All papers examples

All papers examples

Disciplines

- MLA

- APA

- Master's

- Undergraduate

- High School

- PhD

- Harvard

- Biology

- Art

- Drama

- Movies

- Theatre

- Painting

- Music

- Architecture

- Dance

- Design

- History

- American History

- Asian History

- Literature

- Antique Literature

- American Literature

- Asian Literature

- Classic English Literature

- World Literature

- Creative Writing

- English

- Linguistics

- Law

- Criminal Justice

- Legal Issues

- Ethics

- Philosophy

- Religion

- Theology

- Anthropology

- Archaeology

- Economics

- Tourism

- Political Science

- World Affairs

- Psychology

- Sociology

- African-American Studies

- East European Studies

- Latin-American Studies

- Native-American Studies

- West European Studies

- Family and Consumer Science

- Social Issues

- Women and Gender Studies

- Social Work

- Natural Sciences

- Anatomy

- Zoology

- Ecology

- Chemistry

- Pharmacology

- Earth science

- Geography

- Geology

- Astronomy

- Physics

- Agriculture

- Agricultural Studies

- Computer Science

- Internet

- IT Management

- Web Design

- Mathematics

- Business

- Accounting

- Finance

- Investments

- Logistics

- Trade

- Management

- Marketing

- Engineering and Technology

- Engineering

- Technology

- Aeronautics

- Aviation

- Medicine and Health

- Alternative Medicine

- Healthcare

- Nursing

- Nutrition

- Communications and Media

- Advertising

- Communication Strategies

- Journalism

- Public Relations

- Education

- Educational Theories

- Pedagogy

- Teacher's Career

- Statistics

- Chicago/Turabian

- Nature

- Company Analysis

- Sport

- Paintings

- E-commerce

- Holocaust

- Education Theories

- Fashion

- Shakespeare

- Canadian Studies

- Science

- Food Safety

- Relation of Global Warming and Extreme Weather Condition

Paper Types

- Movie Review

- Essay

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- GCSE Coursework

- Grant Proposal

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- Essay

- GCSE Coursework

- Grant Proposal

- Interview

- Lab Report

- Literature Review

- Marketing Plan

- Math Problem

- Movie Analysis

- Movie Review

- Multiple Choice Quiz

- Online Quiz

- Outline

- Personal Statement

- Poem

- Power Point Presentation

- Power Point Presentation With Speaker Notes

- Questionnaire

- Quiz

- Reaction Paper

- Research Paper

- Research Proposal

- Resume

- Speech

- Statistics problem

- SWOT analysis

- Term Paper

- Thesis Paper

- Accounting

- Advertising

- Aeronautics

- African-American Studies

- Agricultural Studies

- Agriculture

- Alternative Medicine

- American History

- American Literature

- Anatomy

- Anthropology

- Antique Literature

- APA

- Archaeology

- Architecture

- Art

- Asian History

- Asian Literature

- Astronomy

- Aviation

- Biology

- Business

- Canadian Studies

- Chemistry

- Chicago/Turabian

- Classic English Literature

- Communication Strategies

- Communications and Media

- Company Analysis

- Computer Science

- Creative Writing

- Criminal Justice

- Dance

- Design

- Drama

- E-commerce

- Earth science

- East European Studies

- Ecology

- Economics

- Education

- Education Theories

- Educational Theories

- Engineering

- Engineering and Technology

- English

- Ethics

- Family and Consumer Science

- Fashion

- Finance

- Food Safety

- Geography

- Geology

- Harvard

- Healthcare

- High School

- History

- Holocaust

- Internet

- Investments

- IT Management

- Journalism

- Latin-American Studies

- Law

- Legal Issues

- Linguistics

- Literature

- Logistics

- Management

- Marketing

- Master's

- Mathematics

- Medicine and Health

- MLA

- Movies

- Music

- Native-American Studies

- Natural Sciences

- Nature

- Nursing

- Nutrition

- Painting

- Paintings

- Pedagogy

- Pharmacology

- PhD

- Philosophy

- Physics

- Political Science

- Psychology

- Public Relations

- Relation of Global Warming and Extreme Weather Condition

- Religion

- Science

- Shakespeare

- Social Issues

- Social Work

- Sociology

- Sport

- Statistics

- Teacher's Career

- Technology

- Theatre

- Theology

- Tourism

- Trade

- Undergraduate

- Web Design

- West European Studies

- Women and Gender Studies

- World Affairs

- World Literature

- Zoology

Real Options, Case Study Example

Hire a Writer for Custom Case Study

Use 10% Off Discount: "custom10" in 1 Click 👇

You are free to use it as an inspiration or a source for your own work.

In every business, there is a need to make certain decisions before doing something. For instance, before a company decides on its production, it has to consider the fact that there are some materials that it may require to buy from an outside party and some that it is going to produce by itself. Sometimes these decisions are not easy to make and other aspects are required to be brought in so as to aid in the making of these decisions. This is where real options come in.

In the world of business, real option valuation by using a couple of models has been helpful in making some business decisions. ROV by itself is the right and not necessarily the obligation that a business requires in order to undergoes some business decisions. Real option can be applied in a situation where the management of a particular company wants to make an option of whether to abandon a part of the company production, expand some section of the company and many other things.

This paper is thus a case study of real option as applied in high tech manufacturing company. The main aim is to see how real options can be applied in high tech manufacturing when it company to making the decision of whether to buy or build some parts of a product. To make this argument more interesting I am going to base it on one of the high tech manufacturing company Micro-Tech, Inc.

To begin, I would to point out the fact that Micro-Tech, Inc. is one of the many billion dollar companies that are currently known for the manufacture of high tech products. Micro-Tech is known for its ability to make very complicated computer applications including very small hard disk drives that can fit in the hands of a child.

However, every good thing has its bad side and Micro-Tech not being left out has its shares of the bad side. The problem that has been in the core of the company production lies beneath the company’s art of creating this hard drive. Look at it this way the larger the capacity in which the company has to produce these hard drives; the larger the magnetic disc has to be. Don’t forget that this also effect of the speed in which it has to spin (Real Options, 2010).

In addition to that the company is facing some risks that include marketing risks. Micro-Tech in most cases has been faced with some of the questions like, will this hard drives sell? And if they will by what margin and price? This is however after they have finished developing the product. Before the company has started product development, it is faced with certain questions too. The company cannot make clear judgment on some of the in company decision like the rate at which they can produce the product faster enough to beat the industry competition (Cortazar et al, 1998). It is also faced with uncertainty of whether the technology is really going to work.

This problem however can be solved by the company acquiring another company that will help them with the first development of the product. At the moment there is a start-up corporation although not big but a small one that Micro-Tech can acquire to help them with the production of this product (Real Options, 2010). Good news is that the start-up is ready to be acquired at a very small fee.

The main question now lies with Micro-Tech, should they acquire this small firm and try to use it for the good of their company? As much as the start-up is known its products are partially developed. But look at this; if Micro-Tech acquires this firm then it has high chances of getting rid of its rivals in the industry. It also has the chance to alleviate the chances of its investors acquiring the start-up firm. The question of the firm’s worth may still remain and many investors may be comparing it to the firm’s asking price of $50 million (Dias M.A.G, 2000).

In addition to that, there are other questions too that have risen to the wake of this problem. What are the existing options that can help the firm alleviate some of the company’s marketing and development risks that it is facing? Do there exist any other advantages that this company will have if they consider going on with the acquisition of the start-up company?

It is however hard to find a real way out without seeking help somewhere else. Micro-Tech has to turn to any of the strategic real options. The finance department in the company where using the NPV analysis to find a solution to the company problem but they will have to merge this with a strategic real option. The main aim is find out if by acquiring start-up will be sufficient enough to help Micro-Tech not to fall into failure. A failure was consider coming from building the product itself as well as marketing it.

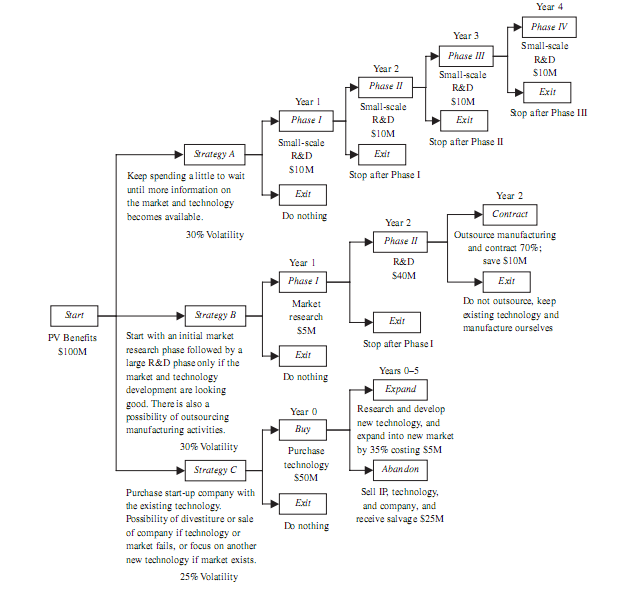

Through the process of finding this out, the finance department came up with a diagram that they though would enable them to solve the problem. The diagram is as shown below:

Figure 1: figure showing a strategy tree for High-Tech Manufacturing(Real Option, 2010)

In this diagram, three strategies are considered. The first strategy, strategy A is to keep spending a little to wait until more information on the market and technology becomes available. The second strategy or strategy B, is where the company starts with an initial market research phase. This is followed by a large research and development phase where only the market and technology development are looking good. In this strategy, there is also a possibility of the company to outsource some of its manufacturing activities.

As part of the three strategies, strategy C the purchase of start-up company and use it existing technology for their own benefits. Strategy A and B have 30% volatility while the third strategy has 25% volatility. However, as this is the case for the company, it still has to find out the worth of employing any of the strategies. Which strategy is going to give them the most income? To cater for this, the software ‘Multiple Super lattice Solver developed by Real Options Valuation, Inc. was used. All the three strategies were weighted but the use of this software in order to know which strategy was the best and the company could adopt.

Many factors were checked upon, some of them included dividends, shareholders’ equity as well as the company sales. By using the software it was found that some things cost the company a fortune. Strategy A value summed to an amount of $64.65M by using the software (source). since the Net Present Value for this strategy is $60M it is viable to say that the option value for this strategy is approximately $4.65M.

A lot of time would be spend in research and development which may cause the company a fortune since they will be incurring a lot of losses annually from their revenues. However, strategy B has NPV value of $55M with an optional value of $20.90M. The final strategy C was valued at $131.12 and when the company removed the $50 that would be used to purchase the start-up company the value remained at $81.12M (real option, 2010). Compared to the other two strategies being that after the purchase of this company no other charges were expected to befall the company.

All the strategies are good strategies, but the third strategy out weights the other two strategies. This means that it is better for Micro-Tech to buy start-up is instead of using the other two strategies. However, this should just be their initial plan since it would be advisable that the company make sure that there is a backup plan since by just buying the start-up company may not be enough. If at all things fail to work out them the company should be able to sell start-up.

In a nutshell, the analysis of real option helped Micro-Tech come up with a better decision of whether to buy or build all its products in house. By choosing to develop the technology all by itself the company could have incurred a lot of costs. In addition to that there is a possibility that the company was in the verge of making a lot of bad decision that could have cost them a fortune if real option valuation was not put into picture.

Works Cited

Cortazar, G & E.S. Schwartz. “Monte Carlo Evaluation Model of an Undeveloped Oil Field.” Journal of Energy Finance & Development (1998): 73-84.

Dias, M.A.G. Selection of Alternatives of Investment in Information for Oilfield Development Using Evolutionary Real Options Approach. working paper. PUC-Rio, 2000.

Real Options Valuation . 2010. 26 5 2011 <http://www.realoptionsvaluation.com/pdf/Case_Study_High-Tech_Manufacturing.pdf>.

Stuck with your Case Study?

Get in touch with one of our experts for instant help!

Tags:

Time is precious

don’t waste it!

writing help!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee