All papers examples

All papers examples

Disciplines

- MLA

- APA

- Master's

- Undergraduate

- High School

- PhD

- Harvard

- Biology

- Art

- Drama

- Movies

- Theatre

- Painting

- Music

- Architecture

- Dance

- Design

- History

- American History

- Asian History

- Literature

- Antique Literature

- American Literature

- Asian Literature

- Classic English Literature

- World Literature

- Creative Writing

- English

- Linguistics

- Law

- Criminal Justice

- Legal Issues

- Ethics

- Philosophy

- Religion

- Theology

- Anthropology

- Archaeology

- Economics

- Tourism

- Political Science

- World Affairs

- Psychology

- Sociology

- African-American Studies

- East European Studies

- Latin-American Studies

- Native-American Studies

- West European Studies

- Family and Consumer Science

- Social Issues

- Women and Gender Studies

- Social Work

- Natural Sciences

- Anatomy

- Zoology

- Ecology

- Chemistry

- Pharmacology

- Earth science

- Geography

- Geology

- Astronomy

- Physics

- Agriculture

- Agricultural Studies

- Computer Science

- Internet

- IT Management

- Web Design

- Mathematics

- Business

- Accounting

- Finance

- Investments

- Logistics

- Trade

- Management

- Marketing

- Engineering and Technology

- Engineering

- Technology

- Aeronautics

- Aviation

- Medicine and Health

- Alternative Medicine

- Healthcare

- Nursing

- Nutrition

- Communications and Media

- Advertising

- Communication Strategies

- Journalism

- Public Relations

- Education

- Educational Theories

- Pedagogy

- Teacher's Career

- Statistics

- Chicago/Turabian

- Nature

- Company Analysis

- Sport

- Paintings

- E-commerce

- Holocaust

- Education Theories

- Fashion

- Shakespeare

- Canadian Studies

- Science

- Food Safety

- Relation of Global Warming and Extreme Weather Condition

Paper Types

- Movie Review

- Essay

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- GCSE Coursework

- Grant Proposal

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- Essay

- GCSE Coursework

- Grant Proposal

- Interview

- Lab Report

- Literature Review

- Marketing Plan

- Math Problem

- Movie Analysis

- Movie Review

- Multiple Choice Quiz

- Online Quiz

- Outline

- Personal Statement

- Poem

- Power Point Presentation

- Power Point Presentation With Speaker Notes

- Questionnaire

- Quiz

- Reaction Paper

- Research Paper

- Research Proposal

- Resume

- Speech

- Statistics problem

- SWOT analysis

- Term Paper

- Thesis Paper

- Accounting

- Advertising

- Aeronautics

- African-American Studies

- Agricultural Studies

- Agriculture

- Alternative Medicine

- American History

- American Literature

- Anatomy

- Anthropology

- Antique Literature

- APA

- Archaeology

- Architecture

- Art

- Asian History

- Asian Literature

- Astronomy

- Aviation

- Biology

- Business

- Canadian Studies

- Chemistry

- Chicago/Turabian

- Classic English Literature

- Communication Strategies

- Communications and Media

- Company Analysis

- Computer Science

- Creative Writing

- Criminal Justice

- Dance

- Design

- Drama

- E-commerce

- Earth science

- East European Studies

- Ecology

- Economics

- Education

- Education Theories

- Educational Theories

- Engineering

- Engineering and Technology

- English

- Ethics

- Family and Consumer Science

- Fashion

- Finance

- Food Safety

- Geography

- Geology

- Harvard

- Healthcare

- High School

- History

- Holocaust

- Internet

- Investments

- IT Management

- Journalism

- Latin-American Studies

- Law

- Legal Issues

- Linguistics

- Literature

- Logistics

- Management

- Marketing

- Master's

- Mathematics

- Medicine and Health

- MLA

- Movies

- Music

- Native-American Studies

- Natural Sciences

- Nature

- Nursing

- Nutrition

- Painting

- Paintings

- Pedagogy

- Pharmacology

- PhD

- Philosophy

- Physics

- Political Science

- Psychology

- Public Relations

- Relation of Global Warming and Extreme Weather Condition

- Religion

- Science

- Shakespeare

- Social Issues

- Social Work

- Sociology

- Sport

- Statistics

- Teacher's Career

- Technology

- Theatre

- Theology

- Tourism

- Trade

- Undergraduate

- Web Design

- West European Studies

- Women and Gender Studies

- World Affairs

- World Literature

- Zoology

Checkpoint- Ratio, Vertical, and Horizontal Analyses, Research Paper Example

Hire a Writer for Custom Research Paper

Use 10% Off Discount: "custom10" in 1 Click 👇

You are free to use it as an inspiration or a source for your own work.

Pepsi and Coca Cola are two of the world’s most premier beverage companies and members of the prestigious Fortune 500 group (Fortune). Coca Cola operates in more than 200 countries (Sicy, 2007) and similarly, Pepsi also sells its products in more than 200 countries (Pepsi Co, 2010). This paper examines the financial statements of both companies in order to conduct a comparative analysis regarding their operating performance, capital structure, financial picture, and competitive strategies. The analytical tools analyzed include vertical analysis, horizontal analysis, and financial ratios. Some of the financial ratios and financial strategies may be quite similar for both companies and this should not come as a surprise since both Pepsi and Coca Cola is each other’s greatest rival. Being close rivals in numerous global markets mean both companies monitor each other’s actions closely.

The importance of vertical analysis stems from the fact that numbers by themselves are of little use unless considered in a bigger context. For e.g. a $10 million income may or may not be an impressive figure, depending upon the sales revenue figure. On $50 million sales revenue, this will translate to 20 percent net income margin which is, indeed, an impressive performance but not so much if earned on $200 million sales revenue in which case it will be merely 5 percent net income margin. Similarly, horizontal analysis is important because a more reliable understanding of a particular company’s performance is obtained by looking at multi-year data rather than single year data. A multi-year data not only helps us recognize the trend but also predict the future direction with more confidence. An impressive performance by a company in any single-year could be one-time lucky event or might have resulted from the fact that the company hit rock-bottom in the near past. Only a multi-year data will help us figure out where an impressive performance may be sustainable or not.

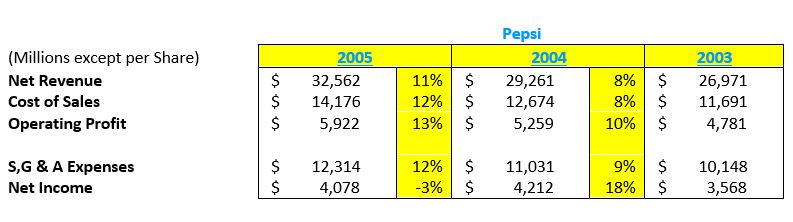

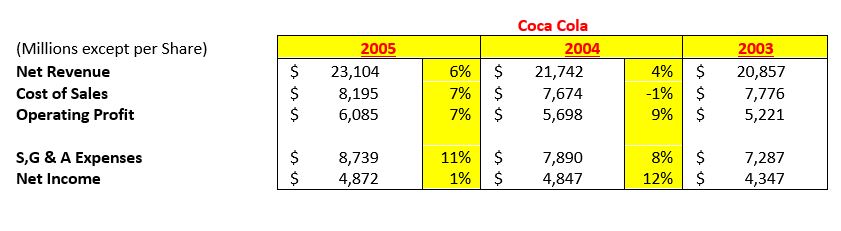

Vertical Analysis

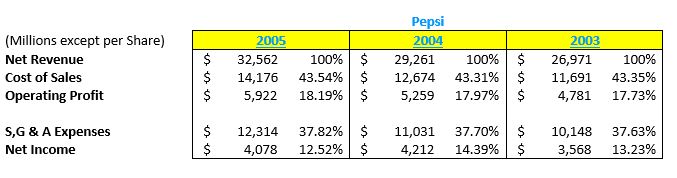

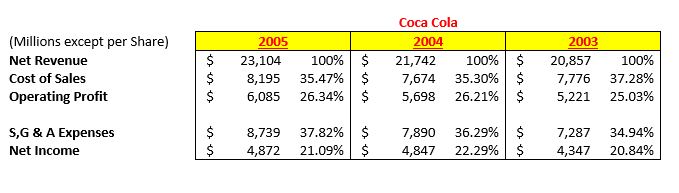

Pepsi’s operating profit showed slight improvement each year during the period 2003-2005. The improvement might have been due to more efficient production processes or better terms from the suppliers. But the company’s net income declined each year from being 13.23 percent in 2003 to 14.39 percent in 2004 and 12.52 percent in 2005. The decline occurred due to an increase in selling, general, and administrative expensive. One reason may be company’s increased marketing expenditure to protect its territory or aggressively market new products introduced during the period.

Coca Cola’s operating profit was 25.03 percent in 2003 and had improved to 26.34 percent in 2005. Like Pepsi, Coca Cola’s selling, general, and administrative expenses also increased which may be an indication of aggressive marketing war between Coca Cola and Pepsi. Coca Cola’s net income increased by 0.45 percent in 2004 as compared to 2003 but declined by 1.10 percent in 2005. In addition to marketing, administrative expenses for both Coca Cola and Pepsi might also have increased as both companies may be adding more people as well as improving compensation to retain talent.

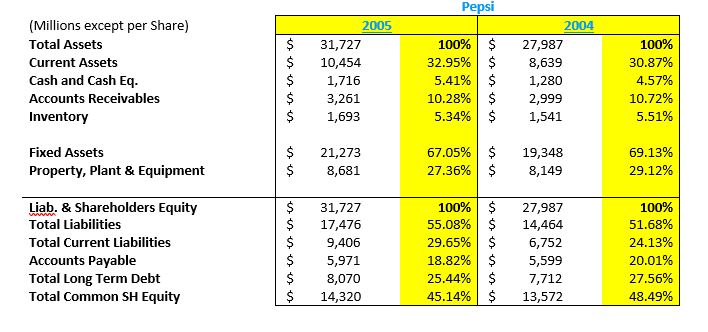

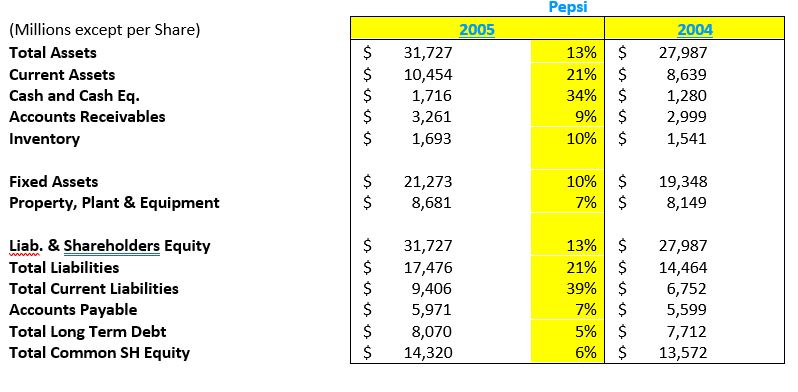

Pepsi’s current assets as a proportion of total assets increased from 30.87 percent in 2004 to 32.95 percent in 2005. One contribution to an increase in current assets was cash reserve which increased by about half a billion dollars from 2004 to 2005. Accounts receivables also increased, probably in order to grow sales. The company’s fixed assets decreased from being 69.13 percent of total assets in 2004 to 67.05 percent in 2005. It’s possible that the company scaled back capital investment plans and probably replaced outright ownership of fixed assets with rental assets. The company’s total liabilities also increased from being 51.68 percent of total liabilities and shareholders’ equity in 2004 to 55.08 percent in 2005. This could be a wise step because long term debt can be a cheaper source of funds than equity financing though debt financing does increase operating expense due to interest. The company’s total current liabilities have also increased and could have negative impact on short term liquidity.

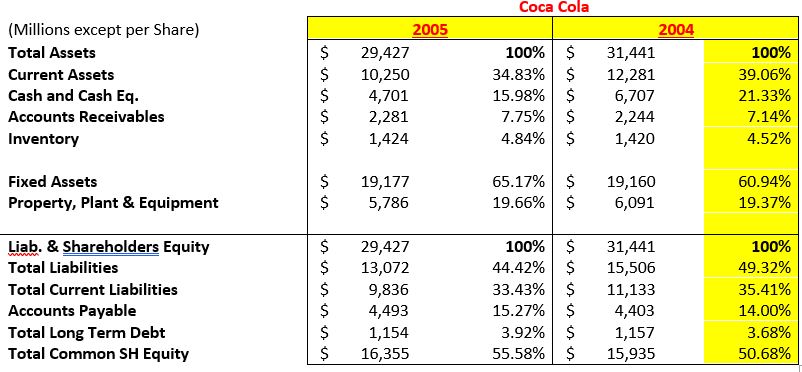

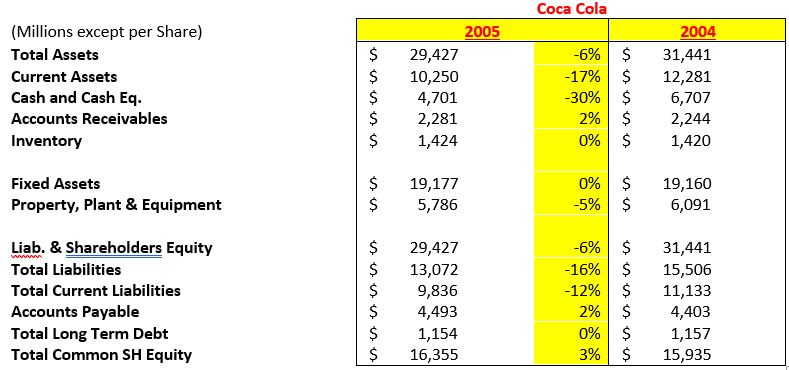

Unlike Pepsi, Coca Cola’s total assets declined during the period. Coca Cola might have sold unprofitable assets or units in order to improve assets efficiency. The company’s current assets also declined from 39.06 percent of total assets in 2004 to 34.83 percent in 2005. Some of the decline occurred due to lower cash reserves, probably due to restructuring costs. A look at the company’s balance sheet indicates the company might have been involved in companywide restructuring and the management scaled back to improve efficiency and control over the business. Total liabilities as a proportion of liabilities and shareholders’ equity declined from 49.23 percent in 2004 to 44.42 percent in 2005. Most of the decline came from a decrease in current liabilities. The company might have paid back some of its account payable and this may also be one of the reasons for decline in cash reserves.

Horizontal Analysis

Pepsi’s net revenue continued to increase over the period. It increased by 8 percent in 2004 as compared to 2003 and by 11 percent in 2005 as compared to 2004. The increase might have been due to greater market share at the expense of Coca Cola as well as the introduction of new products. Operating profit also improved by 10 percent in 2004 and 13 percent in 2005 indicating an improved operating efficiency. Net income improved by 18 percent in 2004 but declined by 3 percent in 2005. The decline was primarily due to increased selling, general, and administrative expenses that might have been due to higher marketing expenditure.

Coca Cola’s net revenue increased by 4 percent in 2004 and 6 percent in 2005. Coca Cola’s cost of sales declined by 1 percent in 2004 but increased by 7 percent the following year. Operating profit improved by 9 percent in 2004 but only 7 percent in 2005 which is in contrast to Pepsi. The company’s net income also showed disappointment. It increased by 12 percent in 2004 but by only 1 percent in 2005. But some of the decline was inevitable as Coca Cola might have been forced to increase marketing and administrative expenditure to deal with Pepsi’s rise.

Pepsi’s accounts receivables increased by 9 percent which may indicate Pepsi’s aggressive sales push. The company’s total liabilities increased by staggering 21 percent which would eat into its profits in the future as the interest payment comes due. But shareholder’s equity also improved due to higher earnings.

Coca Cola’s total assets declined by 6 percent from 2004 to 2005, its current assets declined by 17 percent and its cash reserves declined by 30 percent during the same period. Coca Cola is feeling the competitive pressure from Pepsi and is responding by improving its efficiency and control over its operating. The company’s current liabilities also declined by 12 percent though long term debt remained at the same level.

Financial Ratios

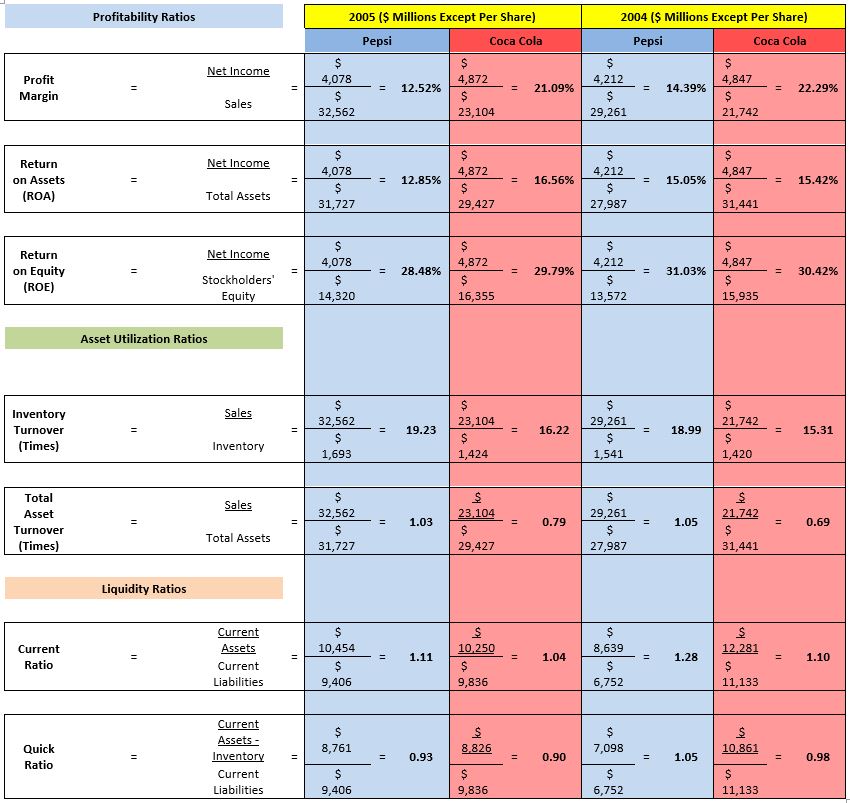

Coca Cola earned more net income than Pepsi in absolute amount despite having reasonably lower sales which explains its higher profit margins of 22.29 percent and 21.09 percent in 2004 and 2005 as compared to Pepsi’s 14.39 percent and 12.52 percent during the same period. Similarly, Coca Cola also outdid Pepsi in other profitability ratios such as ROA and ROE though the lead was less impressive than the profit margin.

Pepsi did better in asset utilization. Pepsi is more efficient at using its assets which may explain why Coca Cola decided to take a second look at its operations instead of continuing to expand aggressively. Pepsi’s turnover ratio was 18.99 in 2004 and 19.23 in 2005 while Coca Cola’s was 15.31 and 16.22 during the same period. Thus, Pepsi sells its inventory faster than Coca Cola and has lower storage costs. Pepsi’s inventory management system is more efficient than Coca Cola’s. Total asset turnover also indicates a similar picture.

Pepsi retains edge in liquidity ratios, too but Coca Cola may catch up as the company has reduced its current liabilities which should reduce its interest obligations and improve profits. Pepsi’s current ratio was 1.28 in 2004 and 1.11 in 2005 while Coca Cola’s was 1.10 and 1.04 during the same period. Pepsi’s lead declines in case of quick ratio which is considered more aggressive measure of short term liquidity.

Pepsi seems to be winning the competitive race but the expansion is coming with a price. The expansion may be one of the causes of lower profit margins. Since Pepsi seems to be the winner, it is likely that Pepsi’s shares have higher price-earnings ratio which makes them more expensive. Coca Cola may be being punished by the stock market but the company is taking steps to scale back and improve its efficiency which should further improve its profit margins. As the stock market takes notice of Coca Cola’s improvements, Coca Cola’s share price will likely see a greater increase in value than Pepsi’s. In terms of management, Pepsi has been a marketing genius but in terms of investment, Coca Cola’s stock is more likely to be cheaper and thus, has a greater profit potential. But our expectations are based on assumptions which could prove wrong. It is likely that Pepsi is able to grab further share of the market and is also able to figure out ways improve its operating efficiency. As we checked the news, we found that Coca Cola embarked on a restructuring campaign of its North American division in 2005 (Red Orbit, 2005).

References

Fortune. (n.d.). Fortune 500: 2011 Full List. Retrieved February 11, 2012, from CNN Money: http://money.cnn.com/magazines/fortune/fortune500/2011/full_list/

Pepsi Co. (2010). Performance with Purpose. Retrieved February 11, 2012, from http://www.pepsico.com/Download/PepsiCo_2010_Sustainability_Summary.pdf

Red Orbit. (2005, July 29). Restructuring at Coca-Cola Enterprises Could Mean Layoffs in Atlanta Area. Retrieved February 11, 2012, from http://www.redorbit.com/news/science/191052/restructuring_at_cocacola_enterprises_could_mean_layoffs_in_atlanta_area/

Sicy, M. (2007, April 23). In cola wars, Coke now has the edge. Retrieved February 11, 2012, from CNN Money: http://money.cnn.com/2007/04/12/magazines/moneymag/colawars.moneymag/index.htm

Stuck with your Research Paper?

Get in touch with one of our experts for instant help!

Time is precious

don’t waste it!

writing help!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee