Capital and Investments, Business Plan Example

Summary

Goorman Capital & Investments Inc. (GC&I) shall be an investments firm specializing in real estate, insurance (annuities, viatical) and economic development consulting (rural areas of United States). GC&I is seeking to raise $15 million in start-up capital to add to its $1 million initial cash investment fund. GC&I will charge a two percent (2%) management fee of the value of all client funds. This fee will be paid quarterly and used to pay for employee salaries, overhead costs and operating expenses (Palo Alto Software #2, 2012).

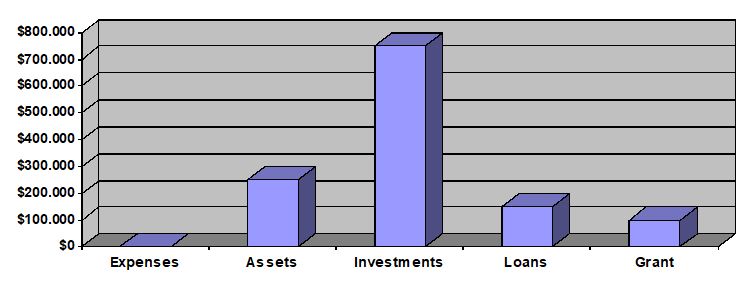

The purpose of this business plan is to obtain financing in the amount of $15 million to be used as start-up capital funding. This will serve as supplemental financing that will complement GC&I’s existing $1 million initial investment fund. The start-up funding is required to begin work on site preparations, equipment purchases, and to cover all expenses incurred in the first year of operations. As part of the proposed start-up cost funding, financing for the $1 million initial cash investment fund has already been secured from 1) the Anywhere City Economic Development Fund in the amount of $100,000, 2) a personal investment from owner/CEO Brad G. Goorman in the amount of $150,000, 3) funds from three private venture capital investors (David Jamison, Simir Rangaswamy and Jonathan Flakes) in the amount of $600,000, and 4) short-term loan in the amount of $150,000 from Venture Capital Bancorp (Palo Alto Software #2, 2012). Additionally, GC&I will start-up with assets va at $250,000 (two company vehicles, office furniture, and office equipment).

Goorman Capital & Investments will be incorporated as a corporation (Inc.). This means the company can go public and be publically traded. It also means however that the company faces double taxation obligations. Goorman’s classification also requires it to hold directors and shareholders’ meetings, and hold votes on major decisions. The $15 million financed funds, the owner/CEO contribution, funding from the shareholders and the Anywhere City Economic Development Fund, will allow for successful operations of GC&I for the first year.

Mission, Goals and Objectives

The initial capital investment will allow Goorman Captial & Investments, Inc. to provide its clientele with full-service consulting services in the areas of real estate, insurance and economic development. GC&I will advise clients and assist them with their long-term investment planning and formulating investment strategies, to assist them in meeting their investment goals (Investment Consultant, n.d.). As reported in the Executive Summary, GC&I will charge clients a two percent (2%) management fee, which will be paid quarterly. The first year of successful operations and profits will put GC&I in the black by the end of year two.

Keys to Success

GC&I’s management team has determined that the three main keys to success in the new operation are 1) the ability to attract quality clients with substantial investment portfolios, 2) the ability to retain those clients over a long period of time, and 3) the ability to actively monitor investments for the clients and work with them as their goals and needs change over time (Investment Consultant, n.d.).

Company Summary

Goorman Capital & Investments, Inc. is a start-up company with headquarters to be located at 1234 Any Street in Anywhere, Montana. The company’s owner, Brad G. Goorman, is an experienced investment portfolio consultant, specializing in the areas of real estate, insurance and economic development. His experience comes from over 20 years working for Executive Investment Consultants Enterprise, a large, well-known investment consultant firm in Anytown, Connecticut. He is not currently under any non-compete contracts and is well-positioned to enter Goorman Capital & Investments into the industry with the start-up capital illustrated in the following start-up summary chart (Palo Alto Software #1, 2012).

Start-up Summary

Goorman Capital & Investments, Inc.’s venture capital consists of an initial fund with the following contributions: 1) a $100,000 business grant from the Anywhere City Economic Development Fund, 2) a $150,000 personal investment from owner/CEO Brad G. Goorman, 3) a $600,000 private joint investment amount from private venture capital investors, David Jamison, Simir Rangaswamy and Jonathan Flakes, and 4) a $150,000 short-term loan from Venture Capital Bancorp. Additionally, as mentioned in the Executive Summary, GC&I will start-up with assets valued at $250,000 (two company vehicles, office furniture, and office equipment).

Industry History

Goorman Capital & Investments, Inc. will operate in the investment consultant industry, which is part of the finance and insurance industries. Occupations in this industry consist of consultants, planners and advisors of financial affairs. According to the Bureau of Labor Statistics, Occupational Outlook Handbook (2012), investment consultant professionals provide financial advice to clients to assist them with their investments (real estate and cash), taxes and insurance.

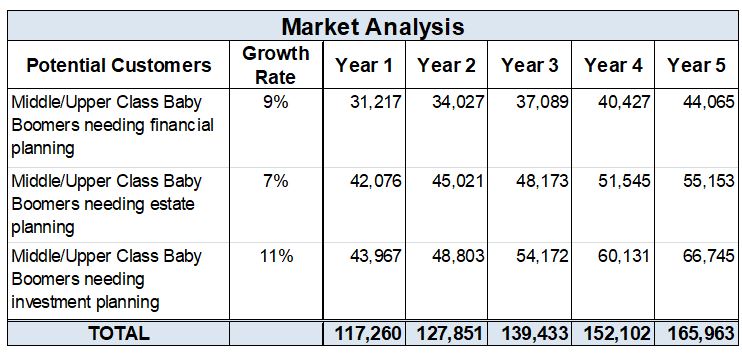

As it relates to industry trends, it is projected that the investment consultant industry will grow 32 percent between the years 2010 and 2020. This growth projection is based on the large number of baby boomers who are reaching retirement age and seeking financial advice (Occupational Outlook Handbook, 2012).

Legal Form of Ownership

Goorman Capital & Investments, Inc. will be incorporated as a Limited Liability Company with one owner (Brad G. Goorman) and three silent partners (David Jamison, Simir Rangaswamy and Jonathan Flakes).

Location and Facilities

Goorman Capital & Investments, Inc. will be located at 1234 Any Street, Anywhere, Montana 55555, at the M&M Building in the heart of downtown Montana, in the business shopping district. The company will lease 2,000 sq. ft. of space in the M&M Building, with first option on an additional 1,500 sq. ft. for future growth. The leasing company is also located in the M&M Building on the ground floor.

Management Structure

Key positions within the management structure of Goorman Capital & Investments are projected as follows.

- Board of Directors – The appointed Board of Directors for GC&I are accomplished community and business leaders who have been instrumental in their work for local and state commercial ventures.

- Chief Executive Officer – Brad G. Goorman will serve as CEO of GC&I, and brings more than 20 years of experience in the financial planning and consulting industry. He has an MBA with an emphasis in Business Marketing and a BA in Financial Management and Planning from the University of Connecticut.

- Vice President – Jack D. Jordon will have the role of VP of GC&I, with over 28 years of experience as a stock broker and 11 years experience in the insurance industry. He holds a BA in Finance from the University of Hawaii.

- Chief Financial Officer – Christine A. Kemp will serve as CFO of GC&I, and has 15 years of Certified Public Accountant experience to her credit. She is also a member of Certified Public Accountants Associates International (CPAAI) and she was licensed by the Texas State Board of Public Accountancy (TSBPA). She has an MBA and a BS in Accounting from Texas State University.

- Chief Information Officer – Greg G. Goorman will have the role of CIO for GC&I. He brings 24 years of information technology experience to the GC&I. He has a BS in Computer Science from the University of Connecticut.

- Other key personnel will include Investment Officers, Administrative Officers and Financial Planners.

Products and Service

Goorman Capital & Investments, Inc. will provide are clients with creative consulting advice, utilizing various solutions customized to their needs. Our services will include financial planning, estate planning and investment planning (Services, 2011).

Financial planning services include:

- Retirement planning

- Tax planning

- Education funding planning

- Asset allocation analysis

- Risk Management

- Insurance review and planning

- Disability planning

Estate planning services include:

- Gift planning

- Trust planning

- Wealth transfer & replacement strategies

- Charitable gift planning

- Tax minimization strategies

Investment planning services include:

- Portfolio construction

- Continuous portfolio monitoring

- Portfolio rebalancing

- Portfolio performance measurement

Market Analysis

Goorman Capital & Investments, Inc.’s marketing strategies will include targeting three segmented groups consisting of people who need financial planning advice, those who need estate planning advice and those who need investment planning advice. Targeting strategies will include multi-channel marketing techniques. Part of GC&I’s goal is to create a competitive advantage for the company through developing outstanding customer service initiatives, competitive pricing and brand awareness.

Target Market

The current market for investment consulting services consists, in large part, of the baby boomer generation who are middle-aged people reaching retirement age. Additionally, within this group, GC&I will target “middle- to upper-class socio-economic groups” (Palo Alto Software #3, 2012). Identifying the target market will be done by market segmentation.

Market Segmentation (Palo Alto Software #3, 2012)

The three targeted groups of baby boomers will be segmented as follows:

- Middle- to upper-class baby boomers needing financial planning advice

This segment needs advice on retirement, taxes, education funding for children or grandchildren, asset allocation, risk management, insurance and disability planning. - Middle- to upper-class baby boomers needing estate planning advice

This segment needs advice on gift planning, trust planning, wealth transfer, wealth replacement strategies, charitable gift planning and tax minimization strategies. - Middle- to upper-class baby boomers needing investment planning advice

This segment needs advice on portfolio construction, continuous portfolio monitoring, portfolio rebalancing and portfolio performance measurement.

Industry Analysis

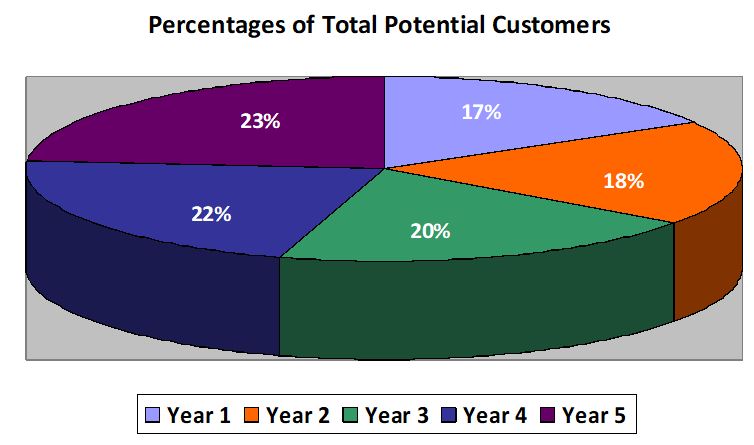

Currently, the market shows positive five year growth trending in the target market for all three of GC&I’s segments of baby boomers in need of financial planning, those in need of estate planning and those in need of investment planning at 9%, 7% and 11%, respectively. This is outlined in the following spreadsheet and illustrated by the chart which illustrates percentages of total potential baby boomer customers by year (Palo Alto Software #3. 2012). (Palo Alto Software #3. 2012).

Competitive Analysis

Goorman Capital & Investments, Inc.’s main market competition includes large financial planning corporations, independent financial planners, and tax and estate planning attorneys (Palo Alto Software #3, 2012).

Large financial planning corporations, such as Charles Schwaab and Merrill Lynch, are often biased with giving advice because they vested interests in the equity companies that sell for (Palo Alto Software #3, 2012).

Independent financial planners are local financial or investment companies with no particular affiliations with other financial companies (Palo Alto Software #3, 2012).

Tax and estate planning attorneys sometimes offer financial services as a sideline to their legal practices (Palo Alto Software #3, 2012).

The advantage that GC&I has in regard to the competition is the fact that it is entering the local and regional market as a specialty company, focusing on niche products and services that consumers need. GC&I will fill a need and a gap in the market and will be well-positioned to capitalize on the baby boomer pool of potential customers.

Market Strategy

According to Effective Education Information (2012), the four P’s of marketing (the Marketing Mix) are price, product, promotion and placement, and can help GC&I gain advantage within the marketplace, by maximizing the potential of its products and services.

4Ps (Marketing Mix)

As it relates to the Marketing Mix, GC&I’s 4Ps are broken down as follows.

Price

As noted in the Executive Summary, GC&I’s management fee will be 2% of fund value for all clients monthly; however, this may fluctuate based on specific variables for each client. Individual transactions will be billed on commission. GC&I’s management team will develop research initiatives to continually monitor pricing trends in the industry, in order to remain competitive, with value-added quality products and services.

Product

The key to a company’s success in this industry is making sure client’s needs are addressed and problems solved. GC&I’s products and services are designed to cater to client’s needs and also to resolve their issues relating to their financial assets. GC&I’s services and products, which include financial, estate and investment planning documents, are unique to the local market because it is the only firm that offers full-service financial consulting services.

Promotion

GC&I’s promotional marketing strategies include television, radio advertising and print advertising that will reach a wide range of the target market and encourage them to make a call to the company or visit the website. Additionally, GC&I’s information technology team will develop effective Internet marketing strategies to draw customers to its website via targeted search engine optimization techniques. Event and email marketing will also be utilized.

Placement

GC&I plans to use multi-channel options for customers to purchase its products (e.g. financial, estate and investment planning documents) either online or by visiting or calling the offices. GC&I services are only available by appointment and meeting with GC&I administrative and investment officers.

Price List

As stated in the Executive Summary, clients will be charged a monthly 2% management fee to handle their full-service needs and individual transactions, such as equity or stock buying or selling, will be billed on a commission basis previously agreed to in each client’s contract.

Selling Strategy

Goorman Capital Investments, Inc.’s sales strategy will be based on its competitive advantage in the market of being the largest full-service investment consulting firm locally. Also, the GC&I management team will continually monitor its competition and marketplace trends to remain competitive. Additionally, GC&I’s sales strategy will include top-of-mind niche advertising to the baby boomer population to stir them toward GC&I when thinking of financial, estate and investment planning options.

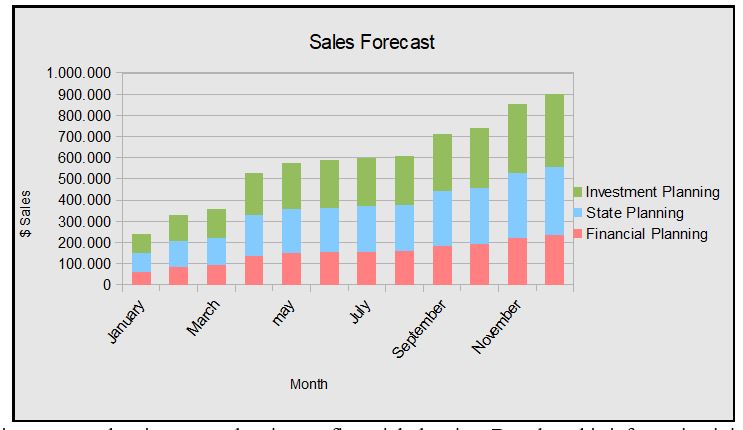

Sales Forecast

The following is a sales forecast for Goorman Capital & Investments over the next three years, based on expected market conditions. It has been established that sales activity is expected to start out at a slow pace, and increase each month as GC&I builds its customer base. Revenue is projected to remain steady beginning in the third month in business. GC&I plans to implement its sales strategy, as outlined above, to ensure profits are in the positive range by the end of the fourth quarter of the first year.

GC&I projects investments of $5 million in each of three products ($15 million) for its clients over the first five years in business. As stated in the Executive Summary, GC&I’s management fee will be two percent (2%) of client investments, paid monthly. This only for the first year projected amounts.

The Forecasted Sales are being estimated depending on the results of the research mentioned before about the potential number of customers for the three different products that the company offers and that satisfy their needs in the financial field.

To calculate the monthly sales expected, the assumption will be that each costumer will need the company to manage an average fund of $3,000. Based on the similar characteristics of the three different services we offer, it is assumed the same average fund for each one.

It is needed to be mentioned the percentage representative of each type of product in the total sales. The financial planning service represents approximately 26% of the total sales, is the less important one in terms of number of potential clients that really need it.

The estate planning is 36% of the total sales leaving the investment planning service the most demanded with a 38% of the total population targeted.

Implementation Strategy

GC&I’s implementation strategy will consist of three phases which include the expanding its management and consultant teams, introducing its products and services to the market, and developing its business operations. The focus will be to consistently research and develop ways to satisfy its client base and to continually attract new clients.

Overall Strategy

Expansion of Management and Consultant Teams: GC&I’s existing management and consultant teams have more than 100 years of combined experience to meet the needs of its clients and to effectively manage the company’s operations. However, in anticipation of positive company growth, GC&I will develop effective recruiting strategies to attract and retain additional experienced professionals in the field to join the team. One of GC&I’s goals it to

Introduction of Products and Services: GC&I’s marketing team will meet weekly to develop and implement new processes to streamline and develop the company’s existing products and services. Additionally, new marketing team members will be bring in potentially new ideas to help GC&I present the best possible products and services to its clients.

Development of Business Operations: GC&I intends to continually and strategically develop its business operations to meet the demands associated with successful investment consultant marketing and managing of diverse client financial portfolios. Business operations development will include outlining and implementing specific departmental functions to handle various aspects of the business that require specialized experienced personnel such as Accounting, Information Technology, Finance, Human Resources, Client Services, Administration, Research and Development, etc.

Implementation

GC&I’s target date for implementation of the initial phases of its strategy is scheduled for first quarter 2013. GC&I’s goals and objectives include creating an effective value proposition presentation for potential clients. As an emerging business into the market of investment consulting, GC&I desires to increase its chances of success. Therefore, the focus will be on understanding individual client needs and offering value-added services and products to meet those needs on a regular basis. Additionally, GC&I’s goal is to be the practical and most reasonable choice for potential clients. GC&I desires to be the investment consultant company of choice.

Control Plan

GC&I’s control plan for reaching milestones is to schedule proposed dates to meet the most important milestones for the new business. GC&I’s corporate strategy is outlined in the milestone chart below (Palo Alto Software #5, 2012).

Objectives of the milestone schedule are to assist GC&I in staying on target to position itself for steady, long-term, sustainable growth. Additionally, GC&I will target market new potential clients in middle- to upper-class baby boomer groups, and will strive to achieve 100% satisfactory results in meeting these clients needs. GC&I will also initiate an aggressive recruiting phase to bring in top talent, and this will be based on continuous clients needs (Palo Alto Software #5, 2012).

Major milestones include: 1) incorporation, 2) communication infrastructure, 3) company website, 4) first employees, 5) first clients, 6) services expansion, and 7) geographic expansion. The projected scheduled dates for reaching these milestones are outlined in the spreadsheet below (Palo Alto Software #5, 2012).

Financial Statements and Projections

Revenue and Cost Estimate

The projected revenue the first year will be estimated based on the sales forecast. The estimations in the sales forecast are based on three groups of potential customers, those who need investment planning, state planning, or financial planning. Based on this information it is estimated that 26% of the client base will need investment planning, 36% will need state planning, and 38% will need financial planning. It is also estimated that the average consumer fund will be $3,000. As the chart shows, sales are estimated to be lower in the initial months but then gradually increase, once startup costs have been overcome and revenues have accrued. It is estimated that by the end of the year GC&I will have 117,227 clients in total.

For the first month, January, the company is estimated to earn $240,000 in sales, due to being new in the market. As the chart shows, this rate will gradually increase over time. In February it is $331,200, in March it is $360,000, in April it is $529,200, in May it is $576,000, in June is $588,000. In the last two quarters, the forecasted sales have a major increase. In July the estimated sales are $597,000, in August $606,708, in September $711,000, in October $740,640, in November $853,800 and finally in December the projected sales are $900,000.

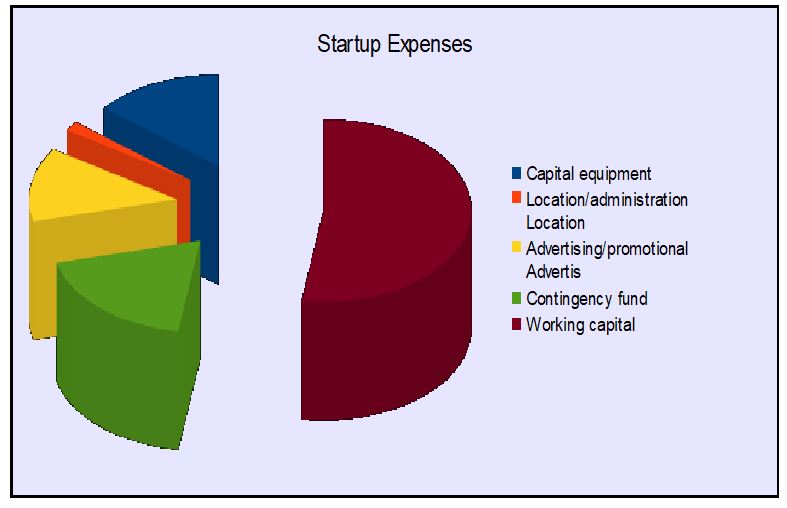

In addition, estimated costs have to be overcome before the company can generate revenue. The company must first overcome startup expenses in capital equipment, location and administration expenses, advertising, the contingency fund and the company needs to have working capital to cover expenses.

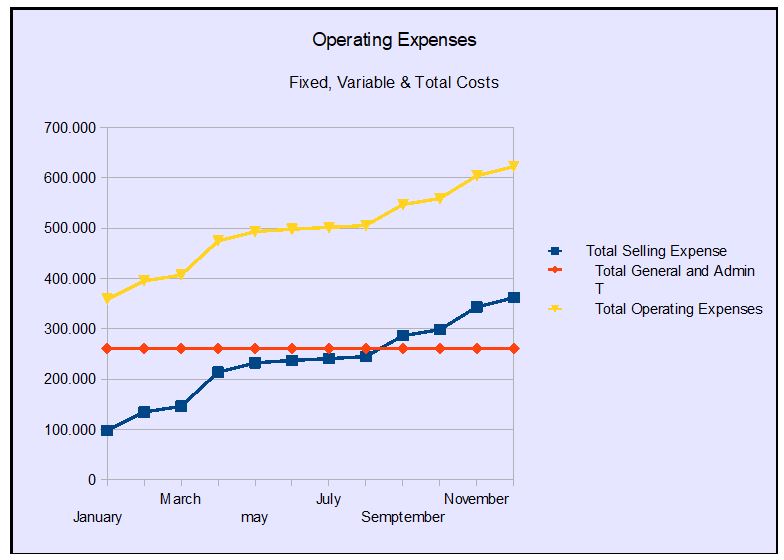

When it comes to costs, there needs to be a distinction between fixed costs and variable costs. The variable costs applied in this case are going to be from advertising and distribution network support. The first one will be $0.25 per unit sales and the second one will represent $0.15 per unit. The fixed costs, as its own name says, won’t change when the sales are different. In this category there are included costs like administration salaries, salaries, utilities and service, rent, insurance, payroll service, accounting and legal, repair and maintenance, website maintenance and other general and administration expenses. The next chart shows the relation and evolution of the fixed costs, variable costs and total costs estimated.

Forecasted Profit and Loss Statement

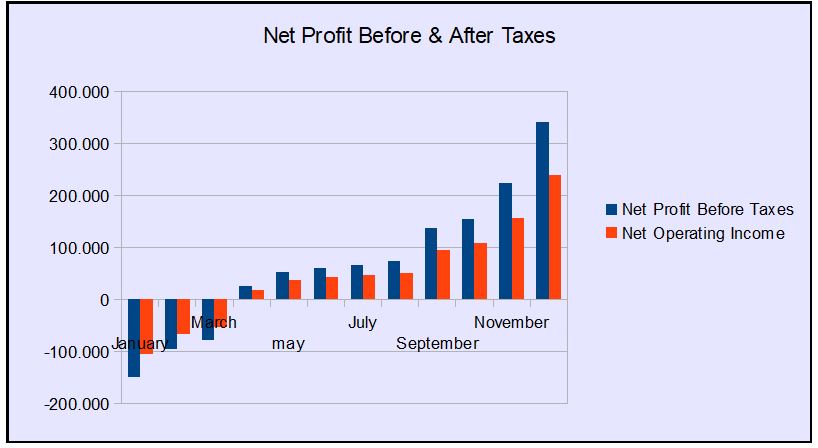

The forecasted profit and loss statement derives from the revenues and costs. The loan interest plus the cost of taxes are subtracted from the difference between revenues and costs.

The initial interest expense as a result of the loan is $31,250 in the first month, and by the 12th month it’s $2,589. For more information on this please refer to the “Loan Schedule Page” of the financial report. It will reveal net profit obtained from subtracting the interest expense from the profit before interest. The profit before interest is calculated by subtracting total expenses from total revenue. Examples of expenses may include: the company starting with sixty professional employees earning $3000 salary a month. Also, the company having administrative personal with salary of $1,800 per month, in total they represent 30 administrative positions. The “Net Profit Before & After Taxes” chart show the amount of profit the company will have before and after taxes. These values demonstrating the forecasted profit and loss can better be seen in the chart below:

Forecasted Balance Sheet

The Forecasted Balance Sheet is attached in the spreadsheet. In summary, the total value of assets of the company is $16,000,000 being equal in value with the total liabilities plus equity. The liabilities represents $15,150,000 ($150,000 current borrowing plus $15,000,000 the investment required) and the equity 850,000 ($150,000 is capital from the owner, $100,000 is a grant received from the company and $200,000 is the investment of each of the three investors).

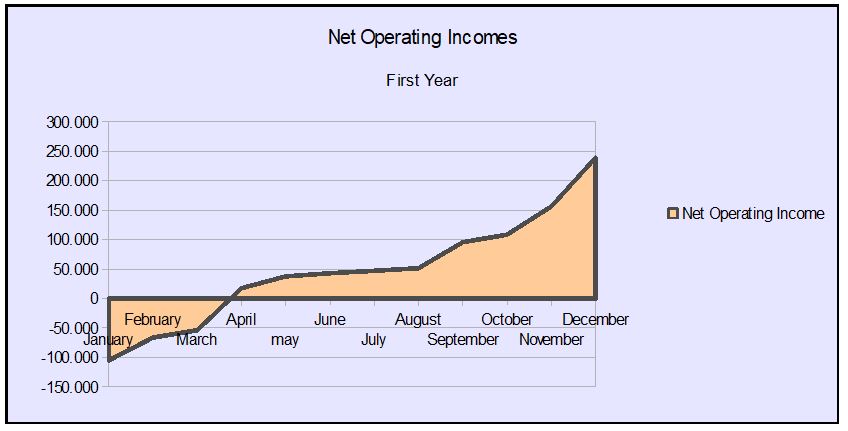

Financial Projections

In summary, the company will expect an increase gradually of the sales, obtaining more profit because of more clients and higher gains on investments, as well as lower operating costs. After the first four months, it is expected to start getting positive incomes which it will position the financial situation in a good condition being able to pay the operating expenses and also the long term debt. Due to the increasing of potential clients and the advertising the company will increase the profits and look forward to an expansion in the long-term.

Breakeven Point

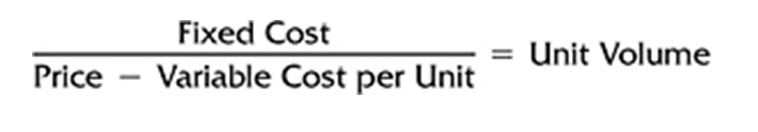

This method is used to determine the exact point at which the business makes neither takes a loss nor makes a profit. It is calculated at a point where sales have grown at a greater rate than costs and the two lines cross.

Another way of expressing this formula would be:

Breakeven-point= Fixed Costs/ ((1-Variable cost %)/1)

In this case, as it can be seen in the spreadsheet, the fixed costs are $527,010 and the variable costs are formed by 20% cost from adversiting and 15% from distribution network support, so variable cost is 35%.After it’s calculated, the breakeven-point is estimated in $81,0785, so, the company reach the breakeven-point when the sales are $810785. This means that if the sales level is higher than that amount, the company starts building profits. As you can see in the chart below, that level is reached around April.

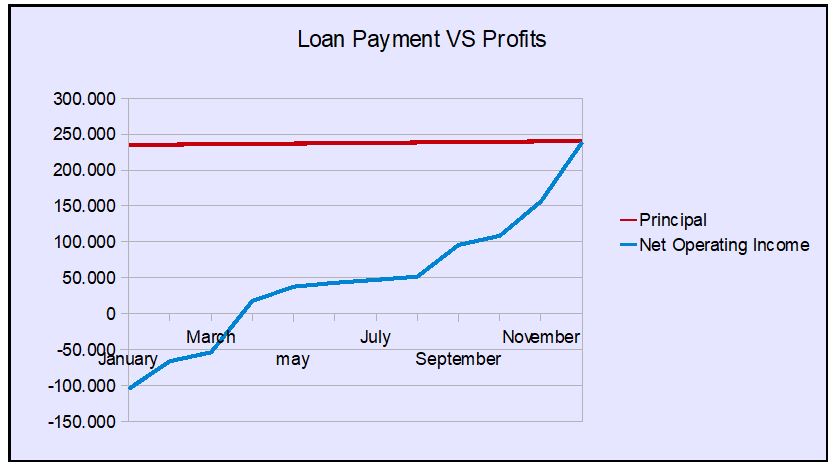

Financial Position:

At the end of the first year, the sales level will be much higher than they are at initial launch, which will make the company more liquid and fiscally stable. It will also increase the profit positioning as the monthly loan obligations will be significantly reduced. The debt by the end of the year will be reduced to $12,147,942. The principal portion of the debt payments paid over time show how subtracting them from the net income eventually puts the company in a profitable financial position by the end of the year. This will ultimately put the company in a more liquid position of sustainable profitability and higher projected growth. The chart below paints a clearer picture of this transition. The

corresponding data can also be found in the “Loan Scheduled” section of the excel sheet.

Capital/Investment Needs:

As mentioned before, the company needs a capital of $16,000,000 to be able to start running. Since there is a part of the needed amount already secured by contributions from three different investors, the owner and a grant obtained from the local government, the company must take on a debt of $15,000,000 to attain the remaining capital need for startup. More details of needed investments and required start-up capital can be seen in the table below.

References

Executive Education Information. (2012). How to Develop an Effective Marketing Plan. NotreDameOnline.com. Retrieved from http://www.notredameonline.com/effective-marketing-plan/

Howell, R. (2012). What Is an LLC Business? Chron: Small Business. Retrieved from http://smallbusiness.chron.com/llc-business-3741.html

Investment Consultant. (n.d.). Definition of ‘Investment Consultant’. Investopedia.com. Retrieved from http://www.investopedia.com/terms/i/investmentconsultant.asp#axzz2C6OTk7mR

Investment Consultant. (n.d.). Investopedia explains ‘Investment Consultant’. Investopedia.com. Retrieved from http://www.investopedia.com/terms/i/investmentconsultant.asp#axzz2C6OTk7mR

Occupational Outlook Handbook. (2012). Personal Financial Advisors. Bureau of Labor Statistics. Retrieved from http://www.bls.gov/ooh/business-and-financial/personal-financial-advisors.htm

Palo Alto Software #1. (2012).Investment Company Business Plan examples, Company Summary. Bplans.com. Retrieved from http://www.bplans.com/investment_company_business_plan/company_summary_fc.phpPalo Alto Software #2. (2012).Investment Company Business Plan examples, Executive Summary. Bplans.com. Retrieved from http://www.bplans.com/investment_company_business_plan/executive_summary_fc.php

Palo Alto Software #3. (2012).Investment Company Business Plan examples, Financial Planning Business Plan. Bplans.com. Retrieved from http://www.bplans.com/financial_planning_business_plan/market_analysis_summary_fc.php

Palo Alto Software #4. (2012).Investment Company Business Plan examples, Strategy and Implementation Summary. Bplans.com. Retrieved from http://www.bplans.com/financial_planning_business_plan/strategy_and_implementation_summary_fc.php#5.2_Marketing_Strategy

Palo Alto Software #5. (2012).Investment Company Business Plan examples, Marketing Strategy Business Plan. Bplans.com. Retrieved from http://www.bplans.com/marketing_strategy_business_plan/strategy_and_implementation_summary_fc.php

Services. (2011). The Glenview Trust Company website. Retrieved from http://www.glenviewtrust.com/services

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee