Financial Analysis of ALICO, Capstone Project Example

Executive Summary

The global arena of trade and industries has greatly changed through the years. The pattern by which business organizations take on the challenge of developing into larger and more competent businesses provides a considerable attention on how business groups tend to expand their territories therefore developing the markets that they serve as well. In a way, this approach helps them contend with the most evident points that could affect their industrial performance and rate of profitability. It is with this fact that business organizations today are gearing themselves up to promote a remarkable instance by which they are able to rise to the occasion in response to the need of staying within the considerable stance of competitive market value.

ALICO is one if not the best organizations enjoined in the aluminum production and distribution industry. In the presentation that follows, its financial standing along with its competitive level of defense against the failure of the world economy shall be examined with the company elements defined strongly for reference. Seeing how the organization performs in line with its internal and external factors of competition, this financial analysis shall also try to define what the future is likely to look like for ALICO up to the coming five years of business operations.

Financial Analysis for ALICO Inc [2008-2010] and Forecast

Introduction

Competing in the face of global development is most often than not a hurdle among industries that are being affected by issues of scarcity and economic adjustments. For a long time, the industry of aluminum production and distribution has been a luxurious sector that provides a distinctive chance for international traders to find a profitable way of engaging in the business. ALICO or also known as Alcoa Inc is considered to be among the largest producer and manager of aluminum products in the United States. Between the years 2008 towards 2010 are among the years that marked the new status of Alcoa in the new trading field in the US and even in the scopes of international commerce. In the documented presentation that follows an understanding on the progress and adjustments that Alcoa had to encounter between the years 2008 and 2009 shall be identified in line with the future market of aluminum. Alcoa, as important as its stance in the market is shall also be considered for analysis especially in consideration with its operations on branches outside the country.

Company Background

Noted to be one of the primary producers of primary aluminum, fabricated aluminum and other forms of aluminum-based products, ALICO or Alcoa is defined to be at its best stance during the year 2008. With yielding revenue of $26.9 billion, the company decreased when it comes to its profitability in the year 2009 only yielding $18.4 billion. This is considered to be a 32% drop from their previous revenue hence suggesting that there had been an adjustment in the industry that affected their performance during the said year. To note, the capability of the business to serve four primary markets was hoped to make a remarkable impact on the increase of its sales, however things changed and the operational stimulation on its China-branch for production has strongly affected such market competence.

The aluminum market is most often than not a growing aspect of development that the Northern Region of America strongly relies unto. Nonetheless, the increased production of aluminum in China is deemed to have a great effect on the release of such products in the international trade systems. The said arena of development affects the pricing of the aluminum as it is released in the market. The more the produced product is, the lesser the price will become. The larger amount of the supply is, the faster the demand would be filled up and the increase of surplus is expected to happen. The increase in the revenue of Alcoa in 2008 is deemed to have been affected by the 8.2 % drop of aluminum production in China [one of the primary source of processed alloys]. It is because of this that prices for alumni based products have dramatically increased while the demand for it remained at the ceiling. However, as 2009 comes in and the production stimulus has been applied in China, the prices began to drop because of over production.

In line with this, it is also expected that with the drop of prices, more businesses are sure to consider entering the said industry and engage in global trade involving aluminum and aluminum-based products. While aluminum products are expected to remain in the market as a regularly demanded form of material for building, transportation development and other aspects of social and industrial development, it could not be denied that such increase in production shall make it easier for the end-buyers to access the said material from numerous providers hence challenging the position of Alcoa in the market.

The Chinese over production is assumed by the Deutsch Bank to have an affecting 1.75 million metric ton of aluminum supply increase that would specifically decrease the profitability of the business that Alcoa runs due to the fact that more Brazilian and Indian companies that used to just think about running an Aluminum distribution business are now able to embrace the industry and join in the competition. Besides this, the expenses spent by Alcoa in consideration with its operational concerns is far higher than its Chinese counterparts who are expected to take over the course of industry in the coming years if Alcoa does not consider taking on certain company adjustments.

Analysis of Mission and Vision

Alcoa specifically defines its social role through holding integrity both within and outside the organization. Take note how this particular matter is responded to in the diagram herein. Observe how the company tries to evolve in response to the SMART Procedures it continuously applies in line with its operation. Notably, the organization tries to create a growth environment within and even outside the organization’s culture. The company basically aims to create a culture of advancement within its body of employees to enforce them to work further and perform better resulting to more satisfied clients and a society that is ready to accept what the company is ready to offer. As of now, what the company hopes to embrace is the mission to be one of the foundations of social and environmental sustainability that would give them an edge in making a responsible consideration of how they work for the community’s best values. So far, in line with the performance of the business in the face of international trade and how it chooses to operate in the industry, Alcoa is indeed holding up to this mission, creating business sectors that would support their desire of promoting a cleaner better environment through adjusting their own procedures of operation and assuring both the quality and the efficiency of the products they release in the market. This will be further shown in the financial performance analysis that shall expose how the company adjusted its procedures of operation just so to be able to find better ways to handle market pressures while retaining the company’s integrity in the market and towards its mission as well.

Analysis of Financial Performance

In the course of desiring to expand its business, Alcoa is currently considering the expansion towards the regions of Australia, Brazil, China, Iceland, Papua New Guinea, Russia and Saudi Arabia. From these expansions, Alcoa is aiming to create several points of production and other points of distribution. At the onset of the increase of production, Alcoa is hoping to have established ample number of branches that would distribute their incurred products hence controlling the increase of surplus that the company could count as primary losses. To note, there are three primary reasons that halted the increase of development and profitability of the company. These three factors include:

- Higher energy costs

- Decrease demand for aluminum

- High growth in other emerging industries

As a response to these particular points of hardships Alcoa tries to respond with an attempt to save the company from being completely overtaken by new comers in the industry through expanding its market of service. Notably, such response involves at least four primary sections of market expansion which includes:

- Primary metal and aluminum supply market [earns up to 26% of the company’s revenue]

This sector of the business is defined to be its primary operation for production and distribution. However, this does not mean that this sector receives most profitable considerations on the part of the business.

- Flat Rolled Products [earns up to 27% of the revenue]

Because of this sector of operation, Alcoa embraces at least having a share of 16% in the aluminum market as it releases products such as tin, aluminum sheet and foil. With the capability to yield up to $10 billion sales of the company’s yearly operations, this sector accounts for at least 10% of Alcoa’s total earnings.

- Engineered Solutions [earns up to 19% of the revenue]

This sector provides a remarkable reputation for Alcoa as it does provide a remarkable support for the raw materials needed to produce automobiles. However, with a 20% drop in the industry of the automobile production, Alcoa transfers its focus to aerospace production and industrial gas turbines development hence reassuming control of the industry.

- Extruded and End Products from Aluminum Basics [Accounts for 16% of the revenue]

To avoid waste, the extruded and end products are created from the extra materials left when producing the primary items for release in the product. Over a 50% of the waste materials are reused to impose on these extruded products hence lessening expenses on materials that are used for the production options.

Expanding their operations to these four market sectors extends their operational scope; however, this does not guarantee the company of a better sailing option of development in the international industry of aluminum distribution. The points from which the company picks up from a remarkable market fall in 2008 is expected to affect its performance towards 2011. At this point, ROI or the return of investments could be accounted for the realized performance of the company in 2010 released from the 2009 position that it has taken over.

Reportedly, Alcoa operations surfaced a net income of $258 million at the end of the fourth quarter ending the fiscal year. This marked the highest growth of the company compared to 2008 operations which was by far the highest earnings rated during the past four years of its engagement in the international trade. Hence the return of investments could be accounted for as follows:

Return on investment (%) = Net profit ($) / Investment ($) * 100 %

Hence: $258 billion /$115 million(100%)=$22,434 million (ROI)

True, the 14% increase of sales and revenues of 2010 operations compared to 2009 ensures that the coming years of business for the organization is to be extensively interesting especially when it comes to coming off from a year of supposed failure due to the external aspects that affect the condition of the company’s operation in the face of global competition and pressure. With the increase of the industry’s attention to sustainable forms of transportation and electric automobiles, it is expected that the company would benefit most from these adjustments in the field they are enjoined in.

Analysis of Marketing Strategy

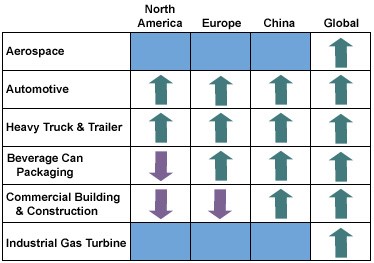

Observe from the graphical presentation herein that the marketing approach that Alcoa preferred to embrace is more dependent on its mission to expand and develop its market influence outside the country. In line with the financial performance of the organization in the past [2008, 2009] and all the different challenges that the business had to face, the company foresees the development of the organization towards 2011 and beyond through this particular chart:

Take a closer look on how the company intends to adjust its focus from local to global operations and from centralized market to a larger market to compensate for the possible increase of surplus that the Chinese production overflow might cause the business. From here on, it could be realized then how much preparation the business is aiming to embrace especially when it comes to boosting up their sales through improving their marketing approaches in the industry through empowered online visibility to both clients and investors from all over the globe. This face still coincides with their desire to complete the mission of imposing the culture of integrity that the organization is grounded upon.

Recommendations

Respectfully, it could indeed be recognized how the company is seriously embracing its possible options of expansion. Eyeing a more progressive and more developed process of business operation in the coming years, ALICO or Alcoa is extending its capabilities to handle a larger market through researching what the modern market needs and demands for a company like themselves. Fueling up the capability of the community to become sustainable is something that specifically involves strong indication of what Alcoa is prepared to do. In this regard , it is seen that a proper consideration on specifically accessing international connections in line with the supposed legal matters that they have to consider should be seen as an essential part of the expansion process. Although the company is already a well-known multinational company, it is still worthy of keeping themselves updated about the most considerable procedures of maintaining their balance and creating more conceivable working environments for themselves and for those whom they hope to give assistance or service to in the field of international trading industries.

Conclusion

Every business operation has its ups and downs. The lifecycle of a product could be accounted to have a great impact on the lifecycle of the business itself. In line with this, Alcoa has faced both of its best and worst nightmares suggesting that they have indeed come across probably one of the hardest points of their operation. Considering that there are several external factors that affected their fall in the year 2009, utilizing such aspect to their own advantage through expanding the effects of their operation in other countries have done them good, allowing them to recover in 2010. In the coming years [2011 and beyond] it is expected that external elements of business operation would again affect their operation especially in consideration with the increasing focus on automobile and transportation sustainability approaches along with the increase of attention given to sustainable buildings, it is expected that the market of aluminum products would increase again thus empowering the capability of Alcoa to operate in a much better position.

References:

Aaker, D. A., McLoughlin, D. (2010). Strategic Market Management – Global Perspectives. West Sussex: John Wiley & Sons Ltd.

ALICO: Alcoa. http://www.alcoa.com/global/en/home.asp. (Retrieved on December 11, 2012).

Brigham, Eugene and Johnson, Ramon (1998), Issues in Managerial Finance, Holt Rinehart and Winston Publishers, Hindale Illinois.

Chen, Henry editor, (1967), Frontiers of Managerial Finance, Gulf Publishing, Houston Texas.

Ehrhardt, M., Brigham, E. (2008). Corporate Finance: A Focused Approach (3rd ed.). p. 131.

Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010). Marketing Metrics: The Definitive Guide to Measuring Marketing Performance. Upper Saddle River, New Jersey: Pearson Education, Inc.

George J. Kress,Taryn Webb, and John Snyder. (1994). Forecasting and Market Analysis Techniques: A Practical Approach (Westport, CT: Quorum Books).

Gitman, Lawrence (2003), Principles of Managerial Finance, 10th edition, Addison-Wesley Publishing.

Kieso, D. E., Weygandt, J. J., & Warfield, T. D. (2007). Intermediate Accounting (12th ed.). Hoboken, NJ: John Wiley & Sons, p. 1320.

Weston, Fred and Brigham, Eugene (1998), Managerial Finance, Dryden Press, Hinsdale Illinois.

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee