Portfolio Management, Essay Example

Abstract

Portfolio management requires a specific set of tools, technique and best practices to build the appropriate framework for success. While the basic foundation lies within the core project management functions there are additional attributes that guide portfolio and program management. Project portfolio management centralizes the focus of the project management activities and creates a collective synergy to drive strategic goals and objectives of the larger entity while also managing macro level constraints. Project portfolio management manages a variety of multiple projects and programs within a formalized management framework aligned with the strategic goals and objectives of the corporation or business unit. The tools and techniques facilitate the decision making process in order to meet goals and objectives of the portfolio to meet the strategic vision of the business.

Project Portfolio Management

The first step in understanding the tools, techniques, methodologies and best practices for portfolio management is to understand what portfolio management encompasses and how the key attributes are similar and different from that of the framework regarding project management and program management. The portfolio is built through a group of programs that are driving business solutions and striving for improvement or growth within the company. Each area of the portfolio exhibits commonly aligned features such as investment of resources at a strategic level, alignment of business goals and objectives, alignment of leadership roles to portfolio objectives and a prioritization based on the hierarchy of needs. These components are built on the basis of the programs and projects underneath the portfolio as a whole. As a best practice for the tools, techniques and management methods there are certain areas that a portfolio management team focuses. These areas include project selection, decision support tools, prioritization methods, modeling tools for resource allocation and capacity management, accountability techniques and risk management. All of these areas follow their own maturity curve and incorporate a continuous improvement frame of mind for the portfolio manager and leadership.

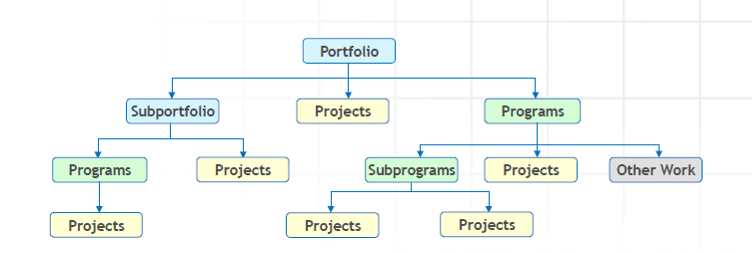

The programs do not necessarily need to be interrelated in their deliverables but are connected through the restraints on resources the company can provide to the program managers. Just as any other project the portfolio and programs are constrained by the three constraints of any project including scope, schedule and cost. The programs are built from highly corollary projects that are providing a set of dependent deliverables. These project build the programs that are ultimately managed by the business portfolio manager. There are specific skills and techniques that are applied in portfolio management that are in addition to the skills, tools and techniques applied at the program and project levels. As a visual the following diagram depicts a typical portfolio organization.

Project portfolio management is the process in which a collective of programs built with a group of related projects is managed by aligning the expected deliverables of the programs and projects with the strategic business objectives. This alignment requires identifying, coordinating, prioritizing and guiding the programs to align resources, schedules and scope of all efforts. There are five areas according to the “Standard for Portfolio Management-3rd Edition” that supports the framework of portfolio management. These areas include, Portfolio Strategic Management, Portfolio Governance Management, Portfolio Performance Management, Portfolio Communication Management and Portfolio Risk Management. These five knowledge areas provide the basis for Project Management Institute’s basic best practices and guidance for portfolio management. This framework outlining the portfolio management work is the basis for the best practice working environment for the portfolio managers. Each area has their distinct and beneficial focus.

Best Practices

Portfolio management is more involved than managing multiple projects and ensuring their successful completion. The art of portfolio management involves a mixture of doing the right things and doing them at the right time in the right. Being effective in portfolio management includes aligning the limited resources to the programs and projects that promote the accurate strategic intent of the business (Monk and Wagner 2009). A strong methodology in managing a portfolio is only half of the equation to run a successful business portfolio. The framework must be corroborated with set of best practices to ensure the tools, skills and techniques are optimized for success. Part of this best practice framework includes the standardization of work including prioritization, project/program selection and monitoring and controlling of the programs and projects. Each organization must also be able to remain flexible in their methodologies and be willing to incorporate change while still maintaining the rigors of their established processes. One established framework for portfolio management include approximately seven steps (PMI 2008). These steps are in a continuum and help keep the portfolio alive through the process. The steps include project identification/solicitation, managerial review/prioritization, alignment and acceptance, resource allocation, project/program execution, monitor/control, portfolio review/adjustment and back to the project identification phase. This cycle of portfolio management embeds areas that will provide a framework for reviews, feedback and ultimately the ability for lifecycle management of the programs and projects that provide the sustenance to the portfolio. The mix of artistic interpretation facilitated by quantitative control and information is where the portfolio framework meets best practices established by the organization to fully implement their limited resources.

Prior to reviewing the five knowledge areas established by the Project Management Institute it is important to know the significance of effective portfolio management and what the best practices coupled with an established framework can provide. As a general rule businesses are in operation to create wealth for themselves and their stakeholders. Businesses have core functions that provide specific goods or services that translate into a form of revenue. Focusing on building products faster or cheaper can provide direct impacts on revenue but improving internal processes and managing the limited resources such as funding and labor can also directly impact the bottom line to the corporation. Aligning resources to projects and programs that improve quality, decrease processing time, streamlines processes or eliminates waste in the product or service lifecycle is beneficial strategically to the company. The purpose of the portfolio manager is to align these resources in complimentary ways to align to the strategic goals of the company as well as not negate the benefits of the individual programs.

There are specific challenges that corporations face. There are competitive forces that have an invisible market push that could result in companies trying to find new and innovative ways to lower the amount of inputs it requires to provide their goods or services. The competitive forces can be obvious such as other companies providing the same good or service but it could also come in the form of talent acquisition, company risk management, collaboration strain or other external forces competing for time and resources. As the level increases from project to program to portfolio management the challenge to meet specific goals and objectives exponentially increases in terms of risk to the portfolio and risk to the goals and objectives of the corporation.

Effective portfolio management also includes managing the priorities of the business including the changing priorities. The risk to these priorities are compounded if there is a lack of coordination between management levels and is even further complicated if there is not an established process and framework. This framework provides a coordinated effort in measuring success and understanding the health of the portfolio as it is built by the programs and projects of its infrastructure. The importance of effective portfolio management includes completing those programs and projects on time, on budget and with the appropriate level of quality as outlined in the requirements. The framework of the portfolio management increases the visibility of the portfolio management standards and processes and provides the insight into the performance, costs, schedules and the programs and projects linkage to the strategic goals of the business. Providing this visibility into the management of the portfolio will allow the business and those running the programs and projects to better understand their roles and responsibilities within the corporation and how the decisions they make impact others within the portfolio.

With visibility comes the ability to influence and create accountability within the organization. While the portfolio manager is responsible for the overall success of the portfolio as well as the linkage to the strategic intent they are also inherently responsible for maintaining the command and control of the programs and projects aligned under the portfolio. This is established through a best practice of governance of the portfolio (PMI 2006). The governance of portfolio management establishes a framework for alignment, communication, accountability and awareness. The governance is more than a set of rules and regulations but a cultural initiative that promotes working through the projects/programs through the framework and best practices to facilitate positive results within the portfolio. The first areas includes raising issues and concerns within the governance channels to ensure the appropriate level of attention is paid to the subset programs within the portfolio. There must be a way for the program managers to raise and escalate issues through their leadership chains as well as through the hierarchy of their stakeholders to ensure that all of the appropriate levels of management are informed and aware of the health and issues of the programs. This escalation process should be easy to use and not have the stigma or negative repercussions if used appropriately. Raising issues early can help stem the negative repercussions before they are no longer manageable and lead to a signification loss or realignment of projects. Raising issues early allows the leadership and stakeholders to take appropriate actions at the project and programs levels as to negate the ramifications to the portfolio. Since the portfolio’s goals and objectives are tied directly to the strategic intent of the business issues that are not appropriate handled and risks that are not mitigated in a timely fashion could have devastating impacts to the business.

Raising issues and brining visibility into the problems facing the programs and projects leads into the next area of governance that supports the best practices of portfolio management. This area is accountability. Accountability is more than an action taken by individuals in a corporation. Accountability is a cultural initiative that is led by leadership and established as a core value within the company. As a portfolio manager or a member of the programs and projects that make up the composition of the portfolio, accountability to the project and program teams as well as the stakeholders provide another level of security and successful business traits to the business. Accountability within the realm of project, program and portfolio management includes performing against a specific set of quantitative and qualitative objectives based on the success criteria established by the portfolio management and leadership (Prencipe, Davies and Hobday 2007). Without the ability to hold the people accountable for their actions there would be no way of enforcing the best practices or framework the portfolio and governance teams are establishing. Accountability also flows both ways. The members of the project and program teams are accountable for providing results measured by metrics that are aligned to the goals and objectives of the company but the portfolio management team is also accountable to lead and provide the guidance needed to the teams making up the portfolio. This is a practice that facilitates the successful nature of the framework and provides a method of ensure accountability throughout the organization.

With the instillation of issue escalation and awareness as well as implementing an accountability system that is both integrated horizontally and vertically through the corporation there is also the imperative need for communication. This communication is not just providing the avenues or vessels for communication but also ensuring the communication is effective and efficient in purpose and impact. This communications plan built by the portfolio management must promote and manage the appropriate communication methods and timing as tied to the performance objectives. The communication of how and what the portfolio is accomplishing ties directly to the visibility and clarity it needs to provide as a best practice to the organization. As the information on how well the portfolio’s health is filtered down to the other members of the organization they can adapt and understand how their roles and actions are impacting the business as a whole. In any corporation the actions taken by the individual contributors should impact the overall direction and success of the company. Providing communication to this type of insight allows for individual contributors to identify where they stand within the organization as well as work with their leadership teams to define goals and objectives that align with the intent of the business.

The portfolio management’s best practices align programs and projects with resources and corporate bandwidth in order to push the company toward the goals and objectives set forth by leadership. The portfolio manager must also think about how multiple departments work with each other as well as the interdependence amongst them impacts the resource allocation and alignment within the portfolio. This cross-functional business coordination demands a centralized command at the portfolio level and a decentralized execution at the program and project level. The goals and objectives are aligned and established at the portfolio level and this is also where the framework is established and enforced. The decentralized execution between business units is managed at the program and project level but is monitored and controlled at the portfolio level to maintain accountability (Miller 2009). The coordination is established through process governance establishing a portfolio charter and rules of engagement among the programs and projects underneath the portfolio. This establishes the code of conduct and operating procedures in a well-documented and process oriented guideline for the program and project managers to conduct business.

Knowledge Areas

The aforementioned best practices establish activities that facilitate the overall management and execution of the portfolio. There are also five knowledge areas that are a composite of portfolio management. These areas are broken down into strategy, governance, performance, communication and risk. These knowledge areas correlate directly with the best practices and tools that were discussed earlier. All of these areas focus the portfolio management team on doing the right things right. Portfolio management as defined by the PMI is “the centralized management of one or more portfolios, which includes identifying, prioritizing, authorizing, managing, and controlling projects, programs, and other related work, to achieve specific strategic business objectives”(PMI 2006). The knowledge areas provide the basic foundation to build the framework for the portfolio management tool kit. There are also key capabilities that the portfolio managers must incorporate in order to manage the constraints of the portfolio. This includes managing each level of the process including intake of projects to the pipeline, resource management, change management, financial management and risk management.

These areas contribute to the overall success of the project and have specific key business action drivers associated with them. The key business drivers that the portfolio manager must focus on include the areas that will manage and monitor the progress of the portfolio versus the needed and expected results of the strategic plan. There is a centralized approach to portfolio management that demands a specific set of skills, tools and management ability to execute. These areas of focus contribute to a best practice approach that will facilitate the framework for success. The primary objective of the portfolio manager is to align the programs and projects with the strategy of the company. This is done by understanding the programs and projects that will make up the composition and landscape of the portfolio. The prioritization of projects and programs requires the decision support tools and prioritization methods outlined within the business to enable the planning, monitoring and controlling of the portfolio to ensure on-time performance and delivery criteria are met. These decision support tools can range from in-house matrixes built on the criteria of the business to pre-packaged software applications that can help facilitate the decision making process by turning business generated data into useful information to facilitate the business decision making process.

Increasing the amount of useful and poignant communication becomes a best practice in any organization but also becomes an imperative column for holding the portfolio structure sound. Identifying issues, communicating their impact as well as extending the solution throughout the organization not only keep everyone informed of the health and progress of the portfolio but also facilitates the elimination of boundaries and self-imposed barriers between units and operations. This eliminates the unnecessary need to firefight issues and provides the stage to implement proactive solutions to problems before they become drains on the already limited resources.

Planning and maintaining flexibility in the management of the portfolio requires a high degree of confidence and leadership skills in not only maintaining the proactive stance in operations but also maintaining the key linkage between the purpose of the portfolio and the strategy of the business. This flexibility and planning involves insight into resource allocation through the capability planning models as well as forecasting future needs of the business and successfully implementing resource allocation processes. Best practices are implemented enterprise-wide and this is driven from the top down. The portfolio manager has a unique stance in the company as not only a leader and guide to meet strategic intent but to also drive process and policy changes from a leadership perspective.

Summary

Project portfolio management tools, techniques and processes include best practices of aligning the project, programs and portfolio’s goals and objectives with that of the business’s strategic plan (PMI 2006). This alignment is the overall goal of the portfolio manager but is also accompanied by the skills and tools to derive the correct prioritization, manage capacity, ensure accountability and mitigate risk. The tools and processes used to measure and maintain the key performance indicators will drive the direction of the portfolio. The portfolio manager will align the key metrics with the intent of the business and drive the programs and projects of the portfolio to perform and align their goals and objectives to the business.

Project portfolio management is the centralized execution of the business intent by utilizing the resources of the programs and projects of the business in a synergistic fashion and building upon the framework in a continuous improvement governance model. The tools and techniques implemented by the portfolio manager must facilitate the framework and best practices of portfolio management and facilitate the decision making process and consequent actions to promote the goals and objectives necessary to meet the strategy of the company.

References

Badiru, A., (2012). Half-life learning curves in the defense acquisitions of life cycle. Defense ARJ. 19. 3. Retrieved from: http://www.dau.mil/pubscats/PubsCats/AR%20Journal/arj64/Badiru_ARJ63.pdf

Cooper, D. F., Grey, S., Raymond, G., & Walker, P. (2005). Project risk management guidelines, managing risk in large projects and complex procurements. John Wiley & Sons

Fleming, Q. W., & Koffleman, J. M. (2010). Earned value project management. Project Management Institute.

Highsmith, J. A., & Highsmith, J. (2010). Agile project management, creating innovative products. Addison-Wesley Professional.

Magal, S. R., & Word, J. (2011). Integrated business processes with erp systems. RRD/Jefferson City: Wiley.

Kaufmann, A., & Desbazielle, G. (1969). Critical path method. New York, NY: Gordon and Breach Science Publishers.

Leach, L. P. (2005). Critical chain project management. Norwood, MA: Artech House, INC.

Miller, D. (2009). Building a project work breakdown structure: visualizing objectives, deliverables, activities, and schedules (esi international project management series). Boca Raton, Fl: Auerbach Publications.

Monk, E., & Wagner, B. (2009). Concepts in enterprise resource planning. (3 ed.). Boston, MA: Course Technology Cengage Learning.

Prencipe, A., Davies, A., & Hobday, M. (2007). The business of systems integration. Oxford University Press, USA.

Project Management Institute (PMI). (2008). A guide to the project management body of knowledge. (4th ed.). Newtown Square: Project Management Inst.

Project Management Institute (PMI). (2006). The standard for portfolio management. (5th Ed.) Newtown Square: Project Management Inst.

Stewart, R. (1995). Cost estimator’s reference manual. (2nd ed.). Wiley.

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee