Financial Analysis of Wal-Mart Stores INC., Research Paper Example

Founded by Samuel Walton in 1962 and incorporated in 1969, Wal-Mart Stores Inc. (NYSE: WMT) runs chains of department stores and warehouse stores in 15 countries under different names. Ever since going public in 1972, the American retail giant has grown considerably over time to become the third largest public corporation in the world; The Walton Family controls 48% stake in Wal-Mart businesses. Wal-Mart is rated as one of the valuable companies in the world, according to the Fortune Global 500 list. Wal-Mart operates successfully as Walmex in Mexico, Asda in UK, Best Price in India, and Seiyu in Japan. The Wal-Mart operations in Germany and North Korea were less successful, compared with South American and Chinese operations. (Frank, 2006)

Wal-Mart enjoys the status of a near monopoly with minimal challenges in retail segment supported by its logistics and information technology establishments. This allows the company to study how products are performing across markets and stores. In simple words, the modern technologies continue to strengthen the Wal-Mart’s time-tested procurement methods. The Wal-Mart stores operations are organized into three main divisions: Wal-Mart Stores U.S., Sam’s Club, and Wal-Mart International. In turn, these divisions control the Wal-Mart businesses that make up different models of retailing stores: Supercenters, food and drugs, merchandise stores, discount stores and restaurants. (Frank, 2006)

Initially, the success of Wal-Mart heavily relied on providing goods to the consumers in a cost-effective way, and thus Samuel Watson (in his tenure as CEO) mostly focused on structuring costs and procurement; he worked successfully to cut costs on the procurement fronts and passed on the discounts to consumers to propel sales volume. This demanded loading of stores’ inventories on a continuous basis, often referred as cross docking in logistics and this loading efforts paid rich dividends as expected. Wal-Mart Stores now concentrates more on developing advanced supply chain management to exploit the existing advantage in different markets. (Frank, 2006)

On the acquisition arena, Wal-Mart is keen to acquire stores in existing markets than to eye on new potential regions; While addressing the investor conference recently, The CEO of Wal-Mart International, Doug McMillon spoke on the retailer giant’s acquisition plans for the future; he said the company is keen on consolidating its place in the existing markets than to expand to new markets, however declined to give any specific targets. He also said the company will take up opportunities in potential markets if presented. Following the announcement, Consensus expects Wal-Mart to acquire more assets in Japan. Also, the retailer may consider acquiring the famous U.S. drugstore chain Rite Aid or Natalie Berg in United States. (Boyle, 2011)

With Tesco unveiling plans to exit the Japanese market, the acquisition arena for Wal-Mart in the island nation remains favorable. Earlier in 2012, the retailer entered Africa by acquiring major stake in Massmart Holdings for $2.1 billion. The company is optimistic about its U.S businesses while cautiously expanding across the globe. The international division generates over $100 billion in sales for the U.S. based retailer every year. (Boyle, 2011)

On Monday, February 11, 2013, Wal-Mart market capitalization totaled little less than $240 billion with 3.35 billion outstanding shares. Wal-Mart stock listed in NYSE closed trading at $71.48 (up 0.35%) on a per share basis.

Industry Overview

If not mistaken, Wal-Mart, Carrefour, Tesco and Metro are the four international retailers fighting for the market share, as growth and conditions at their homes appear gloomy. In a recent research report, Lucintel (2012) said growing population and GDP along with greater disposable income will drive the global retail industry and the market is estimated to grow CAGR of 3.9% to an estimated $20,002 billion in 2017.

From the industry perspective, Wal-Mart has lot do in the international markets as it moves forward to the projected growth rate of 4.9%; at this growth rate, Wal-Mart will derive over 50% of its revenues from international markets. The retailer is keen on consolidating its place in South American and African markets, and as the Chinese and Mexican markets for the retailer continues to expand in the future years, Wal-Mart is trying to redesign its approach for U.S. with many initiatives. (Ellwood, 2012)

Tesco is the fastest growing retailer in the global grocery retailing business with CAGR of 6.8%. Right now, Tesco enjoys a market share of over 30% in U.K with the nearest competitor, Wal-Mart owning 17% of the market. With European retail businesses expected to grow by 4.2% CAGR, the French retailer Carrefour is facing a huge challenge and using cash reserves efficiently is high on its agenda. On the other hand, Carrefour expects a strong growth in its Chinese and south American markets. (Ellwood, 2012)

For Metro, international operations have been favorable, however the growth rate in domestic markets is visibly slow; the company is expected pronounce 5% CAGR growth overall for the upcoming years. Metro Cash and Carry is also keen on expanding to China’s tier 2 cities and the company is looking for potential markets, outside Europe. In Eastern Europe, Metro tested a retail model – soft franchise format aimed at helping independent retailers and in the role Metro provides marketing support, training and discounts on volume sales.

The growth potential in Brazil, Russia, India and China is more promising than countries in Europe and North America. BRIC nations is said to be the key marketplace for retailers by 2015. As china sets itself to the rapid growth, India will also be steadily moving forward favoring the giant retailers. India has already relaxed investments on retail industry and retailers like IKEA and Marks & Spencer could now operate without Indian partners and accelerate expansion. Tesco and Wal-Mart now operating as wholesale and support providers in India could move further to benefit from the Indian market place. On the other hand, Metro has announced plans to grow its base of nine stores to fifty in India.

Wal-Mart Positioning in Global Market – Analysis

Strongly supported by cash reserves and technologies, Wal-Mart has everything in reserve to hold on to its market share; with relatively high entry barriers in retailing, Wal-Mart has an outstanding logistics, brand name, and financial capital to fight its competitors. Wal-Mart famous for its discounts has the absolute cost advantage over other competitors. Among established companies, Target is the only company that is as competitive and forward moving as Wal-Mart and the stiff competition provided by Target remains the sole concern for Wal-Mart in domestic market place. The bargaining power of consumers is very minimal or nil; on the other hand, though Wal-Mart offers business to wholesalers, Wal-Mart has low to medium pressure from large suppliers like Proctor & Gamble and Coca-Cola on pricing factors.

Walmart’s financial summary

Walmart is an American company operating in the retail industry. The company operates on a multinational level and operates with large departmental stores offering discounts on a variety of products to customers worldwide. The company has been termed as the largest private employer in the world as the company currently employs in excess of 2 million people. The company is owned (48%) by the Walton family and the company currently has 8,500 stores open in 15 nations of the world. The company’s revenue in 2012 from operations only amounted close to $444 billion with a total net income of $16.4 billion. In addition, the company’s total assets in 2012 amounted to $193 billion with cash flow from operations amounting to $24.2 billion. On a year on year comparison, it was found that the company’s revenues have increased by 5.9% on a year on year basis compared to 3.4% in 2011; the company’s net income has increased by 3.1% in 2012 compared to 6.7% in 2011 and the assets have grown by 7% in 2012 compared to 6.1% in 2011.

Balance Sheet Analysis

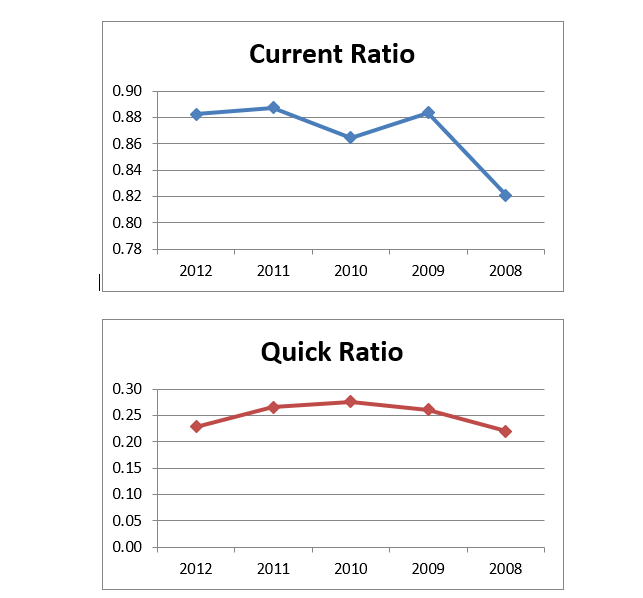

Liquidity: A company, in order to finance its operations tends to rely on a mix of funding sources. These sources may be short term in nature or may be long term. The liquidity ratios measure the company’s ability to meet its short term obligations whereas solvency ratios measure the company’s ability to meet long term obligations. In terms of liquidity ratios, the two major measures of performance include the current ratio and quick ratio.

The current ratio measures the company’s ability to meet its short term obligations with the help of current assets i.e. the assets that are considered to be convertible to cash in less than a year. The current ratio should ideally be equal to or more than 1, and a ratio of more than 1 demonstrates that the company’s assets are liquid enough to cover its current obligations. A further measure of liquidity is the quick ratio; the quick ratio or acid test ratio considers inventory to be an illiquid asset and thus does not consider it as part of the assets used to meet short term obligations. The results of the ratios for Walmart highlighted the following results.

The current ratio of the company has remained relatively stable throughout the five year period and comparing the current ratio and quick ratio, it can be concluded that inventory constitutes a major part of the company’s current assets. An analysis of the current asset figure for 2012 indicated that inventory made up 74% whereas cash constituted only 12% of current assets. In addition, a time series analysis of the cash position over 5 years illustrates that the overall cash position has gone down i.e. from 4.4% of total assets in 2010 to 3.4% of total assets in 2012. This indicates potential problems for the company as it might run out of cash in the future.

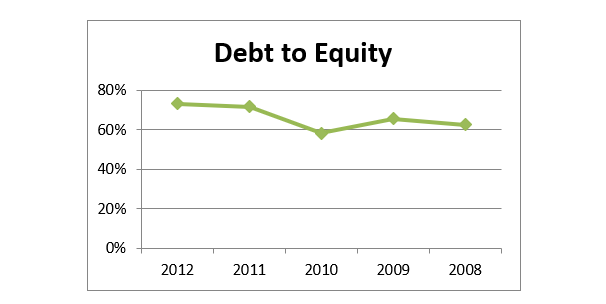

Capital Structure: It is also important to evaluate a company’s capital structure largely because it is important to know where the financing is coming from. On a macro level, there are two major sources of finance including debt and equity. Debt is usually cheaper than equity largely because it carries tax benefits and because equity carries with it a hefty underwriting cost. In addition, with equity placements there is always a risk that the shares might not be subscribed and this is where debt is preferred largely because debt is easier to arrange. In contrast, a higher debt to equity ratio indicates that the company is highly leveraged i.e. there is a greater debt percentage. This will make the company a risky investment from the perspective of the shareholders because a larger chunk of the profits would go to the company’s creditors and the probability of the shareholders to get a return would be low; as a result, the return on equity for shareholders is likely to be high. An analysis of the debt to equity ratio Walmart indicated the following results:

The figure illustrates the fact that the company has been financing its operations largely through debt, as the debt to equity ratio stood at 73% in 2012 compared to 63% in 2008. The overall interest expense for the company has also risen by 20% and it is interesting to highlight that the company’s revenue has only increased by 19% in 2012 compared to 2008. This seems to be an alarming signal for the company since the revenue growth should ideally be higher; since it is not, it is probable that the company is unable to generate enough profits to sustain, thus the inflated interest expense.

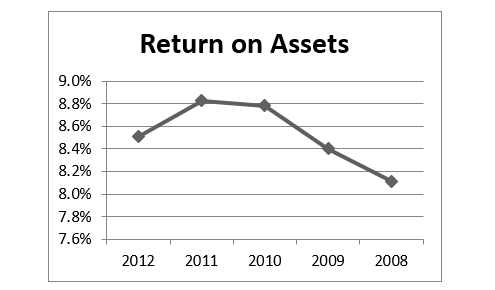

Return on Assets: The Return on Assets is generally an indication of the company’s ability to use its assets efficiently in an attempt to generate profits. As per the DuPont Analysis, the return on assets is a product of the net profit margin and the asset turnover. The net profit margin measures the company’s ability to keep overall costs down in order to generate a higher net income figure; in addition, asset turnover measures the company’s efficiency levels i.e. the usage of the assets to generate revenues. A higher return on assets indicates that not only has the company made optimum use of its assets but it has also established sound operations which have allowed them to keep costs down and thus achieve a higher bottom line figure. The return on assets for Walmart is illustrated in the following figure:

The figure indicates something to ponder for Walmart; the return on assets for the company in 2010 was 8.8% which has been reduced to 8.5% in 2012. The net profit margin of the company is good however the asset turnover figure for the company has declined from 2.45 times in 2009 to 2.29 in 2012. A declining asset turnover represents that the company has been unable to utilize its assets to the fullest extent but whatever revenue it is generating, it is able to generate a sustainable profit margin. A declining return on assets can be problematic for the company largely because it is one of the major ratios considered by shareholders before investing their money in the company’s stocks.

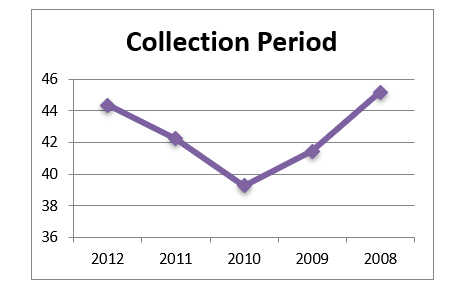

Inventory use: In order to measure a company’s performance in terms of its inventory management, the inventory turnover ratio is used. The ratio compares the cost of sales figure with the average inventory; a higher figure illustrates that the company has been able to keep inventories down resulting in less capital being tied up; in addition to inventory turnover, the inventory collection period is also used which expresses the number of days it takes the company to convert its stock into cash. These two measures in conjunction can be used to identify the liquidity of the company’s stock as well as its sales and marketing practices which result in stock being converted into money. The performance of Walmart with respect to inventory can be summarized in the following illustration:

The collection period i.e. liquidity period of the inventory of Walmart has increased from 39 days in 2010 to 44 days in 2012. This can be better explained by highlighting that the inventory turnover ratio has declined from 9.3 in 2010 to 8.2 in 2012. This is largely due to the fact that the two factors affecting the inventory turnover ratio have gone up but the denominator i.e. the total inventory figure has increased by a higher percentage than the cost of sales i.e. inventory on a year on year basis has increased by 11.7% in 2012 compared to cost of sales, which has only increased by 6.4%. Although the figure is not bad considering the company’s past performance however Walmart needs to pay attention to this figure because the longer the company holds inventory, the likelihood of the inventory going obsolete increases, especially for perishable items like fruits and vegetables.

Income Statement Analysis

Profitability: In addition to liquidity and solvency, it is also very important to analyze the company from a profitability standpoint. All companies except for not-for-profits have a profit motive and all their decisions are based on the idea of generating profits. In addition, a company’s ability to generate profits is particularly important to all its stakeholders especially the shareholders and debt holders. Through a profitability analysis, debt holders are able to comprehend the fact that whether the company would be able to follow through on its interest payments; in addition, it also affects the decision of whether or not additional financing should be extended to the company or not. Shareholders are concerned with returns on their investments and the ability of the company to generate profits governs the probability of a dividend payout; even if the company does not pay out dividends, the money is then reinvested in the business and the shareholders can then have a capital appreciation on their investment. Either way, the availability of profits is of paramount importance to any company.

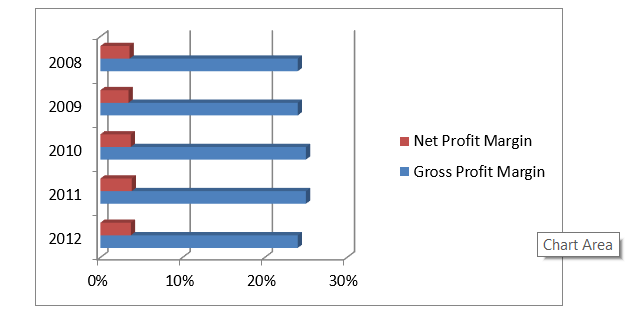

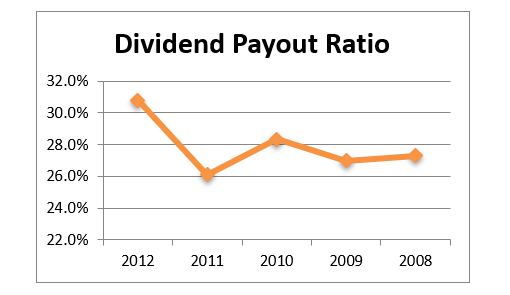

Among the various profitability measures that the company can utilize, the primary measures include the gross profit margin which measures the company’s performance in terms of reducing its cost of sales; the net profit margin measures the ability of the company to reduce its overall costs. In addition, the dividend payout ratio indicates the company’s ability to satisfy shareholders. The results of the aforementioned ratios for Walmart are highlighted as follows:

The performance of Walmart with respect to profits has been quite good because the company has been able to maintain and sustain a stable gross profit margin and a net profit margin. This indicates that the company has been able to maintain a lower cost base i.e. both variable costs as well as fixed overheads.

The performance of the company is also evident from its dividend payout ratio i.e. the company has gone on from paying 27% in 2008 to close to 31% in 2012. This indicates that despite being highly leveraged, the company has been able to satisfy its stockholders by paying considerable amount of dividends. The amount of dividends paid in absolute terms has also increased by 14% in a year on year comparison compared to 2011.

Industry Standards: The biggest problem for all companies and retailers in particular is the issue of administrative and overhead expenses. These are costs which are deducted from net profit by a company in order to arrive at the net income figure. For retail companies, the administration costs comprise a significant proportion of the sales and therefore if the company is not careful, it can spell disaster. Among the various administrative expenses, the largest ones include the cost of staffing, rent, advertising, distribution and finally the cost of support functions i.e. accounts and finance. In order to safeguard themselves from excessive administrative expenses, many retailers are making use of the wonders of information technology and are moving from an actual physical location based outlet to an online based environment. This presents the company with various benefits including the fact that the company is now open to an audience on a global scale and the identification of suppliers also becomes a better exercise. In addition, the company is able to save on a lot of other expenses including costs associated with the supply chain. This is assisted when a retailer makes a decision to outsource certain aspects of the supply chain, particularly distribution (BDC, n.d.).

In addition to managing expenses, the retailers also have to worry about their financing strategies. With the global financial crises, it became very difficult for companies to operate financing. There are two primary reasons behind this perspective. Firstly, the lenders are cautious in giving out their money to retail companies and even companies with maturing debt obligations are finding it difficult to renew their financing facilities. Secondly, the asset values on the balance sheets of retailers seemed to be declining and as a result of low value collaterals, the willingness of the lenders to lend to retailers was low. As a result, many retailers which operated cut back their operations and liquidated certain parts of the business to finance the remaining business with internal savings and money raised. This highlights the importance of a positive cash balance for retailers and the importance of operating at an optimum level whereby the negative impacts of the tradeoff between profitability and liquidity are minimized (KPMG, 2008).

Operations: In terms of operations, Walmart has always been the market leader leading with innovative product ideas and marketing strategies that has transformed it into one of the world’s most preferred brands. The results of the above analysis highlights that although the company has been able to generate sufficient profits, it has not fully utilized its assets. This may present a problem because it is probable that the company might be operating at a level lower than what it is actually capable of. However despite the fact, the company’s strategies have always kept it one step ahead of the competition; for instance, Lutz (2012) reported that the company faced competition from dollar stores in terms of cheaper products that consumers prefer to buy especially during the end of the month when the buying power is at its all-time low. Product ranges like toiletries and medicines presented a challenge for the company because dollar stores presented cost beneficial alternatives offering low quality often bundled up products. The answer of Walmart to this competitive strategy was to introduce its own brand of single roll toilet papers and single soap bars which caught the attention of the consumers. The company was able to successfully waive off competitions and it is now this competition that is following suit with Walmart.

In addition Chase (2006) reported that Walmart has had a history of operational changes which have always been the benchmark for the retail industry; for instance, the company operated with a state of the art inventory management system which is able to integrate its warehouses with its stores; in addition, the company opted for the strategy of opening up shop in areas which were less dominated by larger more established retail chains. The company deployed the two strategies together and developed its abilities to such a significant extent that it was able to compete with the big boys in the urban areas easily. The company further developed an internal culture whereby the importance of stakeholders was communicated and a result all strategies that the company formulated included the interests of its stakeholders and this culture was company specific and therefore the ability to replicate the same was low providing the company with a competitive edge over the rest.

Cash Flow Analysis

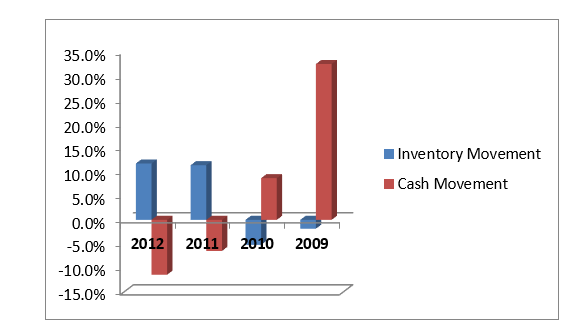

An analysis of the cash flow position of the Walmart indicates that the company has declining cash flow. This may be an alarming signal for the company because although it is highly profitable, a declining cash flow position might indicate that the company might be overtrading and therefore more capital would be tied up in working capital and this seems to be the case as the figure for inventory has increased significantly. The increase in inventory is consistent with the declining cash figure i.e. the company enjoyed nearly a 33% increase in cash in 2009 compared to a decrease of 11.4% in 2012.

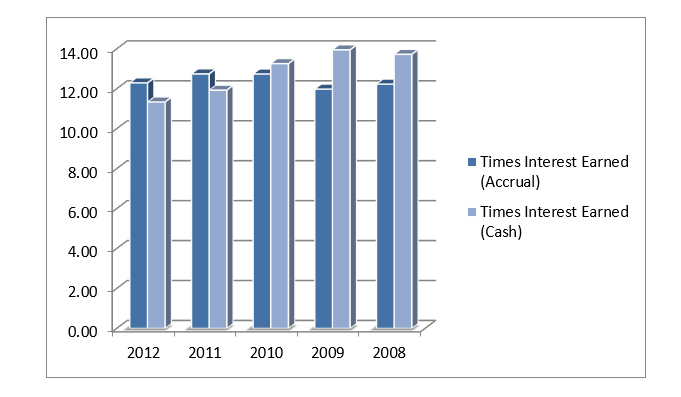

Debt coverage: In terms of its debt coverage, the use of two ratios has been made; one compares the earnings before interest and tax (EBIT) with the interest expense while the other compares the cash flow from operations with the interest expense. A higher ratio depicts the company’s ability to pay off interest and the performance of the company in this regard seems to be stable as in both scenarios, the company has been able to maintain a stable coverage ratio.

Although the company is highly leveraged, the profits have been able to cover the interest expenses whereas the cash flow to interest ratio represents a slightly declining figure largely due to the money the company has tied up in working capital i.e. inventory. If the company refines its inventory management procedures even further, it would be able to refine its overall ability in terms of cash to meet its short term as well as long term obligations.

Strategic plan for operations going forward

Marketing strategies: Marketing strategies are imperative for a company largely because no matter how good a company’s product is, lack of marketing would mean that the company was unable to create awareness about its products and as a result, the desired sales would not be achieved. The emphasis on marketing has been at its all-time high especially after the global recession of 2008. The buying power of the consumers has been squeezed and the customers are now looking for ways to save rather than spend money. Walmart puts in money to conduct research on what its customers want and then design their marketing strategies based on the information collected. The results of the research indicated that the customers of Walmart look for deals rather than prices on individual products. In addition, Walmart customers seek value for money and therefore would only buy items if they feel that the item would add value to their lifestyle and standard of living. The marketing strategies of Walmart are designed to communicate to the customers that the company offers the lowest prices and the products it offers are the ones that the customers are actually looking to buy. Marketing is a challenge for retailers like Walmart because they have to find the right balance between what assortments the customers are looking for and retailing what brands would help fulfill this preference. The company needs to combine customer preferences with brands and then align them with their marketing strategies (Colvin, 2011).

Walmart designs its marketing strategies based on the data it collects; the data collection mechanisms are majorly of two kinds; one is the data provided to the Walmart strategy makers by the merchants selling the merchandise while the other is obtained through the market research exercises conducted by the company which in recent years has seen newer trends including the use of social networking websites like Facebook and Twitter. In 2011, the company had 11 million Facebook fans and the company has also launched individual pages for all its stores because the company believes that retailing is in fact a business which is local in nature and therefore the company interacts with its customers at the local level (Colvin, 2011).

New market segments (e.g. new products or lines): It is important for companies at levels of the economy to ensure that the product ranges of service lines it offers are subject to innovation. This helps the company remain popular in the market and helps retain customers for longer periods. In terms of new market segments, Walmart has operated with an online store however the effectiveness of its online store has been non-existent compared to its bricks and mortar stores. According to Welch (2012), the company has been working hard to develop its online stores by deploying foreign consultants and web developers however despite the fact, the company’s online sales accounted for only 2% of the total sales figure. In comparison, the company’s online competitor, Amazon has been doing considerably well on the online front and as a result was able to post a revenue growth of 41%. Although Walmart is still the first choice for consumers as 53% people preferred Walmart over other brands however Amazon has been catching behind as the second favorite i.e. the popularity of the brand has gone up from 38% in 2011 to 46% in 2012. This can be problematic for the company because losing out its place as the most preferred brand would mean that there would be a probable loss of sales in the future. As a result, the recent past has seen Walmart acquire various internet based businesses including “Kosmix” and “Small Society”. In addition, the company aims to use the physical stores as centers for pickup for online sales. The company offers the lowest prices on its products and that is one of the primary reasons why it is preferred by customers and combining this strategy with its online store would help achieve an inflated sales percentage. The company also aims to make its stores tech friendly by allowing customers to buy items online or through their smart-phones. One of the primary strategies that the company deployed was to target its 20% customers who did not have the ability to shop online largely due to the unavailability of bank accounts and credit cards. These customers would use the internet to book the items they wanted to buy and then visit their nearest Walmart store to pay cash for the items and pick them up. These innovative strategies have helped the company stay No.1 and remain a brand to be reckoned with.

Corporate responsibility plans: Being the brand that Walmart is, it owes a responsibility to the community it operates in to provide benefits beyond the products and services it offers. Kaye (2012) reported that as part of the Global Responsibility Report issued by Walmart in 2012, the company has set for itself various ambitious CSR initiatives including the plan to run all Walmart outlets on renewable energy. In order to achieve this aim, the company has started to install solar panels on its outlets. The goal is ambitious because it would take a toll on the company’s profitability. The company had successfully installed its 100 solar panel and the use of alternate energy accounts for 22% of the company’s usage which is enough to power 78,000 homes in the US annually. In addition to alternate energy, the company also aims to reduce its wastage by not disposing of waste in landfills. The company has always operated with a plastic bag strategy however the company was able to cut it down by 35% in 2012 while the Walmart stores in Japan were able to achieve a 100% recycle status. In addition, the stores in the US have also increased their intake of local produce and have started to buy their material from local US farms and have also made a commitment of buying $20 million worth of goods from businesses that are women owned as part of its women empowerment plan.

Reuters (2011) reported that in addition to operations, the company’s products are also packaged in a way as to benefit the members of the community; for instance, the company produced packets of the most commonly used medicines in the US and offered these products at a flat rate to the consumers. The medicines were enough to cover a 30 day course and the low cost med packets was met with great popularity by the public. The role that Walmart plays in the society is exemplary for other multinational organizations because these companies have a footprint on the global economy and affect communities worldwide as a result they should do more than they already are in making the world a better place to live in.

Personal thoughts and recommendations

In my personal opinion, Walmart is probably the largest retailer in the world and the products it offers through its outlets, both physical and online are greatly popular with public not only due to their quality but the low prices which makes Walmart stores the ideal choice for all consumers belonging to all social classes operating at any time of the month. In terms of financials, the company has done a great job in achieving a higher bottom line figure largely due to innovative marketing strategies and strategies which are aimed at developing a competitive edge. The only problem that the company might have is that it is highly levered and as a result, seeking further financing might be difficult for the company. In addition, the company seems to have depleting cash reserves which would mean that the company is less liquid than it should be. This is largely due to the increasing inventory levels that the company maintains and therefore requires effective inventory management so that the tradeoff between liquidity and profitability can be lowered. In addition, the company should seek to develop its online operations because such as strategy can prove to be successful for the company in the long term.

References

BDC. (n.d.). Retail industry standard for administrative costs. Retrieved March 09, 2013, from http://www.bdc.ca/en/advice_centre/manage_the_bottom_line/supply_chain_management/Pages/AskAProfessional.aspx?PATH=/EN/advice_centre/ask_professionnal/Pages/retail_industry_standard_for_administrative_costs.aspx#.UTsCodbTxMh

Boyle, M. (2011). Wal-Mart Says M&A Strategy Will Focus on Existing Markets. Retrieved from http://www.bloomberg.com/news/2011-10-12/wal-mart-says-m-a-strategy-will-now-focus-on-existing-markets.html

Chase. (2006). Operations Management for Competitive Advantage. Tata McGraw-Hill Education.

Colvin, G. (2011). Wal-Mart’s Makeover. Retrieved March 09, 2013, from https://www.google.com.pk/#hl=en&sclient=psy-ab&q=http:%2F%2Fmoney.cnn.com%2F2011%2F12%2F14%2Fnews%2Fcompanies%2Fwalmart_stephen_quinn_leadership.fortune%2Findex.htm&oq=http:%2F%2Fmoney.cnn.com%2F2011%2F12%2F14%2Fnews%2Fcompanies%2Fwalmart_stephen_quinn_l

Ellwood, C. (2012). What next for Walmart, Carrefour, Tesco and Metro? Retrieved from http://www.igd.com/our-expertise/Retail/retail-outlook/4895/What-next-for-Walmart-Carrefour-Tesco-and-Metro/

Frank, T.A. (2006). A Brief History of Walmart. Retrieved from http://reclaimdemocracy.org/brief-history-of-walmart/

Kaye, L. (2012). Walmart 2012 CSR Report: Focus on Waste, Renewables, Local Food. Retrieved March 09, 2013, from http://www.triplepundit.com/2012/04/walmart-2012-csr-report-focus-waste-renewables-local-food/

KPMG, (2008). Retail Industry Update. Retrieved March 09, 2013, from http://www.kpmgcorporatefinance.com/engine/rad/files/library/Retail%20Newsletter%2013754BAL.pdf

Lucintel, (2012). Global Retail Industry 2012-2017: Trends, Profits and Forecast Analysis. Retrieved from http://www.researchandmarkets.com/reports/2173102/global_retail_industry_20122017_trends_profits

Lutz, A. (2012). The Brilliant Tactic Walmart Uses To Fend Off Competition From Dollar Stores. Retrieved March 09, 2013, from http://www.businessinsider.com/the-brilliant-tactic-walmart-used-to-squash-competition-from-dollar-stores-2012-8

Reuters. (2011). What Walmart Teaches Us about CSR. Retrieved March 09, 2013, from http://www.reuters.com/article/2011/08/15/idUS338719572920110815

Welch. (2012). Wal-Mart Gears Up Online as Customers Defect to Amazon. Retrieved March 09, 2013, from http://www.bloomberg.com/news/2012-03-20/wal-mart-gears-up-online-as-customers-defect-to-amazon.html

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee