Strategic Business Economics, Essay Example

Strategic planning and execution of business objectives incorporates many tools and techniques to facilitate the opportunity for the success of a project implementation. Demand planning as well as the inherent variables, including dependent and independent variables, play a contributing role in determining the optimal pricing for goods or services. The selection of price impacts the supply and demand for a product and the gravity of that impact is based upon the elasticity of the good or service provided. The factors play a major role in planning the optimal price to provide the most amount of revenue for the good or service or could provide the key leverage point to gain market share in a competitive market. The business model of the Foam Fabricators Company’s automobile division revolves around supply chain management and a centralized focus on distribution of products to their consumers. With many companies that sell products to consumers, it is the sales force that drives market strategy and determines the best tools to provide key data to their customers. This is due to the fact that the more sales that are generated the more production supply is needed to meet that demand. The unique situation is the dual marketing strategy of Foam Fabricators based upon their customer.

Business Overview and Purpose

In New Albany, Indiana, Foam Fabricators is taking on multiple major initiatives in which the focus of their business model is moving from an outsourced focus model to local development and implementation of their goods. The focus is to manufacture and produce injected molded and foam material to manufacturing facilities on a global level. The primary location of Foam Fabricators is their molding and fabricating facility in New Albany, Indiana. The focus of Foam Fabricators is to invest heavily in the domestic production of their process and create centers of excellence in New Albany, Indiana, Arizona, Pennsylvania, California, Georgia, Tennessee, Georgia, Texas, Missouri and abroad in Mexico. This is a revitalization effort by Foam Fabricators to ensure their appliance business is committed to become increasingly competitive with the expanding market and to ensure market share stability and then growth in the appliance market. With the movement of work from abroad to centrally locating the efforts stateside, this not only does this have positive impacts on the local community but with it the move also brings questions and concerns about administrative laws as well as considering applicable sales, licensing and e-Commerce laws that may need to be taken into consideration while starting up an enhanced and in some cases new manufacturing facilities in the United States.

Manufacturing Impact

Manufacturing goods has become increasingly difficult in the United States due to increased globalization of the market place and exponential growth in competition and supply base where the goods are made with equitable quality and at a lower cost. Although the perception is that the United States has lost significant ground in the manufacturing arena the actual lost in global market share is approximately 1.1% from 1984 to 2007 (Emery, Finnerty & Stowe 186). The ability for the United States to compete globally has relied heavily on America’s economic and political power which allowed the manufacturing companies to hold fast their traditional manufacturing operations and maintain the higher wages consistent with the U.S.’s standard of life. Complacency in the strategically aligned goals and objectives will lead to further devaluation of U.S. manufacturing and substantial loss of global market share (Kaplan and Norton 76).

Factors affecting the manufacturing playing ground reach far beyond the cost of labor in the low wage countries producing parts and systems competing with U.S. goods. Time to market, agility in manufacturing and optimizing the total supply chain become integral parts to reduce or eliminate non-value added processes to the final product. In order for the United States to maintain their competitive advantage while maintaining wages for their employees other means to drive cost out of the product must be taken. Implementing tools to better service the business such as lean manufacturing techniques, Designed for Six Sigma process lines, and 6 sigma methodologies will potentially negate the initial cost differentiation and ultimately lead to the highest quality product at the lowest cost to consumer.

Manufacturing is crucial to the United States economy in ways much more than just the finished good or part. Manufacturing innovation causes a ripple effect in the microeconomic and macroeconomic environments. Locally the innovation and process improvement leads to increased ability to produce goods at a lower cost. This leads to more operating profit and a higher profitability to the shareholders. When a company is doing well wages tend to increase and a pull demand for greater talent and leadership arises. Like with any other limited resource, the talent pool for creative, intelligent and potential leaders is limited but with increased demand there would be generation of supply. Educational opportunities would increase so that roles could be filled by the demand of manufacturing companies.

The impact of increased business makes sense for the local economy and the U.S. economy if the company is large enough such as Boeing or General Electric which have market shares of $89 billion and $252 billion respectively (Yahoo! Finance, 2014). These companies do not compete globally in a vacuum. Numerous suppliers both based in the United States and abroad input parts, expertise, infrastructure, processes and finished goods that result in a 747 jetliner or a hybrid water heater rolling off the assembly line.

Manufacturing in the United States depends on innovation, leadership, total ownership of the supply chain process by American manufacturers. Continual process improvement and allowing lean management techniques and 6 sigma processes to infiltrate the manufacturing process the manufacturing companies in the United States can maintain their market share and potentially garner greater share due to increased efficiency and quality. The total big picture encompasses the government not hindering companies and opening new venues for trade, suppliers providing agile support with a focus on quality and finished goods manufacturers managing and leading the entire product life cycle through an end to end view throughout the local and global markets.

Competition with other global entities involves trying to hit an ever moving target. Competing with wind energy production in Germany differs vastly than competing with an automotive manufacturer in Korea but the bottom line to success is reducing non-value add processes through the utilization of proven techniques and tools such as 6 sigma and lean management. Innovating new ways to compete and thinking of new solutions to get product to market faster is imperative to the competitive nature of global manufacturing. The United States has the opportunity to shape the competitive environment by forcing productive changes up and down the supply chain and pushing the governing bodies to make changes to policies that hinder growth in a rapidly changing business environment.

Financial Analysis

A project is by definition a temporary endeavor to produce a unique deliverable at the conclusion of the endeavor (PMI 257). With any endeavor that will result in a specific deliverable there is a cost associated with the work and other resources that go into the delivery of that good or service (Monk & Wagner 122). As the project progresses through the lifecycle the time draws closer to start assigning costs to the project. At this point, the project’s scope has been appropriately defined. With that being said the expectations are set with the stakeholders and a deliverable is expected at a certain time in the future. During this project the main objective is to ensure the competitive advantage of producing low cost and high quality is maintained while also balancing the supply and demand in conjunction with optimizing the shareholder’s wealth. Maintaining the ability to adjust and optimize the key variables within the parameters of demand is the key to ensuring the maximum amount of profit is obtained. During the current planning phase both cost estimating and cost budgeting activities will occur. There are multiple tools and techniques for estimating the project costs. The tools will be examined and applied as needed to result in the cost estimation for the project. The processes for implementing an effective and accurate cost estimate will include estimating costs, determining budget and controlling the costs (Emery, Finnerty & Stowe 43). All three areas are imperative to project execution and cost management.

The current market supply is extended to many diverse manufacturing and process businesses in appliance, automatic and aeronautical entities which are located in the domestic market as well as foreign markets. This is potentially going to expand as the demand increases for the product due to an economic rebound globally. The current objective is to accurately and precisely measure and manage the demand based upon the independent and dependent variables that exist for the high quality and low cost injected molded applications. With independent variables, the key attribute revolves around their ability to not be impacted by other variables. These independent variables, while important, are steadfast in their relationship with other entities. For example, type of business is independent of the location of the organization due to the fact that logistics and business opportunities present a way for the organization to centralize their production and decentralize their supply base. Time is constant and is not impacted by other variables. The dependent variables rely on other variables within the equation. The size of the business could have an impact on the amount of injected parts the organization orders. The length of time it takes to prepare and ship the material based on short term requirements could impact the reliability and quantity ordered on each purchase order. These variables are impacted by outside sources and with each impact a different result could occur in the demand equations.

Elasticity Calculation

Computing elasticity for independent variables allows the data from demand to become information that is usable to make informed business decisions. The elasticity shows a level of responsiveness between the demand for an item and the price that is placed on that item. It shows the relationship between the percent change in quantity demanded with a specified percent change in price, either up or down. In order to maximize the revenue generated from a specific good, in this case foam and injected molded parts, the price would be set so that the elasticity of demand or (PED) is set to 1. This optimizes the amount of demand with the best pricing option which allows for maximum profit. This maximization of profit would ultimately lead to increased shareholders’ wealth and fall in line with the goals and objectives of the organization. To calculate the elasticity of demand we would use the formula: Elasticity of Demand=(% Change in Quantity)/(% Change in Price). In this example is we had a base price of $7.00 and increased it to $10 and had a quantity of 10,000 and it decreased to 9,000 the PED would be: (-1,000/10,000)/(3/7)=-0.2333. In most calculations for PED the resulting number would be a negative based on the fact that with the law of demand an increase in price more than likely results in a decrease in demand. That does not mean that the increase in price is not effective or necessary.

The increase in price could ultimately negate the decrease in demand by providing an increase in revenue that would not be experienced with a lower price and higher volume (Prencipe, Davies & Hobday 297). There are multiple factors in regard to acceptance of higher prices for consumers. The factors vary between multiple areas. These include the availability for substitutions or replacements for the good or service being provided. In this case, if there are other foam or injection molded parts that are comparable in quality and content and it is an easy switch for the consumer to make there could be less ability to move price on the item. Another factor would be the actual revenue of the consumer. The target market, of the foam and injected molded parts, play a key role in the overall ability to move price points and adjust the demand in order to optimize the revenue. The amount of income an individual devotes to a specific good or service would be a determinant on how elastic or non-elastic the good or service is. Injected molded parts are elastic because they are dependent upon the demand for the parent product. While they are shielded by some of the elasticity because there are very few competitors with the injection molded business and they are necessary for completion of the larger parent project.

In general, if the price increases the demand decreases and the opposite is true if the price decreases the demand generally increases. With the ability to increase or decrease prices there is a decision to make on how to gain market share. With decreased prices the demand should ultimately increase and thus take a larger portion of the market share away from the competitors. On the other hand to realize maximum revenue the PED should approach if not reach 1. There are two main factors that need to be understood prior to making a price change. Those include the price effect and the quantity effect. For inelastic goods a price increase will increase revenue and a price decrease will decrease revenue. The parts manufactured by Foam Fabricators is produced by the company is actually not an elastic good due to the fact that there are few substitutes. But some parts are elastic due to brand loyalty being low and the percentage of expense for the parent product is not held within the foam or injected molded parts. This means that the opposite is true in most cases. Increase in price does not mean direct increase in revenue and a decrease in price does not mean a decrease in revenue. Based on the price elasticity for demand being less than zero the price could be raised to increase revenue. To gain market share and increase the amount of product in the market the price could be decreased to increase demand based upon the elasticity calculation. We should drop the price to increase demand until the market share desired is achieved. The risk with this option is due to the inelasticity of the good and the price may have to remain there on a consistent basis to maintain the market share unless a new product is released or the competition changes their pricing strategy (Cooper, Grey, Raymond & Walker 205).

Supply and Demand Curves

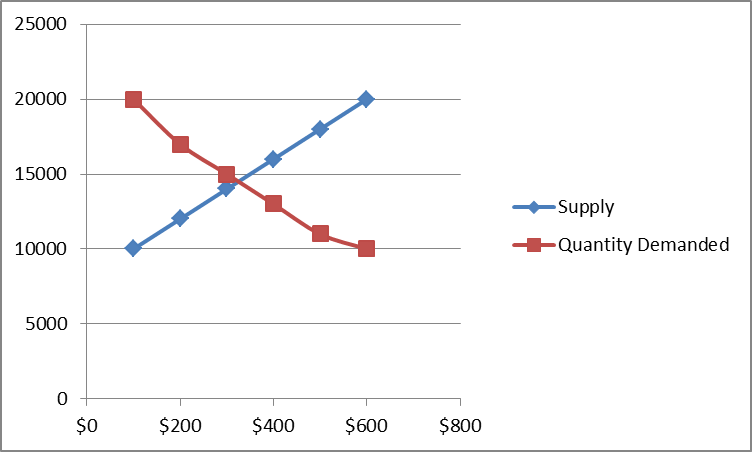

The supply and demand curves are calculated through plotting the prices changes from 100, 200, 300, 400, 500 and 600. See chart below:

Within the supply and demand equation for this product there are multiple factors that could impact both areas. Supply and demand is a fundamental foundation for understanding the concepts of economics. In order to understand these concepts it is imperative to understand what impacts both supply and demand. There is a direct and calculated relationship between the prices of a good or service, how much is supplied to the consumer and how much is actually demanded by the consumer based on availability, price, quality and other key factors. Key factors that impact the demand for an item revolve around income of the consumer, price of the good, intrinsic need or want for a good and the amount of people that can actually use or consume the good. With the foam and injected molded parts, there is a specific target market that the company is looking to pursue. There is a specific target market that the company wants to provide source part to as well. The demand for the good is significant but there are also factors such as substitutes and pricing that impacts the demand.

The supply curve can be shifted for different reasons. The price shifts both the demand and supply curve but in different directions. The increase in price removes demand while the increase in price makes the producer want to increase supply of the good. Production of the foam and injected molded parts impact supply based on the fact that either there can be only a specific number of meals created or there are limitations within the supply chain that limit supply to the consumer. The substitutes also play a key role in the supply. If the substitutions are truly interchangeable and the prices vary from one supplier to the next, the pricing of the goods will play a key role in the amount of supply that is needed to fill the demand for the good.

Conclusion

With the demand estimations based on dependent and independent variables there are decisions to be made based on the pricing models, amount of demand desired and the ability to supply the consumers the quantities they need. To gain market share in this example, the pricing should be lowered slightly while the understanding that market share will be gained but the optimization of profit will suffer slightly. The overall objective was to gain market share while also maintaining a profit and slightly lowering prices should, based on the calculations, increase the demand for the product thus increase the overall market share owned by the organization.

Works Citied

Cooper, D. F., Grey, S., Raymond, G., and Walker, P. Project risk management guidelines, managing risk in large projects and complex procurements. John Wiley & Sons. 2005. Print.

Monk, E., and Wagner, B. Concepts in enterprise resource planning. (3 ed.). Boston, MA: Course Technology Cengage Learning. 2009. Print.

Prencipe, A., A. Davies, and M. Hobday. The business of systems integration. Oxford University Press, USA, 2007. Print.

Project Management Institute. “A Guide to the Project Management Body of Knowledge (PMBOK Guide) Fourth Edition.” Project Management Institute. Newtown Square, PA. (2008). Print.

Kaplan, R. and Norton, D. “Using the Balanced Scorecard as a Strategic Management System,” Harvard Business Review (January-February 1996): 76. Print.

Emery, D. R., Finnerty, J. D., & Stowe, J. D. Corporate financial management. Pearson College Division. (2007). Print.

Yahoo! Finance. General Electric Company. October. 2014. Web. http://finance.yahoo.com/q?s=GE.

Yahoo! Finance. General Electric Company. October. 2014. Web. http://finance.yahoo.com/q?s=BA.

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee