China Mobile Ltd, Research Paper Example

Background Information

China Mobile Ltd (CHL) is a Chinese multi-national firm that was established and incorporated in 1997. The company deals with the provision of telecommunication products and related services. CHL provides various Internet-related services that include digital services, mobile internet, information services, and certain applications. Primarily, the company operates in two segments – data business and voice business. It offers a wide range of mobile services in over 30 regions or provinces, Hong Kong, directly-administered municipalities in mainland China, and other autonomous regions. Today, the company offer mobile services to over 833.9 million users. It supports transmission in all three generation – 2nd, 3rd, and 4th generation standards. In the segment of voice business, the company provides value-added voice services and user services. With their voice usage services, subscribers can make and receive calls via mobile gadget at any point of company’s network coverage area; consumers can make the local, domestic-long distance, and international calls, as well as international and domestic roaming. In regards to their data business, the company offer SMS, MMS, wireless broadband services, wireless data traffic services (both mobile data traffic services & WLAN), and information services. Moreover, CHL offers information services via their own applications such as Migu Music, Migu Animation, IoTs, Migu Reading and Migu Video among others, and Internet Data Center (IDC).

Mission and Vision Statement

Mission and vision statement are vital elements for any business. That is because they play a vital role in communicating what the company is providing, how they intend to provide those products and how they intend to fulfill their promises to their existing and potential customers. CHL mission statement holds that the company is ingrained to take a leading role for developing and offering best mobile communication services in China as well as in global markets through an established and comprehensive network with a wide-range coverage, world-class customer services, and high-quality services. Evidently, the company’s mission statement has clearly indicated what they offer and promise to deliver unmatched product and services that enhance customer experience and leaves their needs and expectations met. On the other side, CHL’s vision statement holds that the company intends to become a global leader in the provision of telecommunication services and achieve leapfrog evolution that exceeds excellence and maintain prominence. The vision statement is clearly to guide firm workforce on achieving the organization’s short-and-long-term goals and objectives.

Generic Strategy

Porter’s Generic Strategies

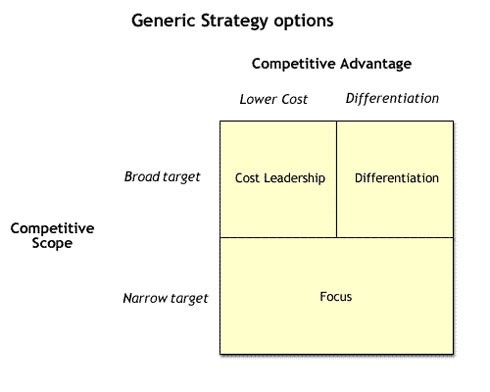

No matter market, industry or sector a business operates in; it has to face competition. In the current modern world, competition has vastly increased due to the evolution and advancement of technology and globalization. Specifically, technology and disruptive innovation have made it easier for small and medium firms to enter markets and thereby to increase market competition. Market policies and increased globalization have all alleviated some of the challenges that face used to face when entering new markets in the last centuries. Hence, today, competition has increased in the market forcing firms to adopt generic strategies that fit their organizational goals and objectives. Michael Porter suggested three generic strategies that firms would use to beat the market competition, ensure their operations are carried out congruent to organizational strategies and enhance overall competitive advantage (Sharp). These strategies include cost leadership, differentiation, and focus.

With cost leadership, firms would provide products or services at lower prices and ensure they produce on large scales thereby getting the opportunity to exploit economies of scale (later explained in details). Differentiation strategy, firms aims to offer products or services that are different from that of competitors with the goal to target broader market share and groups of customers. The last strategy is focus where a firm concentrate on specific niche markets, understand the needs of customers as well as dynamics of those market and goes on to develop well-specified products or services and offer them at low-cost. Firm’s selecting this strategy aim to build brand loyalty among their clients making the market less appealing to firms to enter the market. A model of Porter’s generic strategies is illustrated in Fig 1.

Figure 1: Porter’s Generic Strategy

CHL’s Cost Leadership Strategy

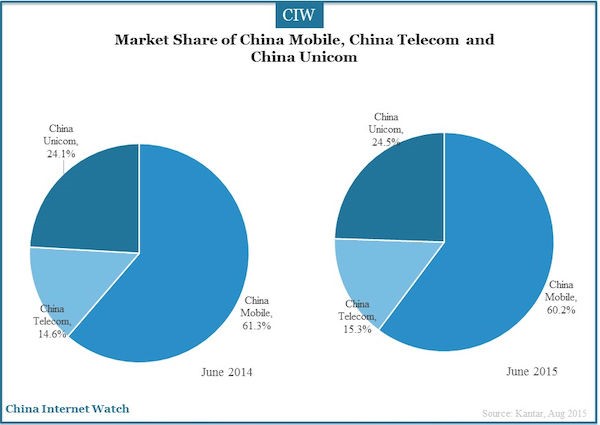

CHL is a company that operates in a broader market or industry. Chinese telecommunication is one of the largest telecom industry based on the number of customers. Today, CHL has over 833.9 million subscribers or customers that use their telecom services. In 2015, the company had over 60.2% market share in the Chinese telecom industry with closest competitors being China Unicom with 24.5% and China Telecomm with 15.3% as shown in Fig 2.

Figure 2: China’s Telecomm Industry Market Share

Clearly, from Fig 2, CHL is the market leader in China’s telecom industry (Yan). To maintain and increase its market leadership, the company use a cost leadership strategy as a competitive tool to beat its market rivals. This strategy is characterized by increasing overall profits by cost reduction while the firm charge industry-average prices and increasing customer base (market share) by charging lower prices. A combination of these features means the company has made reasonable profits in sales since they have reduced costs and have more customers. Over the years, CHL has used cost leadership due to various reasons. First, the company has sufficient resources, financials and workforce to deliver high-quality services. Secondly, they have very efficient logistics; the movement of services and delivery to the client in a quick and efficient manner. Thirdly, CHL has access to capital required to be invested in technologies that need to bring costs down. Lastly but not the least, the company have adopted continuous improvement which ensures their low-cost base is not rivaled and found a sustainable way for cutting costs in levels competitors cannot afford.

CHL is a large business that offers world-class products and services with little differentiation; their offerings are readily acceptable by most customers. CHL also offers their subscribers massive discounts to maximize their sales – when customers are offered discounts, they tend to buy more of those services and any other additional services offered by the company. By doing so, the high revenues offset the production costs and other expenses and lead to huge profits. Further, the company is able to extend its market share and takes advantages of economies of scales to enhance market leadership. Through cost leadership, CHL has been able to achieve high capacity utilization, increased productivity levels, and effective use of technology in the delivery of telecom services. Overall, cost leadership has been a successful generic competitive strategy for CHL.

Value Chain Analysis

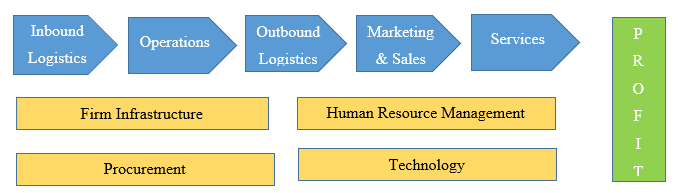

For a firm to remain competitive, ensure it’s in line with market changes, and be at pace with current customer needs and expectations, it needs to keep analyzing its primary activities on an annual or quarterly basis (Porter). CHL can achieve this competence by using value chain analysis to analyze their internal activities. Value chain analysis is a model developed by Michael Porter to help organizations evaluate their internal or primary activities which are most valuable to them and those that can be enhanced to offer a competitive advantage (Gary and Karina). In simple terms, by evaluating internal activities, value chain analysis can reveal where the firm has competitive advantages or disadvantages. The model is shown in the chart below.

Primary Activities (Internal)

Support Activities

Primary Activities

Inbound Logistics

Over the years, CHL has developed strong relationships with its market suppliers since their support has aided in receiving, storing (products), and distributing. Additionally, the company has ensured its inbound logistics are well-managed through effective logistic systems. As such, CHL has earned extra value thanks to their positive relationships with its suppliers. Inbound logistics is a key element that can help the company in eliminating challenges faced in the production stages of their products and services.

Operations

Analyzing operational activities is necessary to understand issues that arise production and service levels of the organization. CHL has enhanced the efficacy of their operational activities and in turn achieved productivity, maximized efficiency, and ensured there are competitively sound in the telecom industry. The increased productivity has helped the company enjoy a consistent increase in profits, economic growth, and set a powerful standard for competitive market advantage.

Outbound Logistics

This category includes activities that help the company deliver products and services to its customers via different intermediaries. CHL has analyzed and optimized their outbound logistics to explore sources of competitive advantage whilst achieving business growth goals. Since the company has ensured outbound activities are timely managed with product and service delivery process and optimal costs, it has maximized customer satisfaction and improved their growth opportunities.

Marketing and Sales

In regards to marketing and sales category, CHL engages in several activities that help communicate or persuade customers that its offering is better than those of market rivals. These activities include promotional activities, advertising, sales force, selecting better channels, pricing, and building relations with their channel partners. Additionally, CHL uses marketing funnel technique for structuring its sales and marketing activities. The company has wisely and effectively integrated sales and marketing activities which have in turn aided in developing brand equity.

Service

The company offers pre-and-post-sale services to its customers to ensure its win customer loyalty. Today, modern customers view post-sale services as important as other marketing and promotional activities. As such, CHL has offer customer support service to address any issues and challenges that customer face when using their products and services. As a result, they have developed a positive brand reputation and continues to be recognized as one that serves customers better, timely and delivers efficient services.

Secondary or Support Activities

CHL’s primary activities cannot work effectively without the support of secondary activities. These secondary activities not only offer support but also coordinates and facilitate value chain activities.

Firm Infrastructure

CHL’s firm’s infrastructure consists of numerous activities ranging from quality management, accounting and finance, strategic management, handling, planning, and legal matters. CHL has an effective infrastructure that has allowed optimization of the whole value chain activities. They have successfully controlled their infrastructure activities to maintain and strengthen their competitive positioning in the industry.

Human Resource Management

The company has effective recruitment and selection strategies that aid in choosing the best workforce in the industry. Additionally, they have effective rewarding and performance management approaches that help in the retention of the best workforce and reduce employee turnover rates. Effective HR management and policies have allowed the company to reduce market competition pressure based on commitment, skills, and motivation of their workforce. Moreover, the company has achieved cost minimization goals through evaluating their hiring, training and developing costs with their relative investment returns.

Technology Development

In the current modern business, technology has become a significant and key determinant of business success. We are living in an advanced technology era where everything has become digital and has technology continues to evolve; more activities are becoming automated via technological support. CHL has integrated into all of its primary activities to increase operational efficiency and improve product and service excellence.

Procurement

This category denotes all activities and processes that are involved in the purchase of inputs and items required for producing finished good or service. The company has linked its procurement activities and primary activities such as inbound, operational as well as outbound value chain.

Financial Analysis (Financial Statements and Ratio Analysis)

For any company to succeed in the current competitive environment, they have to make effective strategies including financial objectives. Today’s modern business requires to develop strategies which not only improve their bottom line but also ensure their business is financially healthy and stable for a sustainable future. Without adequate financial analysis to reflect on past, current and future performances on key accounting facets, an organization’s future would be doomed for future failure (Foster, 2004). Thus, financial performance analysis is critical for any business to make better financial decisions, reflect on past and project the future. In a similar case, CHL financial performance analysis is done to examine how the company has been performing over the previous four years and use the information obtained and trend analysis to project future financial performance. Additionally, the analysis is done to help identify key areas which have performed well and those that necessitate improvements. Ratio analysis and trend analysis, are key metrics that can be used to analyze and comment about CHL financial performance (Helfert and Erich).

Income Statement

This financial statement is used by firms to show revenues and expense in a given period. For CHL, the income statement (See Appendix 1) shows that revenues have grown over the years. In 2015, the company recorded $824 million revenues and grew by 0.41% to $827 million in revenues in 2016. However, the last two years, 2018 and 2017, the company sales have massively increased with the former showing $872 million revenues an increase of 2.21% of 2017 revenues of $853 million sales. In addition, the company has reduced its cost of goods over the four years. This is reflected by the gross income growth. In 2015, the company had $400 million gross income has significantly to $419 million in 2018. Similarly, the net income has increased from $133.8 million in 2015 to $139.5 million in 2018. These metrics are shown in Table 1 below.

Table 1: CHL’s Income Statement

| 2018 | 2017 | 2016 | 2015 | |

| Sales/Revenue | 872,728 | 853,877 | 827,732 | 824,378 |

| Sales Growth | 2.21% | 3.16% | 0.41% | 0.54% |

| Gross Income | 419,691 | 418,501 | 399,780 | 400,623 |

| Gross Income Growth | 0.28% | 4.68% | -0.21% | -7.56% |

| Net Income | 139,506 | 131,774 | 127,055 | 133,881 |

| Net Income Growth | 5.87% | 3.71% | -5.10% | -2.60% |

Balance Sheet

This is a financial statement that shows assets, liabilities, capital, and equity of a business in a given accounting period. CHL has reported a comprehensive statement of financial position for the last for years (see appendix 2). According to CHL’s balance sheet, total current assets which include cash and cash equivalents finished goods, and account receivables increased from $607 million in 2015 to $680 million in 2018. This increase affected the total amount of their total assets which increased from $1.70 billion in 2015 to $1.75 billion in 2018, an increase of $50 million of assets. On the other side, liabilities (what the company owes other parties) reduced from $605 million in 2015 to $547 million in 2018. These figures are shown in Table 2.

Table 2: CHL’s Balance Sheet

| The fiscal year is January-December. All values HKD Millions. | 2018 | 2017 | 2016 | 2015 |

| Total Current Assets | 640,639 | 700,223 | 680,324 | 607,715 |

| Total Assets | 1,751,486 | 1,827,213 | 1,696,884 | 1,704,201 |

| Assets – Total – Growth | -4.14% | 7.68% | -0.43% | 1.14% |

| Total Liabilities | 547,487 | 640,116 | 601,170 | 605,736 |

| Total Liabilities / Total Assets | 31.26% | 35.03% | 35.43% | 35.54% |

| Liabilities & Shareholders’ Equity | 1,751,486 | 1,827,213 | 1,696,884 | 1,704,201 |

Financial Ratios

Liquidity Ratios

These are ratios that are used to show the ability of the firm to pay their debt obligation using current assets such as cash. A higher ratio in this category shows the company has no difficulties in meeting the debt obligations (Penman & Penman, 2007). They include the current ratio, quick ratio, and working capital

Current ratio

It is done by dividing current assets with current liabilities. Over the past four years, CHL’s current assets have massive increased; notably, current assets increased from $607 million in 2015 to $640 million in 2018. In contrast, the current liabilities decreased from $598 million in 2015 to $541 million in 2018. As such, the current ratio as increased from 1.01 in 2015 to 1.18 in 2018. This shows that the company is liquid and can meet their debt obligations. They have a positive trend in the last four years with a positive increase in the current ratio in each of the period. Thus, the company has a bright future and creditworthiness, meaning they can secure loans to finance their operations and meet the repayments. The working ratio is similar to the current ratio that also shows that the company can repay its debt obligations.

| 2018 | 2017 | 2016 | 2015 | |

| Total Current Assets | 640,639 | 700,223 | 680,324 | 607,715 |

| Total Current Liabilities | 541,239 | 636,339 | 598,467 | 598,036 |

| Current Ratio | 1.183653 | 1.100393 | 1.136778 | 1.016185 |

Efficiency Ratios

These ratios are used to determine whether the company utilizes its assets as well as liabilities internally. Accounts receivable ratio and inventory turnover ratio are key efficiency ratios that show the firm ability to use its assets to generate income.

Accounts Receivable Turnover Ratio

This ratio shows the number of day or times in a year the company collects average accounts receivables. The ratio is used to show how CHL is efficiently issuing credits to its customers and collects them in a timely manner. In the previous four years, the number of days required to collect the credit decreased from 56 days in 2015 to 20 days in 2018. This shows that the company is efficient in collecting its accounts receivables. This is an impressive performance which shows a positive trend; the company has developed effective credit collection policies over the years.

| A/R Turnover Ratio | ||||

| 2018 | 2017 | 2016 | 2015 | |

| Sales/Revenue | 872,728 | 853,877 | 827,732 | 824,378 |

| Total Accounts Receivable | 83,969 | 68,538 | 28,023 | 28,948 |

| A/R Turnover Ratio | 20.78691 | 24.91689 | 59.07519 | 56.95578 |

Profitability Ratios

These ratios are used to show the ability of the company to generate earnings and income relative to their operating costs, revenues, shareholder’s equity, and assets.

Net Profit Margin

This company is used to show how much income CHL has generated over the last four years as a percentage of revenues. CHL’s profitability has decreased from 2015 to 2018 that is from 16.24% to 15.99%. This could be caused due to increased costs. Firm’s profitability is decreasing and show a negative trend.

| Net Profit Margin | ||||

| 2018 | 2017 | 2016 | 2015 | |

| Sales/Revenue | 872,728 | 853,877 | 827,732 | 824,378 |

| Net Income | 139,506 | 131,774 | 127,055 | 133,881 |

| NPM | 15.99 | 15.43 | 15.35 | 16.24 |

In sum, the financial performance analysis of CHL shows a positive trend analysis. Ratio and trend analysis shows that the company is performing well and the future looks bright in financial terms. In respect to liquidity and profitability, the company has shown a positive trend. However, they should plan on ways to improve the collection of account receivables. CHL financial performance analysis indicates the company has positive financial health and position.

Conclusion

In conclusion, CHL is performing in the market in terms of profitability, operational efficiency, and competitiveness. In the past, the company did not face a lot of competition compared to the current market. Initially, they used the strategy to penetrate in markets and generate revenues which would enhance more market expansion. However, today, the company has dominated the Chinese telecom industry and is the market leader with over 60% market share. The company has strategies on offering products and services that meet consumer needs and expectations. This can be seen from the generic competitive strategy of cost leadership by offering products and services at low cost to win more consumers and generate more customers. As such, through its value chain activities, the company continues to provide unmatched and world-class products and services. This has ensured they remain competitive in the market while they maintain and increase brand reputation and recognition. Moreover, financial analysis as shown that the company is financially stable and have capabilities to internationalize in the future, enter new global markets and exploit new opportunities offered in new markets. In the future, the company will enter new foreign markets and compete with other telecoms MNCs in the global markets. Overall, the future looks bright for the company in many dimensions.

References

Gereffi, Gary, and Karina Fernandez-Stark. “Global value chain analysis: a primer.” Center on Globalization, Governance & Competitiveness (CGGC), Duke University, North Carolina, USA (2011).

Helfert, Erich A., and Erich A. Helfert. Financial analysis: tools and techniques: a guide for managers. New York: McGraw-Hill, 2001.

Porter, Michael E. “The value chain and competitive advantage.” Understanding Business Processes (2001): 50-66.

Sharp, Byron. “Competitive marketing strategy: Porter revisited.” Marketing Intelligence & Planning 9.1 (1991): 4-10.

Yan, Xu. “Mobile data communications in China.” Communications of the ACM 46.12 (2003): 80-85.

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee