How Useful Is the Audit of a Bank? Essay Example

“The auditor is a watchdog and not a bloodhound.” Lord Justice Topes (Searchquotes, 2012)

By definition, audit refers to an assessment made a person, company, enterprise or organization on records or financial accounts to verify and validate its accuracy (Millichamp, 2002). A financial audit is performed to give credibility to the financial statement of an organization. It provides an objective analysis of the company’s daily operation. In this case, two types of audit may be conducted in an organization. These include: (a) internal audit and (b) external audit. By mere comparison, an external audit is one that is conducted by an analyst or auditor to give credibility on the integrity of the corporate report submitted by the management. On the other hand, internal audit is an independent and objective declaration that is fashioned to add value and improvement to the company’s operation.

This paper is about the usefulness of audit in financial institution like banks. This paper presents the nature, scope and purpose of an audit. It also involves the discussion on the importance of audit to maintain the credibility and integrity of financial institution. At the same time, this paper also included the discussion of fraud and corruption stressing the importance of audit.

A financial audit is conducted to review the organization’s operation and its stability. This financial audit is used by investors to decide whether an organization of worthy of their investments. An audited financial statement would also reveal the presence of fraud and corruption, or the lack of it, to ensure that investments made to the organization are protected from such anomalous circumstances.

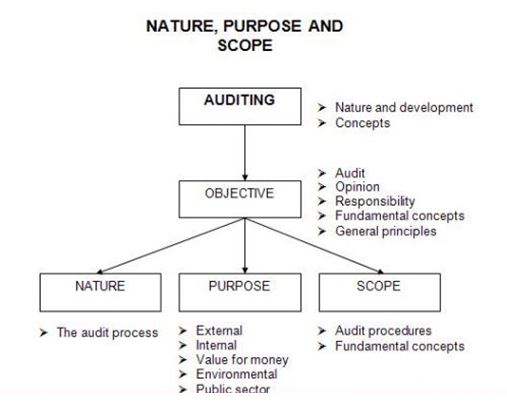

Perhaps the best way to understand the concept of conducting an audit is to know its nature, purpose and scope (Refer to Figure 1). Originally, the term audit comes from the Latin word audire meaning “to hear.” The term had been coined during the middle ages when auditors were called to literally hear the revenues and expenditures of an organization. By the turn of the century, around the year 1900, statutory audits became mandatory for some companies. During those times, audits played a significant role of detecting fraud, technical errors and errors concerning various principles.

Figure 1: The Nature, Purpose and Scope of Audit

(Source: Source: http://bilaras.hubpages.com/hub/nature-purpose-and-scope-of-audit-and-review)

However, over the years audit did not just serve the purpose of detecting fraud. At present, an audit is being conducted to serve the following purpose:

- To give confidence to the integrity of corporate report

- To add value to the organization’s operation to be utilized for its improvement.

- To conduct an analysis of the use of resources to ensure that it is maximized.

- To assess the degree by which organizations comply with environmental legislations.

On the other hand, the scope of audit depends on the standards set by the country from which the audit is being conducted. In addition, the scope of an auditing process would also depend on the fundamental concepts. The fundamental concept of audit requires the auditor to deliver a high level of assurance that frees the financial statement of any misstatement or wrongful declaration.

A financial audit is especially useful in financial institutions like banks. Internal audit is most especially important in banks to curve out corruption and detect fraud. Thus, it is important to discuss the need for an internal audit in this financial institution. By knowing how an internal audit is facilitated, the integrity of the financial statement can be preserved and trust for financial institutions can be restored and held with the stakeholders’ highest respect.

Internal audit programs are seen as the bank’s chief mechanism for evaluating controls and operations. This also performs the task of creating an avenue that would allow the board and management to testify with utmost accuracy the sufficiency of the bank’s adapted internal control system.

On the other hand, an external audit program would normally concentrate on financial reports along with the associated progression and concerns that might cause the lack of depth in materials. This event would jeopardize the bank’s financial statement.

Thus, audit programs may be composed of several separate audits that will present different information to the board regarding the bank’s financial condition as well as the usefulness of its internal control system. The most familiar types of audits carried out in banks include operational, financial, compliance and IT.

An audit judgment is unique to every individual auditor. Comparing the differences in audit judgment passed by auditors worldwide may present noteworthy challenges. It must therefore be address carefully to prevent any problems that may arise from the comparison. Throughout history, there had been significant changes in most accounting principles that greatly affect how a financial statement is evaluated and assessed (Wedemeyer, 2010, pp. 320-333). This has increased the need for disclosures.

However, the focus of auditor judgment and quality audit is directed at the engagement level, the regulatory amendments and the structure of auditing firms have also increased the influence that it bring into an auditor’s judgment. In addition, this has also affects the independence and skepticisms of auditors.

Banks are being manned and governed by professionals. This being the case, good governance is expected out of the people who depend on these institutions like investors, depositors and creditors. Good governance is defined as a noble exercise of economic, political and administrative power to manage the affairs of an organization in all levels of its operation. The practice of good governance embraces accountability, participatory act and transparency. However, the opposite of which, also known as bad governance would co-exist with corruption and fraud.

To understand the use of internal audit in banks, it is important to define fraud and corruption. This will give the readers the knowledge and a sense of need for employing and reviewing a bank’s financial audit report for their security. Fraud is defined as deliberate act of deception done to secure an unlawful gain. On the other hand, corruption is defined as a wrongful act on the part of those in authority by using means that are considered illegitimate, immoral or incompatible to moral and ethical standards. However people try to look at it, both acts would breach the integrity of the institution. This is the reason why it is important to conduct bank audits, because it will restore the integrity of the financial institutions given the rise cases relating to bank frauds and corruptions.

One example that would stress the usefulness of bank audits was the case of Bernard Ebbers of WorldCom. This former chairman of WorldCom was prosecuted and served a sentence of 25 years after being proven to orchestrate an $11 billion financial fraud (Puttick and Van Esch, 2003). Another case that proves the need for a bank audit was Enron case where chief operating officer, Jeffrey Skilling and chief financial officer Kenneth Lay, misrepresented their company’s financial status by manipulating the accounting information (Albrecht, et.al. 2004). These are not the only cases of fraud that exists in banks. In fact there were at least 13 different types of bank related frauds identified in a Zimbabwean bank alone (Njanike, Dube and Mashayanye, 2009). A few of those types of bank related frauds are as follow:

- A simple cheque fraud would involve the person committing the fraud to forge the name on a simple cheque using an ordinary pen or a more sophisticated technique (Singleton, et al., 2006).

- A discounting fraud would involve using a company to gain the trust of the bank to project a genuine and profitable image of a customer only to avail several privileges from this trick (Njanike, Dube and Mashayanye, 2009).

- Accounting fraud would involve hiding financial problems, by using an anomalous bookkeeping to declare false income, inflate the bank’s assets or state profit where there actually has a lost (Millichamp, 2002).

These are just among the common frauds that occur in banks. However, consideration must be given to financial statement fraud since this is probably the easiest prey among accountants and finance officers to manipulate. According to research (Skalah, Alois and Sellar, 2004), financial statement frauds has been the focus of public interest because of the misappropriation of assets. Again, it has been stressed in the said research that this is typically perpetuated by bank employees given their access to the data and information that could manipulate and control the financial statement.

These are also just among the reasons that would justify the usefulness of bank audits. Albrecht and Albrecht (2001) identified the role that auditors perform in bank audits. Among the roles of the auditors include:

- Prevent, detect and investigate concerns regarding fraud and financial abuse.

- Lead the committee that would address the claims of fraud within the system.

- Design programs that would prevent, detect and investigate fraud as it occurs.

- Endorse knowledge and awareness of fraud risk management within the bank.

In banks, an audit plays a role in protecting its assets. Auditors have the authority to identify any potential fraud. They are also given special authority to investigate cases where fraud had been found. An auditor is also given the task of suggesting effective measures that would deter the incidence of fraud especially in financial institutions.

Conducting an internal audit is not easy. For some banks, the nature of business operation alone with its size makes the task of auditing quite arduous. In addition, completing an audit may also be time-consuming. This is the reason why several banks had design a synergy and economies of scale to facilitate the process of auditing. This warrants the identification of functions more clearly defined. The internal audit must be fully independent and objective in practicing their professional proficiency.

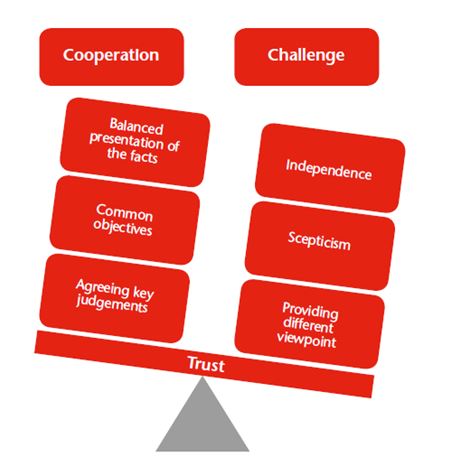

The auditor, audit committee and executive management may be described as the balance of cooperation and challenge. During the different stages of an audit the level of this balance will vary (Refer to Figure 2). As the balance is altered, it is imperative that trust is maintained, otherwise, challenges may be presented that would make confrontation more stressful for all the members of the management.

An effective audit program must be able to provide an objective, independent reviews and evaluation of bank activities, its internal controls and management information system. In addition, it must also help preserve and develop the efficiency of bank risk management processes. And lastly, it must be able to offer a rational assurance regarding accuracy and promptness in delivering financial reports.

Figure 2: Balancing Cooperation and Challenge

Source: ENHANCING THE DIALOGUE BETWEENBANK AUDITORS AND AUDIT COMMITTEES, 2012

An audit report must be able to convey the necessary information that the board needs to know about the bank in relation to its financial status. Specifically, an audit report should tell the board and the management whether the personnel and the bank’s operational activities are following the policies, procedures and protocols. The report must also contain any corrective steps and procedure that the bank may undertake. This must be communicated to the appropriate channels. The communication must contain findings as well as recommendations. However, it must be emphasized that the reports must be properly supported and sufficiently documented. To summarize, an audit report must contain the following:

- A brief summary of the main results and conclusions

- The scope and objectives of the audit

- A detailed result of the audit

- Sets of recommendations

Upon finalizing the audit, the audit team would present their findings and report to the management in a meeting. The report would contain factual information supported by unbiased evidences. This report should include the content as stated earlier. This would give the key stakeholders all the necessary information about the bank’s operation and its performance.

After the presentation, a confidential and a more extensive transcribed audit report will be completed. This would reiterate the findings already presented in the meeting. This report would now include the objective data which is designed to aid in undertaking the follow-up action and any subsequent audits that may be dimmed necessary.

The audit report must be presented to the board as soon as it is completed. However, in any event that the report may not be issued on time or according to the set schedule, the auditor must submit an explanation that would identify the reasons for the delay and state the time when the report will be completed.

The auditor must remember that the audit report serves a purpose. This is why the audit report must be delivered using the right protocol and maintaining its objectivity. Audit reports are used for the following purpose:

- A basis used for instigating corrective and preventive measures. Since an audit result provides objective evidences and unambiguous guidance pertaining to changes and improvements, it must be free from any form of manipulation or subjectivity.

- To serve as an avenue that will help in taking cost-effective financial undertakings associated to improvement. Since organizations continues to operate for the purpose of generating profit. It is the objective of banks that all finances and resources are being utilized in its maximum potentials.

- An audit is also used as a component in decision making to evaluate the supplier’s performance or status.

- An audit is also used to determine the acceptance of customer imposed requirement like that of opening an account, complying with a mortgage or taking a loan.

After considering all the information presented in this essay, it has been resolved that audits are highly useful in banks and other financial intuitions given the similar format. An audit secures the integrity of business transaction. At the same time, it also restores the confidence that the public have about banks. In addition, a bank audit also paves the way for investors, the consumers and the stakeholders to know the performance of a particular bank. This gives the investor the information and assurance that their money has been properly invested. For consumers, a financial audit provides transparency that the bank is stable enough to sustain and keep all their assets. While for stakeholders, it assures them that the employees are performing according to the protocols that has been created and set for the institution.

In conclusion, it may be summaries that, financial audit, both external and internal audits, prevents fraud and corruption. It ensures the accountability of the management and the financial department in liquidation and presenting the bank’s financial statement. As mentioned earlier, frauds come in different forms and the easiest form of fraud is manipulating the figures presented in the financial statement. An audit will ensure that all information presented in the financial statement are accurate and are supported with valid evidence.

The “expectation gap” is the gap among the auditors’ actual standard of performance as well as the various public expectations of auditors’ performance. Many associates of the public expect that the auditors should integrate prime responsibility for the financial statements, in addition to ‘certify’ financial statements. It is additionally expected to a ‘clean’ point of view guarantees the preciseness of financial statements simultaneously with auditors perform a 100% check in addition to auditors should give timely advance warning about the probability of business failure, as well as auditors are presumed to recognize fraud. Such collective anticipations of auditors, which move up from the actual standard of appearance by auditors, have influenced to the term ‘expectation gap’.

In accountancy, “going concern” belongs to a company’s capability to carry on operation as a business substance. It is the accountability of the managers to resolve if the going-concern hypothesis is suitable when getting ready the financial statements. A company is needed to divulge in the records to the Financial Statements if there are any causes that may provide the company’s situation as a going concern in suspicion. In spite of this, many audit layouts do not possess report of going-concern matters, with the consequence that the firm does not comprehend the needed information throughout the audit where the client is anguish troubles. The auditors should therefore, either transformation management’s primary analysis of the rightness of the going-concern supposition, or else contain conversations with management in request to recognize any relevant occurrences or conditions, which feature.

It is also required to provide a basic knowledge and tips to the auditor with respect to outstanding attentions when auditing ‘complex financial instruments’. The complex financial instruments may be used by financial as well as nonfinancial substances of all sizes for a variety of purposes. Some existences have substantial assets and transaction volumes while other entities may only participate in a hardly any compound financial instrument transactions. The applicable financial reporting framework may require the individual to evaluate complex financial tools at fair value or else make known fair value facts for financial instruments conveyed at amortised cost. The direction on valuation, especially related for complex financial instruments calculated otherwise made known at fair value, extend the criterions on areas another than valuation executes equally to complex financial instruments if calculated at fair value or amortized cost. This is relevant to both financial assets in addition to financial liabilities, as the auditing attentions for both are comprehensively the identical, other than that, calculation of credit risk for financial liabilities can be immoderately difficult. The difficulty of auditing complex financial instruments often deceives in the method in which perspective cash flows are decided. All financial instruments uphold the right otherwise responsibility to pay or receive future cash flows.

Thus, after considering all the information presented in this essay, it has been resolved that audits are highly useful in banks and other financial intuitions given the similar format. An audit secures the integrity of business transaction. At the same time, it also restores the confidence that the public have about banks. In addition, a bank audit also paves the way for investors, the consumers and the stakeholders to know the performance of a particular bank. This gives the investor the information and assurance that their money has been properly invested. For consumers, a financial audit provides transparency that the bank is stable enough to sustain and keep all their assets. While for stakeholders, it assures them that the employees are performing according to the protocols that has been created and set for the institution.

An audit will ensure that all information presented in the financial statement are accurate and are supported with valid evidence. In addition, it was also discuss that an auditor must be independent and must make the report without any biases. This would ensure the integrity of the audit report. This means that no other person, department or sector may influence the auditor’s evaluation. The evaluation must be made according to the findings made during the review of the internal control system as well as the operation of the business as a whole. Only then can the audit report be free from any manipulation about by meddling with the data.

References

Albrecht, C. and Albrecht, U. (2004). Strategic Fraud Detection: A Technology-Based Model. Longman, New York.

Albrecht, C. and Albrecht, U. (2001). Can Auditors Detect Fraud: A review of the Research Evidence: Journal of Forensic Accounting. Volume 11 pp.1-12.

Audit. Searchquotes. [Online] Retrieved from http://www.searchquotes.com/search/Audit/. Accessed in, 21, March, 2012)

Dart, E. (2011) ‘UK Investors’ perceptions of auditor independence’. The British Accounting Review, 43 pp173 – 185

Gray, I. and Manson, S. (2011) The Audit Process: Principles, Practice and Cases. (5thed.) Andover: Cengage Learning.

ICAEW (2012). Enhancing the dialogue between bank auditors and audit committees. [Online]. Retrieved from < icaew.com/fsfinspiringconfidence>. Accessed in: 20, March 2012.

Millichamp, A. (2002). Auditing. 8th Ed. Cengage Learning EMEA: Johannesburg, RSA, pp.9-11.

Porter, B., Simon, J. and Hatherley, D. (2008) Principles of External Auditing. (3rded.) Chichester: Wiley.

Puttick, G. and Van Esch, S. (2003). The Principles and Practice of Auditing. 8th Edition. Juta and Company Ltd.

Sikka, P. (2009). ‘Financial Crisis and the Silence of the Auditors’. Accounting, Organizations and Society, 34 pp 868-873.

Singleton, J., Singleton, A. T. and Balogna, G. J. (2006). Fraud Auditing and Forensic Accounting. McGraw-Hill, London.

Skalah, S.L., Alois, M.A. and Sellar, G. (2005). Fraud: An Introduction. McGraw-Hill, London.

UK House of Commons Treasury Committee (2009) Banking Crisis: reforming corporate governance and pay in the City: [Online], London, Commons Publications. Retrieved from: <http://www.publications.parliament.uk/pa/cm200809/cmselect/cmtreasy/462/46204.htm#a5> [Accessed 16th Jan 2012]

Wedemeyer, P. (2010). A Discussion of Auditor Judgment as the Critical Component in Audit Quality – A Practitioner’s Perspective. International Journal of Disclosure and Governance. 7(4), Palgrave Macmillan. pp. 320-333

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee