of UK citizens on financial institutions

As presented in figure 1, the standard deviation in the perception of UK citizens on financial institutions was 1.701, with a mean of 2.73. The standard deviation is high, indicating divergent views of the citizens. The perception by 26.7% of the population that banks are very responsive could be attributed to a new strategy to be implemented by financial institutions in the UK with extensive carrying out of name checks and validation before sending money. However, this strategy has been delayed as it was to commence by the advent of the 2019 summer initially. Furthermore, financial institutions have undertaken keen attention and analysis of fraudulent activities and reported that there is a surge in the number of criminals employing digital schemes to steal sensitive information on cards of online shoppers (Sikka, 2017). Just by identifying the current strategy used by criminals could be sufficient for a given section of the population that the financial institutions are concerned about bringing these criminal activities to a halt. However, premised on the average weighted mean of 2.73, as presented in Figure 1, indicated that on average, citizens felt that the banks were only slightly responsive to criminal activities and had not done enough.

Effect of fraud on financial system

With the hypothesis of the study formulated as;

H0: No significant impact of fraud on the financial system

H1: There is a significant impact of fraud on the financial system

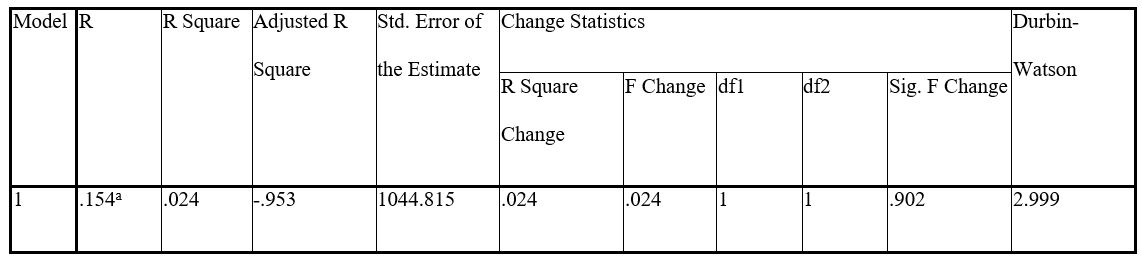

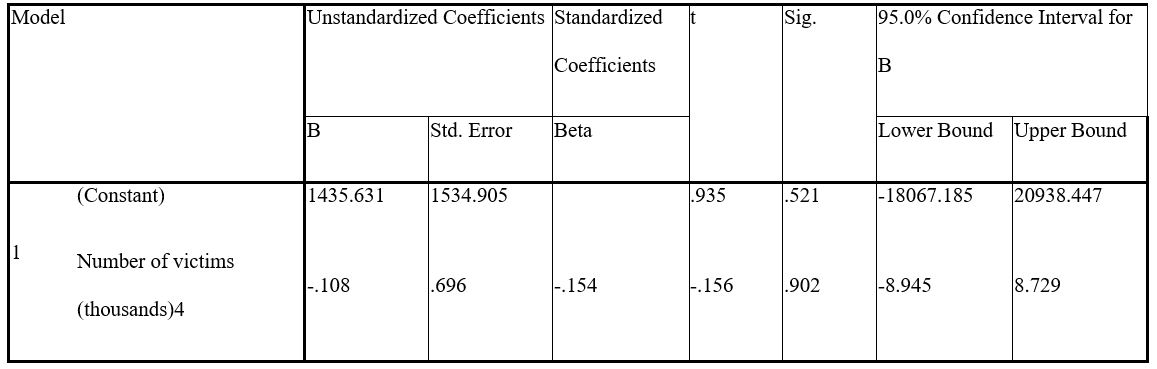

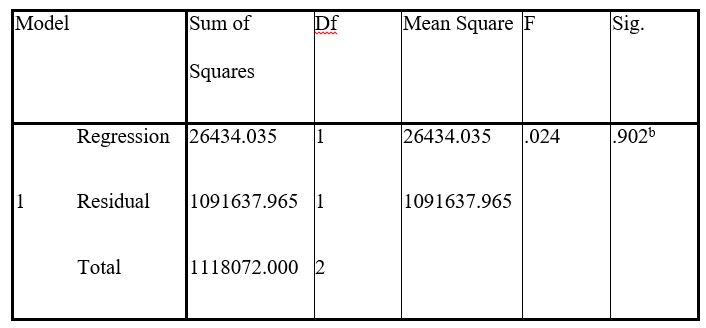

A regression analysis was performed with fraud treated as a dependent variable, while the number of victims affected by frauds treated as an independent variable. The dependent variable (fraud) consisted of bank and credit account fraud, consumer and retail fraud, and all other fraud within the UK financial system.

Table 4: Pearson correlation between fraud and the UK financial system

| Frauds | Number of victims (thousands)4 | ||

| Pearson Correlation | Frauds | 1.000 | -.154 |

| Number of victims (thousands)4 | -.154 | 1.000 | |

| Sig. (1-tailed) | Frauds | . | .451 |

| Number of victims (thousands)4 | .451 | . | |

| N | Frauds | 3 | 3 |

| Number of victims (thousands)4 | 3 | 3 | |

Table 5: Variables Entered/ Removed

Table 6: Model Summaryb

Table 7: Regression model

Table 8: Analysis of variance (ANOVA)

Results:

From the results, it is explicit that there exists a variation on fraud in the UK financial system with reference to the data. The F-statistic (ANOVA) indicates that the mean is statistically significant at level of significance. The is less than the , therefore with respect to theoretical expectation, the estimated parameters are statistically significant at a 95% confidence interval.

Thed t-test was employed to the data to test the significance of the parameter estimates. The is less than , an indication that the null hypothesis is rejected and hence accepting the alternative hypothesis, concluding that there is a significant impact on fraud on the financial system in UK.

Behavior of financial institutions during limited flow and circulation of money

When an economy is embattled with issues of financial fraud, everyone tends to hold to on to their money. As a result, there is a limited circulation of currency within the economy. This is because the targeted group that mostly includes the vulnerable (the elderly), small businesses, and partially the major corporations tend to be averse due to higher financial risks of losing their money to fraud. As a consequence, financial institutions are compelled to increase interest rates for depositing money and lowering the interest rates for borrowing to encourage these sections of the economy are actively engaged in the financial market. As presented in Table 10, it is clear that fraudsters majorly target the elderly who may be not aware of the current schemes employed by criminals who are always changing their tactics with changing security measures. Small businesses closely follow this at 30% and major corporations at 23.3%. These proportions could be attributed to the nature of security measures undertaken by small businesses and major corporations, respectively. The result implies that small businesses are more vulnerable to fraud than their counterparts (Major corporations). This could be attributed to the inability of small firms to protect themselves efficiently by hiring IT experts who can ensure utmost security as compared to the major corporations.

Conclusion

From the analysis, it is evident that there is a significant impact on fraud on the financial system in the UK. According to the R-square from the regression analysis, it implies that around 24% of the variations in the financial system in the UK are explained by fraud while 76% is attributed by other factors. This could be attributed to a raft of actions adopted by the UK thorough name checks and detail validation before transfer or release of funds and introduction of the voluntary code of conduct that requires financial institutions to ameliorate mechanisms through which they respond to fraud. The central bank of the UK has also relooked and increased the security features of currency notes, especially the 5 and 10 polymers, to curb the printing of counterfeit notes within the economy. The regression analysis was also backstopped by a kurtosis of -1.484 with a standard error of Kurtosis of 0.833. This first implies that the data was not skewed and was an adequate representation. The kurtosis value is -1.484 indicates a small probability that the fraud is small, especially when measuring investment or risk (Uhm & Yi, 2019).

Fraud in the UK commonly occur through three main ways, and this includes data breach, identity theft, and the use of counterfeit and pirated goods. Data breach is the commonly used way where criminals gain access to critical information about individuals, businesses, and even the public sector and use it to commit fraud. Through counterfeits, criminals earn monumental benefits from low investments that usually have severe impacts on the economy in the long run as the economy ends up losing revenues in taxes and sabotaging the economy through investors holding back to their money affecting money in circulation. As a result, commercial banks are compelled to undertake different measures that may not be in line with the requirements of the central bank. Furthermore, this may expose consumers to unsafe and low-quality goods in the economy. Criminals may also engage in identity theft where they fraudulently gain access to sufficient information about other individuals using the details through social engineering and outright theft to harvest sensitive data through cybercrime to access bank accounts and other essential documents.

With regard to the perception of UK citizens on financial institutions about fraud, their perceptions were divergent. About 40% of the citizens felt that financial institutions in the UK were not responsive to financial fraud, while 26.7% felt that the financial institutions were very responsive to financial fraud. However, 20% of the citizens equally felt that the financial institutions were at least responsive to instances of financial fraud, with only 13.3% not being aware of the response actions undertaken by financial institutions. The average weighted mean of the citizens’ perception indicated that citizens felt that financial institutions were slightly responsive to fraud, implying that financial institutions had not done enough to address financial fraud.

When the flow and circulation of money is limited in the economy, banks tend to undertake actions that are aimed at encouraging individuals and firms to save and borrow by regulating interest rates for fixed deposits and lending rates. These actions are mostly undertaken to cushion the segments of economy players that are mostly affected by fraud. This includes the long-term measures undertaken to ensures that financial fraud is minimized as much as possible. Premised on the results and findings, the study recommends that financial institutions must invest in technologies that can prevent fraud. Financial institutions should also consider introducing biometrics in access to funds. The study further recommends regular updates of the financial system and software to ensure that possible loopholes that could be utilized by criminals are completely sealed.

References

Daigle, R. J., Hayes, D. C., & Morris, P. W. (2014). Dr. Phil and Montel help AIS students “Get Real” with the fraud triangle. Journal of Accounting Education, 32(2), 146-159.

Dorminey, J., Fleming, A. S., Kranacher, M. J., & Riley Jr, R. A. (2012). The evolution of fraud theory. Issues in accounting education, 27(2), 555-579.

Hutchison, E. D. (2016). Essentials of human behavior: Integrating person, environment, and the life course. Sage Publications.

Lokanan, M. E. (2015, September). Challenges to the fraud triangle: Questions on its usefulness. In Accounting Forum (Vol. 39, No. 3, pp. 201-224). Taylor & Francis.

Retrieved from https://www.dailymail.co.uk/news/article-7509615/Bank-scammers-stealing-1million-DAY-fraud-epidemic.html

Transunion (2019) The Evolution of Fruad. Retrieved https://www.transunion.co.uk/blog/the-evolution-of-fraud/

UK Finance (2019). Fraud the Facts 2019. Retrieved https://www.ukfinance.org.uk/

Wolfe, D. T., & Hermanson, D. R. (2004). The fraud diamond: Considering the four elements of fraud.

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee