Government Finance and Budgets, Essay Example

Introduction

The below report is designed to evaluate U.S. Department of Health & Human Services’ Administration for Children and Families agency’s financial documents, plans and budgets for the recent years. According to Mikesell, (470), the main focus points of evaluating budgets should be the structure efficiency of information delivery, transparency and forecasts. The authors have chosen the Administration for Children and Families (ACF) as it is a government agency with several public policies, administration and reporting issues, as well as goals determined by the Senate. The financial reports will be reviewed alongside with the mission, performance and reporting practices of the HHS in order to build a complete picture of the organization and its strategies.

Nature of the Organization

The organization is a public service government agency, responsible for delivering family care services, carrying out legislative changes in the health care and human sector according to the decisions made by the Senate. The main priorities of the organization for the current year, among others are set as the support early childhood development, faith-based partnerships, tackle human trafficking and to ensure that families benefit from the health care reform.

Mission. According to the statement of the Administration for Children and Families, the agency is committed to “foster health and well-being by providing federal leadership, partnership and resources for the compassionate and effective delivery of human services”. Through their services, the agency is working on ensuring that families feel secure, healthy and economically safe in the United States.

Local Economic Environment. While the government agency belongs to the Federal Government and is led by the Health Secretary, there are ten different regional offices operating in the United States. These all have to deal with state-wide and regional variances and create a priority that matches the public needs of the area. Further, there are eighteen dedicated offices for various support functions, such as the Children’s Bureau, the Administration for Native Americans and the Office of Refugee Resettlement. According to the 2012 Justification report (3), the economic downturn in America and the over 9 percent unemployment rate negatively effected the support enforcement program, however, the child support program delivered by ACF remained cost-effective. See Table below. (Justification of Estimates for Appropriations Committees 58)

Performance. According to the 2012 performance report of the ACF, created by Office of Planning, Research and Evaluation (19), the agency’s budget was cut from the previous year, however, working on the allocation of the funds, the following priorities were selected:

a. child care assistance programs funding increase

b. Head Start program budget increase

c. targeted investments for vulnerable families and children, such as adoption incentives

d. funding of the “Strengthening Communities” program by $20 million

The following programs, however, were eliminated from the budget to cut the costs of operation: Community Services, Mentoring Children of Prisoners, the LIHEAP block grant, Voting Access for Individuals with Disabilities, and the Development Disabilities Projects of National Significance program. One of the success stories for 2012 was foster care programs, where the agency over-achieved the goals in four consecutive years between 2006 and 2009. The assistance provided for callers who were victims of domestic violence also increased every year between 2003 and 2009.

Size. The Department of Health And Human Services’ Administration for Children and Families is led by David A. Hansall, Acting Assistant Secretary, supported by three deputy assistant secretaries and an acting executive director. The thirteen different administration areas all have their directors or commissioners, as well as the regional office administrators assigned to each office. The size of the organization indicates that the agency is one of the main government employers in the United States, providing public services through research, development, planning and program execution.

Budgeting Methods

Budgeting Type. ACF operates a budget based on the funding requests submitted to the federal government for different programs. The enacted budget is based on the initiatives of the government, the requested and decided funding and the expenditures calculated for the fiscal year. The Office of Legislative Affairs & Budget published the all-purpose table of the agency for the year 2013. (Online) The breakdown of the budget is based on the different programs received by the Federal Government, as well as the money spent on programs allocated to the agency. Government agencies in the United States use fund accounting methods (Mikesell 50), to report on the fixed assets within the financial system.

The Budget Process. The budget is created by ACF, containing the funding request and submitted to the Congress. Upon approval, the budget is processed and funds are allocated to the different programs across the organization. The summary is provided by the “all purpose table” for the year, featuring the actual dollars provided by the Congress for ACF funding each program. The Congress also needs to consider the program initiatives and priorities set by the government agency when reviewing the budget. Further, the report includes the list and description of the discretionary programs, as well as the mandatory ones. It also has a table for administrative expenditures proposed for the year.

According to Mikesell (49), the Financial Accounting Standards Board determines the rules and regulations regarding the budgets of federal agencies. The accounting system consists of the following elements: source documents, journals, ledgers and procedures and controls, determining which data needs to be reported and in what form. The fiscal control in the United States is transferred to the relevant agency of the federal government. As the Budget and Accounting Act of 1921 (Mikesell 97) requires, agencies need to submit a budget message or proposal for the Congress for approval. The main change in the U.S. budgeting system was made in 1990, by the Budget Enforcement Act, focusing on controlling spending and reducing deficit. (Mikesell 91). The budgeting of government agencies have three main phases: the Formulation Phase, when agencies receive the planning guidance and priorities and budget submissions are completed, the Congressional Phase when the Congress reviews the views and estimates and completes the resolution, and the Execution Phase, when the fiscal year begins and funding of programs, distribution of funds and sources, delivery of services is completed.

The budget of ACF needs to be not only submitted to the Congress, but there is also a need for submitting supporting reports. In 2013, there were several progress reports created and submitted on individual programs, related to the work and projects completed by the Administration for Children, Youth and Families, Administration for Native Americans and the Children’s Bureau. As child support enforcement is one of the main target areas of the government, this sub-agency also creates annual reports for the Congress.

Recent Budget Documents. The recent Congressional Justification document for 2012 and 2013 includes funding requests for 2012 and 2013. The budget brief (online) also includes information on funding statistics overall related to the whole organization of HHS. According to the brief, the majority of federal funding is spent on Medicare and Medicaid programs, while only 3 percent of the whole HHS budget is allocated for Children’s entitlement, eight percent for discretionary programs and one percent for further mandatory programs.

The allocation of funding for the Administration for Children and Families has slightly increased from 2012 to 2013, however, there was a drop in the budget authority and outlays funding from 2011 to 2012. (Budget in Brief 10)

Expenses. The expenses of the agency are made up of budgets for funding government programs and operating expenses. The 2013 budget’s main expenses are related to temporary assistance for needy families (87), making up a total of 35 percent of the budget. The spending on Head Start program in 2013 is a total of 16 percent of the expenditure, while 14 percent is spent on foster care and permanency services.

Performance and Measures. The 2013 Fiscal Year Budget in Brief (97) also includes proposals for future costs. Mandatory costs on entitlements are likely to increase, according to estimates of the research service. Child Care development fund, family support and emergency funds are likely to increase in the next ten years, according to the ACF Mandatory – Legislative Proposals in Outlays (98)

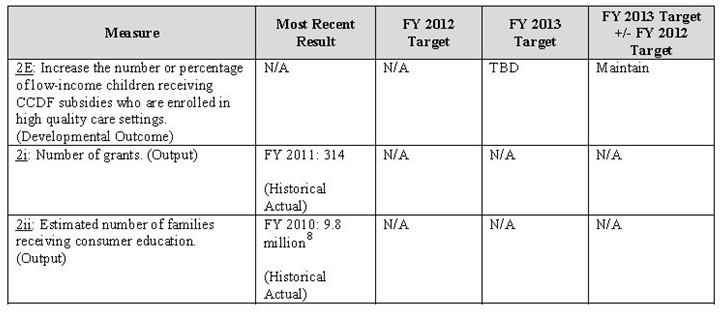

Performance measures need to represent figures that clearly indicate the level of success the agency achieves in delivering priority and mandatory government services, according to the initiatives. The performance measures are set by the Office of Child Care, in association with the Congress’ budget justification committee. (OCC)

Currently, there are four main measures set to assess the performance of the agency, and these are:

a. Access to child care assistance

b. Quality rating and improvement systems

c. Professional development systems

d. early learning and development standards

Further, the government has indicated federal priorities that relate to states implementing quality rating and improvement systems into the agency’s work, as well as the increase of the number of children in high quality classrooms, according to the Head Start project. The agency needs to be able to perform according to these priorities, as well as the four measures above.

According to the Performance.gov website’s data, the agency has increased the number of states implementing QRIS meeting high quality standards from 17 to 19 in 2012. However, the other main priority measure cannot be measured against previous data: currently 25 percent of Head Start grantees receive low scores in Pre-K. The goal of the agency is to reduce this measure by 2 percent by the last quarter of 2013 and further 2 percent by the last quarter of 2014.

Major Revenue Sources

The agency’s main revenue source is federal government direct funding. It consists of various grants and funds provided for the agency to be distributed in the public sector. The discretionary programs include:

Low income home energy assistance program grant

Child Care Development Fund

Various children and families programs, including the Head Start program and Child Abuse program funding

Payments to states allocated for child support enforcement and family support

Children research and technical assistance

Temporary Assistance for Needy Families (TANF)

Foster care and permanency payments

Safe and stable family promotions.

The Major Revenue Source. Block Grants are provided for the agency, covering the cost of funding, grants provided, operating expenses and delivery of public services and research. This, on its own does not tell the authors much about the way and effectiveness of how ACF allocates the funds and how much support is delivered to the public. Indeed, the budget, as it is based on direct government funding assumes that the expenditures of the agency match the allocated funding.

Budget Revenue Section. It is hard to determine the revenue measures and effectiveness of ACF, as funds from the federal government are allocated on a per-program basis, including the services, infrastructure, human resource and operation costs of the delivery, as well as the research. Examining the programs separately, however, provides the authors with an idea of the cost of delivery. Looking at the TANF block grant, it is visible that around 28 percent of the funds is spent on basic assistance delivery, 7 percent on administration, around 7 percent on work expenditures, 16 percent on childcare delivery, 9.6 percent on other work support and 31. 7 percent on other expenditures.

Revenue Changes. The changes in the revenue are directly determined by the Federal Government’s priorities and budget approval. It is clearly visible that after the long recession in the United States, the revenues of the agency were slightly decreased, however, not as much as other government agencies’. While – as it has been proven before – the main budget of the Department of Health and Human Services is allocated for Medicare, Medicaid and the delivery of the Health Care Reform in the U.S., one of the government’s priorities still remains ensuring that families in the country are provided support and health care services, preventive measures.

Forecasting Methods. The budget forecasts are detailed in the enacted all purpose table, submitted to the Congress for approval. However, after the budget is approved by the government, there is a need to submitting a justification budget that details how the money provided by the federal government for different initiatives and programs was spent and measuring the outcomes of different performance measures and priorities. This also means that the accuracy of the enacted budget needs to be carefully thought over initially, considering the goals, initiatives, statistical and research data related to children’s services. Any request for the increase of government funding needs to be explained in the document, while the estimates need to match the cost-effectiveness measures of the government.

The strict requirements of receiving direct federal government funding for programs means that the responsibility for compliance, delivery and administration of child and family welfare programs ensures that the agency performs according to the regulatory expectations of the government.

ACF also monitors state-wide performance against the compliance measures. According to the Annual Report to Congress in State Child Welfare Expenditures Reported on the CFS-101 dated for 2012, the planned expenditures of the agency were distributed the following way: Over 30 percent of the funds were planned to be spent on protection service design and delivery, with the next two priorities being family preservation and preventive and family support. Administrative costs had six percent of the total funds allocated. The planned use followed the patterns of previous years, however, the allocation for family support services increased from 2009.

Rates and Charges. The agency, being a non-profit government organization does not charge for its services, and its main task is to successfully, fairly and effectively allocate funds provided by the Federal budget to families needing support, according to state and federal regulations, priorities and program arrangements. While the service delivery, training, human resources and operation costs add up to a substantial amount, these operating expenses are included in the block grant allocation. This also means that the agency needs to meet its targets while staying within the proposed and approved budget.

New Revenue Sources. Introducing new revenue sources into the organization of ACF is not possible, as – according to the Constitution of the United States – the direct government funding is designed to ensure that there is no conflict of interest between sponsors and that the legislation, regulation and initiatives of the government are closely followed.

By providing block grants, the Federal Government does allocate funds for the agency to be used for delivering grants, funds, financial and training support, as well as the service. This also means that every single block grant needs to be reviewed against performance measures.

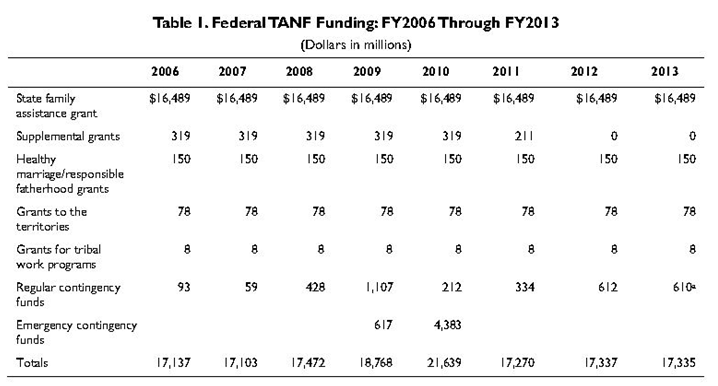

As every block grant has a variable funding level year by year, determined by the government, this also indicates that the revenue sources vary from one grant to another. As an example, The TANF funding block grant consists of seven different funding sources. These are:

a. State family assistance grant

b. Supplemental grants

c. Healthy marriage / responsible fatherhood grants

d. Grants to the territories

e. Grants for tribal work programs

f. Regular contingency funds

g. Emergency contingency funds

Reviewing Table I of the TANF CRS Document (Falk 1) below, it is important to note that the allocations of funds for the program seem to be consistent, except for the two contingency funds, which can be changed according to the priorities, economic requirements and support needed. After the recession, Regular contingency funds were increased, while the Emergency contingency funds were added to the budget of the TANF program.

Debt Management

Government agencies have their own debt management procedures, detailed in the MEFMI document (8). The authorization process involves the review of the agency’s performance, the source of debt. In case of external debt, the government’s debt management agencies get involved in the recovery of funds. When the agency spends more than the allocation amount. There is a review of the budget documents and the statutory bodies, private organizations are contacted by the debt recovery agencies. It is also important to note that the government’s debt management principles are applied in every agency. Government guarantee limits are determined in the beginning of the fiscal year, therefore, even when funding is not available for the programs, they can carry on using the public debt processes of the Federal U.S. Government.

The authorization process of debt within government agencies is in line with transparency and accountability guidelines and regulations set by the government. The terms and conditions of loans provided for the agency need approval of the Federal Government. Government security funds need to be specified and approved by the Accountant General. The Department of Treasury is the financial executive office of the U.S. Federal government. It is responsible for collecting taxes, duties and other payments in order to make them available for the next year’s budget This office also manages the United States’ public debt, including individual agencies’ outstanding payments and finances.

Debt Information. As the U.S government operates a strict and well outlined Federal Reserve system, it ensures that funds for government operations and programs are available when agencies call for them. The U. S. federal budget contains a section of assets, liabilities and details the yearly budget on a national level. The debt information of ACF is not available through common Internet publications of the government, therefore, the authors can assume that these are handled by the federal Office of Legislative Affairs & Budget, publishing financial projections, budget proposals and justification documents. Debt information, however, is found in the justification budget document’s unfunded authorization section, where the funds not available for the delivery of the program are detailed.

Debt Management Practices. Debt management is handled by issuing Agency Bonds, however, only a few agencies use this practice. Unlike government sponsored enterprises, funding of loans is not the agency’s responsibility, but the federal government’s.

Debt Burden and Debt Service. As mentioned above, government agencies’ debt is handled by the federal administration, therefore, it is not included in the budget document. However, it is important to note that without this information it is hard to measure the performance of the agency, as well as the effectiveness of public service delivery.

Debt Issues. There are currently no debt issues arising in the budget of the ACF, and this is due to the strict government regulation, the presence of the overseeing bodies in the financial management system of the agency, as well a the guarantees provided by the Senate for the programs funds are allocated for.

Transparency Issues

The existence of Block Grants in the federal government funding systems has been criticized by several senators and researchers, as it greatly affects transparency of agencies. While different funds and government initiatives, programs are broken down based on expenditures, as the agency operates in the public sector, there are no details published regarding its effectiveness of delivery; namely: how much of the funding goes directly to the families needing the support and how big the operating expenditure of the agency is. This is one of the main questions of transparency of governments today in America, and needs to be addressed.

While the government’s spending on budgets, programs, delivery and initiatives is clearly described in the budget, the background of funding this way is not promoting transparency. Local delivery systems are not reporting to the program’s management, therefore, the spending cannot be monitored or controlled. Spar (2), block grants, such as the Community Services Block Grant, administered by the HHS need authorization of the federal government. The allocation of funds is based on the CSBG Act, and this act provides estimated expenditure figures for agencies. For example, 1.5 percent of the program’s budget is reserved for administration, technical assistance and training. Funds are used for the government’s determined goals: for instance the CSBG is allocated for fighting the causes of poverty. The role of the Child Care Development Fund is to support working families’ children’s development.

The question of accountability and transparency, however, can be viewed from a different perspective, as well. By creating annual reports and research studies about the work completed by the agency, the government is able to oversee not only the budget and spending of ACF but the processes, effectiveness and performance against the targets. In this form, the transparency of the federal government directly determines the level of transparency within the agencies working alongside the State Departments. According to the Federal Government’s transparency initiatives, the executives’ budget proposal should include revenues, expenditures and debt information. Further, there is a need for comprehensive reporting, classification of transactions and liabilities. However, the initiative on the Government’s transparency website also calls for public access to detailed reports of spending, including contracts and subsidiaries. This information is not available for the public on the agency level in the case of ACF, therefore, there is a discrepancy and confusion about how public spending records are made transparent through the government. Still, on the program level, more importantly on the fund level, there is an overlap between programs, funds and state departments, making retrieving and analyzing data more complicated and confusing.

Conclusion

While the review of the Administration for Children and Families’ has produced a result of understanding federal government funding and spending through the programs, block funds and other provisions in place, it is also evident that the review of the budget is not comprehensive, and – due to the legislation related to government agencies’ reporting, as well as the budgeting structure -. there is a lack of information on how effectively ACF delivers public services. While the approximate and estimated costs of operation are included in the block funds and the budget of the organization, there is a lack of information on how much it costs for the federal government to deliver a program or an initiative.

While there are several federal and agency budget priorities determined every year by the Congress, and the reporting obligations require the agency to submit a performance report, as well as a justification budget for the foregone year, reviewing the spending of the government on a state, project and program level is still challenging. As the source of funds changes from one year to another, and the targets are variable based on priorities, the authors conclude that the budgeting system of federal government agencies does not fully serve transparency initiatives started by the current Congress.

References

Administration for Children and Families. Department of Health and Human Services. Fiscal Year 2012 Justification of Estimates for Appropriations Committees. 2012. Web.

Administration for Children and Families. Department of Health and Human Services. Fiscal Year 2013 Justification of Estimates for Appropriations Committees. 2013. Web.

Annual Report To Congress On State Child Welfare Expenditures Reported On The CFS-101. 2012. Web.

Falk, G. The Temporary Assistance for Needy Families (TANF) Block Grant: Responses to Frequently Asked Questions. Congressional Research Service 7-5700 October 17, 2013

Mikesell, J. L. (2011). Fiscal Administration. 8th Edition. Print.

Spar, K. Community Services Block Grants (CSBG): Background and Funding. CRS Document. 7-5700 May 24, 2013 Web. 2013.

U.S. Department of Health and Human Services. Fiscal Year 2013. Budget in Brief. 2012. Web.

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee