Canadian Output Growth, Research Paper Example

Introduction

The recent energy economist talks conceived two opposing conception about the association between output development and use of energy. One conception point argued that the primary value source is energy since other production elements like capital and manpower are heavily depending on energy. Conferring to this conception, energy consumption is supposed to be a restrictive aspect to growth of the economy. Conception two pointed out that energy is a commodity that is impartial to development, which will be termed as “impartiality hypothesis” in this literature.

Energy doesn’t significantly influence the output growth because its cost is very minor as a GDP proportion. Also, it has been suggested that the influence of energy use on development depends on the economy structure and the economic development level of the nation in question. The economy production structure is probably tend to shift towards services while the economy develops that are not rigorous energy activities (See, examples Cheng 80) and Lately, many empirical literature relative to the subject studied the association between output growth and use of energy by experimenting for the presence and causality direction amid the two elements in either a multivariate or bivariate context. However, there are conflicting result produced by this literature and, there is no harmonically finding in both the presence of causality direction between output growth and use of energy. There are circumstances where causality was noted from GDP to use of energy. These include some developed countries (Erol & Yu 97), America (Kraft & Kraft 78), South Korea (Yu and Choi, 633), and Taiwan (Cheng & Lai, 128). In other circumstances, interconnection was noted to be from use of energy to GDP like India (Masih & Masih, 56). Finally, there were circumstances where it was noted that causality ran bi-directionally amid use of energy and GDP like the Philippines and Thailand (Asafu-Adjaye 625). These findings were clustered as proof in favour use of energy neutrality with respect to development or its proxies.

The failure of accounting for time series attributes of the involved variables is the key inadequacy of early studies of empirical data on the association amid use of energy and output growth, therefore most of them might have generated bogus results. Still, the procedures of SBC-Standard Bivariate Causality included in this paper, like Sims’ (82), and Granger’s (69) might not perceive supplementary causality channels and can generate controverting results (Stern, 2000). To be specific, Stern (2000) claims that bivariate assessments may not perceive a fundamental relationship due to switch effects that might take place amid energy and many other inputs. The opposite shifts in utilisation of other aspects, changes in consumption of energy will be experienced. Replacement could result in an irrelevant influence of use of energy on development.

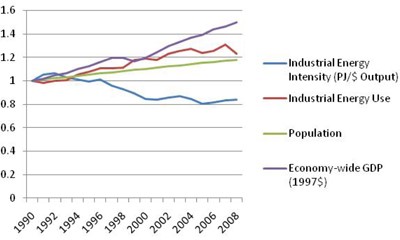

The demand for Industrial energy cultivated to 23% amid 1990 and 2008. Nevertheless, a reduction in use of energy in the past 2 years proves how common economic circumstances impact industrial use of energy. The economic catastrophe in 2008 stemmed fluctuations in use of energy after steady increases over years (Figure 1).

Figure 1 : Source: Statistics Canada, NEB, NRCan, 2010

PAPER OBJECTIVE

This paper’s main objective it to empirically study the fundamental interactions amid output growth and the use of energy in Canadian case. A framework grounded on the production technology of neo-classical one-segment aggregate in which manpower, energy and capital are each assumed as individual inputs. In this structure, data time series attributes is used and construct a VEC-vector error-correction framework to assess Granger-causality and multivariate co-integration. The analysis of the empirical results reveals that labour, capital, energy and output share two common stochastic trends. Singularly, energy and output are seen to be collectively shifting towards a steady long-run balance affiliation that is constant with running of causality bi-directionally.

Discission

Recently, Granger-causality and co-integration analysis have been utilized in empirical studies of use of energy and output growth relationship. Analysis of co-integration was utilised by Jin and Yu (179) to assess the long-run association amid recruitment and use of energy in additional to USA output. Their findings revealed that a relationship of co-integrating did not exist amid these variables and use of energy. Stern (72) scrutinized the causal association between use of energy and GDP in America. He recruited a multivariate VAR-vector autoregressive investigation and implemented energy quality weighting index, where use of energy content moves from inferior quality energy like coal to superior quality energy for instance electricity, instead of utilizing a total use of energy measure. He also implemented a dissimilar causality analysis. His findings suggested that total use of energy does not Granger trigger GDP.

Nevertheless, utilizing a weighting energy measure revealed that Granger is the cause of GDP. Stern (67) prolongs his study on the American economy by introduction of co-integration examination of the association amid GDP and energy. He again found that the use of complete energy use does not support the argument that Granger causing GDP. Nevertheless, using quality weighting index of energy is found to be Granger causing GDP. Stern (80) co-integration findings revealed that energy cannot be assumed from the space of co-integration.

For the meantime, innovative and extra resourceful technology is making improvement in cultivating industrial sector energy intensity in Canada. A current world’s chief industries technical evaluation by the IEA-International Energy Agency advocates that productiveness as a whole might appreciate auxiliary energy productivity gains of 18% to 26%. The industrial division, inspired by aspects like aggregating costs of energy, on-going tutoring and programmes that trigger awareness, and changes in the regulatory division, is already occupied to implement more resourceful technologies. A shift towards more change, advanced technologies is anticipated to see this inclination advance even more. This may comprise of switching of fuel to green fuels, heat retrieval, cogeneration, and other eco-friendly technologies.

Economic Growth Drives Energy Demand

Over 60 years, a Canadian economy of the nation is founded by the sector of energy by supplying affordable and consistent energy, job creation, royalty and tax incomes and technological advances. Canada as a developed country, consistent and cost effective energy allows the services and goods that enhance and lengthen life. For developing countries, the demand for dependable and cost effective energy is more essential. It can advance and even live saving. In these nations, dependable energy sustains extended industry, contemporary agriculture, amplified commercial activities and enhanced transportation. These are considered the main elements that assistance individuals eradicate poverty and generate better lives. Nowadays a significant proportion of the energy used in Canada and globally derives from hydrocarbons, with rudimentary oil being the transportation fuels leading supplier. Despite substantial strides in refining energy productivity, universal demand of energy is estimated to be about 30% greater in 2030 when matched with today’s level.

Production of energy must upsurge to satisfy this emergent demand from both developing and developed nations since renewables alone cannot measure up with the encroaching demand. All energy sources are required. This suggests an oil and gas escalating demand for, which assumed the existing fields exhaust, need progressively sourced from isolated and challenging areas and eccentric bases like sands of oil. Sands of oil are a huge resource of barrels approximating to 173 billion. They’re categorized second solitary to Saudi Arabia in relation to oil reserves that are recoverable in nature. They’re the 6th leading source of fresh source internationally — surpassing nations like Kuwait and China. Over the coming 20 years, oil sands production, contingent to recovery costing and economic markets, is projected to upsurge from 1.3 million barrels per day to around 3.8 million and 5.4 million barrels in day.

Our industry obstacle is guaranteeing that we shift frontward in evolving this globally vital resource in a considerate and accountable approach. At Imperial, we trust that we are capable of having dependable and cost effective energy, a robust economy and eco-friendly environment.

Findings

Out of the 5 models approximated, 3 models were noted to be unidirectional causality amid the use of energy and GDP whereby causality spreads from the use of energy towards GDP. The other 2 models remaining, he realised a causal relationship bi-directional amid GDP and energy utilisation. Stern findings claim that a significant descriptive element clarifying American’s GDP is considered to be energy. Bivariate analysis was used by Cheng (75) out of which he found no causality amid GNP and use of energy in America in either path. He also used multivariate method and found on causal association amid GNP and the use of energy. A six Asian country group was used to research this relationship through a co-integration analysis by Masih & Masih (198) in which they found a co-integration amid GDP and use of energy in Pakistan, Indonesia and India. But for Singapore, Philippines and Malaysia co-integration was not found. In Taiwan, Yang (200) sampled this country to analyse causal relationship amid the use of energy and GDP through utilising varied energy measures of consumption. His findings revealed that a bi-directional causality amid GDP and use of energy.

However, Yang’s finding reverses that of Lai and Cheng (231) in which their findings suggested a uni-directional causal relationship amid income and the use of energy in Taiwan. Lastly, through utilisation of error-correction and co-integration analysis, Asafu-Adjaye (204) using 4 Asian countries, he scrutinised the causal association amid their income and use of energy. His findings suggested, causality spreads from energy to revenue in Indonesia and India, while a causality which is bi-directional in both Philippines and Thailand.

The analysis was steered by the use of a joint F-statistic for the omission of an inconstant from equality. The findings suggest that Granger-causality is spreading in a bi-directional manner amid use of energy and output growth. Hence, when compared with neo-classical claim that energy is growth-neutral, the Canada results are dependable on the view that the use of energy has a causal influence on the output growth. The findings are also in proportion to Asafu-Adjaye’s (210), Stern’s (132) and Yang’s (267) findings where they attained parallel results on other sampled nations. The Granger-causality analysis carried out only suggests causality presence.

Nevertheless, no indications are provided as to the influence of causal importance that energy inflict towards output growth. For instance, when supply of energy experience a shock, it is essential to know the amount of thrust that shock inflicts on output growth frequency. Also, it’s vital to appreciate the effect duration. For the purpose of answering the above questions, we proceed to forest-error variance decomposition of growth of output into quantities attributable to improvements in individual system variable with its own. A shift in any of the random improvements will directly alter the dependent variable value, hence, a change in left out variables future values in the system will be experienced through the model dynamic structure (Akarca 170).

Since shift in the random improvements generate future values variations it is likely the forecast-error total variance to decompose in any of them and find out the quantity of these variance each individual variable elaborated. Since our main objective concentrates on the growth of output response towards shocks in the aspect inputs, especially energy, only decomposition of the output growth forecast-error variance variable where considered in reaction to a standard deviation improvement in labour, energy and capital. Since the improvements are not certainly fully uncorrelated, the residual jargon includes “orthogonalized” using the “Choleski” decomposition for the purpose of obtaining a resulting innovations diagonal covariance matrix, thus, segregate the impact of individual variable on the other.

The manufacturing sector is anticipated to stay as the major energy consumer in Canada in the many years to come. Nevertheless, there are several aspects that will impact Canada’s energy concentration; or the energy amount used, per economic output dollar. These aspects comprise continuing operational modifications in Canada’s economy in addition to industrial production procedures and changes in technology. As the service share upsurges in relation to the commodity sector, the Canadian economy energy concentration will gradually improve (Akarca 160). For the meantime, the global markets shifting dynamics, and emergent trade related with industries of energy intensive will progressively impact the entire demand of Canadian energy inclinations. Lastly, developed and innovative technology will aid decreasing the industrial sector energy intensity in Canada.

Conclusion

This paper tried to examine the causal relationship amid output growth and the use of in Canada. Grounding on neo-classical one sector aggregate production technology, we constructed a VEC structure after analysing for multivariate co-integration amid labour, capital, output and the use of energy. The co-integration analysis suggests that co-integration space is significantly entered by energy (Akarca 155). Furthermore, the shortened aspect of the variables reveals that the causality flow is spreading in bi-directionally amid output growth and the use of energy. Utilising growth output variance decomposition and forecast-error variance, findings suggest that when energy experience a shock, the output growth frequency will be inflicted with a 15% change. Therefore, the findings tend to considerably assume the neo-classical hypothesis that energy is neutral to development. As a result, we come to a conclusion that energy can be considered as a limiting aspect to growth of output in Canada and, thus, shocks experienced in the supply of energy will have a negative influence on output.

Work Cited

Akarca, Ali T, and Thomas Veach Long. “Energy and employment: A time-series analysis of the causal relationship.” Resources and Energy 2.2 (1979): 151-162.

Asafu-Adjaye, John. “The relationship between energy consumption, energy prices and economic growth: time series evidence from Asian developing countries.” Energy economics 22.6 (2000): 615-625.

Brendt, E. Energy Price Increases and Productivity Slowdown in United States Manufacturing. Federal Reserve Bank of Boston, the Decline in Productivity Growth. Federal Reserve Bank of Boston Conference Series. 1980, Boston, USA.

Cheng, B. An investigation of co-integration and causality between energy consumption and economic growth. [J. Energy Dev]. 1995.

Cheng, S.B., Tin, W.L. An investigation of co-integration and causality between energy consumption and economic activity in Taiwan, Province of China. Energy Economics. (1997) 19, 435–444.

Denison, E. Trends in American Economic Growth, 1929–1982. Washington, DC: Brookings Institution, 1985. Print.

Granger, C. Investigating causal relations by econometric models and cross-spectral methods. Econometrica (1969) 37, 424–438.

Kraft, J., Kraft, A. On the relationship between energy and GNP. J. Energy Dev. 3, 1978. 401–403.

Masih, A., and Masih, R. Energy consumption and real income temporal causality, results for a multi-country study based on cointegration and error-correction techniques. Energy Econ. (1996) 18, 165–183.

Sims, C. Money, income and causality. Am. Econ. Rev. 62, 540–552. Solow, R., 1978. Resources and economic growth. Am. Econ. (1972) 22, 5–11.

Stern, D. Energy use and economic growth in the USA, a multivariate approach. Energy Econ. (1993)15, 137–150.

Stern, D. A multivariate co-integration analysis of the role of energy in the US macro-economy. (2000) 22, 267–283.

Yang, H. A note on the causal relationship between energy and GDP in Taiwan. Energy Econ. (2000) 22, 309–317.

Yu, E., Choi, J. The causal relationship between GNP and energy, an international comparison. J. Energy Dev. (1985) 10, 249–272.

Yu, E., Jin, J. Cointegration tests of energy consumption, income and employment. Res. Energy (1992) 14, 259–266.

Yu, E., Choi, P., Choi, J. The relationship between energy and employment: a re-examination. Energy Syst. Policy. (1998) 11, 287–295.

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee