Four Seasons-Regent: Building a Global Presence in the Luxury Market, Article Review Example

Introduction

Four Seasons Hotels, Inc. is an international luxury, five-star hotel Management Company based in Canada. Go, Choi, and Chan analyze the internationalization strategy of Four Seasons for growth and expansion. The researchers analyze the firm’s position against a theoretical framework developed by Johansson and Yip. The analysis indicates that the firm is now situated according to a global strategy from a strategy that is essentially regional. This report reviews Go, Choi, and Chan’s research that chronicles the evolution of Four Seasons from a domestic hotel company to a global hotel operation and analyzes the strategy the firm used.

Background

The researchers chronicle Four Season’s corporate evolution from its establishment in 1961 to early 1990s. The firm was established in Toronto, Canada. It expanded to London in 1970, and entered the U.S. market in 1977 where it began competing with established chains such as Hilton, Hyatt, Marriot, and Westin. By late 1980s, the firm decided to expand outside North America.

The researchers also provided the background that paved the way for Four Seasons Hotels, Inc. to global expansion, particularly in expanding to Pacific Asia. Harunori Takashi’s E.I.E. International Corporation, owner of Regent International, collapsed in late 1991. Among other suitors, Four Seasons was the only prospective purchaser [of Regent International] with the resources and reputation to the sellers. In 1992, Four Seasons acquired all outstanding shares of Regent from Hotel Investment Corporation, a Japanese corporation that continues to hold ownership interest in Regent hotels. The merger of the two regional competitors results to a single competitor with a global presence.

Four Seasons-Regent’s Value Chain and Internationalization Strategy

The researchers used a theoretical framework that contains the notion of value chains which is utilized to a range of activities and the means of interaction of these activities to provide a source of competitive advantages. According to the researchers, “the structure of the Four Seasons-Regent arrangement follows the framework developed by Johny Johansson and George Yip that proposes a five-dimensional management strategy for global competition”. This five-dimensional management strategy consists of market participation, products and services, location of value-added activities, marketing, and competitive moves.

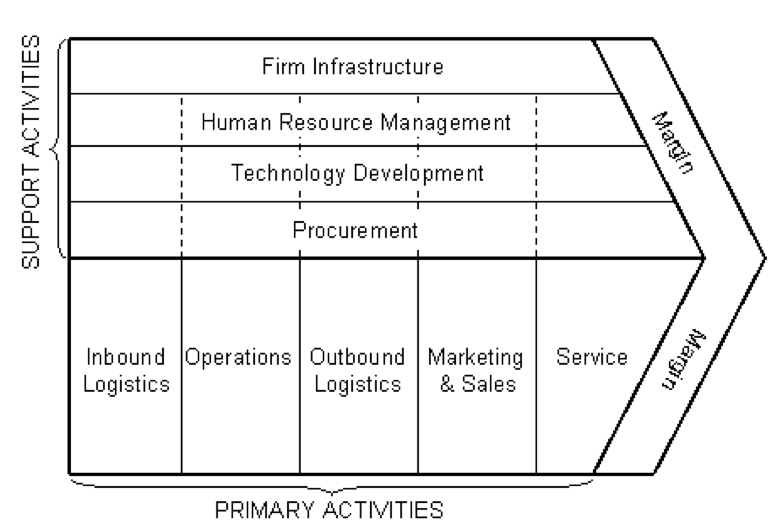

The research shows how the value chain of Four Seasons-Regent emphasizes the importance of focusing on activities on the areas of human resources. The notion of a value chain can be utilized to evaluate where companies can put in value and create future strategy (Richards, n.d.). The notion refers to a series of activities a firm practices to operate and compete in a given industry. Value refers to the total amount a buyer is willing to pay for a firm’s product. This total amount is also considered as a firm’s total revenue. The diagram below is a popular visual rendering of the concept of value chain:

Figure 1: Adapted from Porter’s (1985) Competitive Advantage

The notion of value chain is applied in assessing how hotel and travel industry add value and develop future strategy. For example, it is applied to assessing airline companies: Firm infrastructure consists of “financial policy, accounting regulatory compliance, legal aspects, and community affairs” (Porter, 1985). Human resource management consists of “flight, route, and yield analyst training, pilot training and safety training, baggage handling training, agent training, and in-flight training” (Porter, 1985). Technology development includes “computer reservation system, in-flight system, flight-scheduling system, and yield management system” (Porter, 1985). Technology developments also include “product development market research and baggage tracking system” (Porter, 1985). Procurement includes ICT. These are the secondary supports.

For primary supports, inbound logistics include “route selection, passenger service system, pricing, and fuel” (Porter, 1985). “Flight scheduling, crew scheduling, facilities planning, and aircraft acquisition” (Porter, 1985) are also inbound logistics. Operations include “ticket counter operations, gate operations, and aircraft operations” (Porter, 1985). “On-board service, baggage handling, and ticket offices” (Porter, 1985) are also under operations. Outbound logistics include “baggage system, flight connections, and rental car and hotel reservation systems” (Porter, 1985). Marketing and sales include “promotion, advertising, advantage program, travel agent program, and group sales” (Porter, 1985). Service includes “lost baggage service and complaint follow-up” (Porter, 1985).

Corporate-Level Internationalization Strategy

Global strategy is one of the three corporate-level internationalization strategy (The other are multi-domestic strategy and transnational strategy.) The focus of international corporate level internationalization strategy is the scope of a firm’s operations through both products and geographical identification. When pursuing a corporate level internationalization strategy, a firm decides which goods or services to sell to other countries. There are three corporate level internationalization strategies that firms can choose from to carry put business ventures in markets abroad. These internationalization strategies differ from one another in various ways. Each has comparative advantages and disadvantages. This is the reason why it is important for a firm to choose very well which of these strategies are appropriate for the firm and the business environment where the firm intends to operate.

Multi-domestic strategy

Multi-domestic strategy is characterized by strategy and operating decisions that are decentralized to strategic business units in each country (Hitt et al., 2011). This strategy is an extension of the business level internationalization strategy (Peng, 2006). The focus is competing within each market. This is a prominent strategy among European firms due to the rich diversity of cultures and market in Europe (Hitt et al., 2011).

The approach prescribed by multi-domestic strategy on strategic and operating decision rests on the central assumption that markets differ and hence are segmented by national boundaries. This means that it is important for focus on a geographic area, region, or nation. This is to determine the characteristics of a specific location that will be the basis of development (that is, tailor-fitting) of a firm’s products or services that will be sold to that location. For these reasons, the decision making processes among firms that adopt this strategy are highly decentralized to the strategic business units in each country. In an organizational environment, where decentralization is the approach used, a manager of a strategic business unit in a country have the autonomy to tailor-fit the products and services of the firm. This tailor-fitting accords to the features of the local market wherein these products and services will be sold.

An advantage of firms adopting this strategy is that these firms have the capacity to make their goods and services adapt to local markets well (Cavusgil et al., 2008). This is possible when there are manufacturing facilities provided by foreign subsidiaries. Another advantage of firms adopting a multi-domestic strategy is the minimal pressure over headquarters staff (Cavusgil et al., 2008). This is because managers are given the autonomy to make decisions on regarding management of their respective country operations. This is attributed to the decentralized approach of carrying out strategy and operating decision processes. Firms that adopt this strategy also have the advantage of delegating various tasks to each of the country managers in case the firm has limited international experience (Cavusgil et al., 2008).

A disadvantage of adopting a multi-national strategy is the possibility of duplicated activities and reduced economies of scale (Cavusgil et al., 2008). (This is attributed to the fact that firms that utilize this strategy have managers that develop a strategic vision, culture, and processes that are different from other managers.) This is due to the little incentive to share knowledge with managers operating in other countries. This can further result to the reduction of the possibility of creating knowledge-based competitive advantage. Because managers of the firm do not have a shared corporate vision, it is highly possible for competition to intensify among subsidiaries for the firm’s resources (Cavusgil et al., 2008). Such situation eventually leads to inefficiency to manufacture goods and services. Furthermore, the cost of international operations may rise at significant levels compared to other strategies.

A disadvantage of adopting a multi-domestic strategy is that firms may fail to realize the value from experience curve effects and location economies (Cavusgil et al., 2008). This is due to the strategy’s demand for setting up a complete set of value creation activities, such as production, marketing, and research and development, in each specific location these firms operate. As a result, there is a high cost on maintaining the organizational structure. Firms adopting such strategy also have the tendency to fail to leverage their core competencies within the firm (Cavusgil et al., 2008).

Transnational strategy

Transnational strategy has the objective of achieving global efficiency and local responsiveness (Hitt et al., 2011). In other words, this strategy aims to integrate multi-domestic and global strategy to address both pressures of cost reduction and local responsiveness. In order to achieve efficiency at a global scale, strong central control and coordination are needed. To achieve local responsiveness, decentralization is needed. Transnational strategy then becomes difficult to develop and to execute. Competitive advantage can be achieved through pursuing organizational learning (Hitt et al., 2011).

An advantage of transnational corporate level internationalization strategy is that its effective implementation means higher performance than multinational and global strategies. The disadvantage is, however, this strategy is difficult to implement due to the conflicting goals. These conflicting goals are the goals to attain the requirement to get close global coordination while maintaining local flexibility (Hitt et al., 2011). Implementing this strategy is difficult, and yet, the international business environment indicates that this is the most effective strategy.

Global strategy

Firms that adopt global strategy manufacture products that are standardized across national markets (Hitt et al., 2011). Decisions that involve business-level strategies are centralized in home offices. Unlike multi-domestic strategies, strategic business units are assumed to be interdependent. Moreover, the focus of this strategy is economies of scale. The global strategy is frequently short of receptiveness to local markets. This also necessitates distribution and coordination of resource across national or regional borders (Hitt et al., 2011).

An advantage of firms that adopt a global strategy is that standardizing products lead to efficiency (Cavusgil et al., 2008). This efficiency is on introducing a product around the globe faster. Coordinating prices are also efficiently done. In addition, overlapping facilities are eliminated (Cavusgil et al., 2008). These advantages are all attributed to the assumption behind global strategy that a global market exists. This means that firm adopting such strategy believes that the all the people around the world are willing to buy the same kind of product and live the same kind of lifestyle. This is why firms with global strategy standardize their products. Standardization process involves using common suppliers to design and manufacture goods and services (Cavusgil et al., 2008).

The disadvantage of global strategy is that local responsiveness is sacrificed. Adopting this strategy is reasonable if the pressures of cost reduction is overriding compared to the relatively minor pressures for local responsiveness (Peng, 2006). A situation that makes global strategy seems attractive is a situation where there is soaring demands for global integration and diminishing demands for local responsiveness.

Global strategy is the appropriate strategy for a luxury hotel like Four Seasons-Regent. The researchers provided information showing that Four Seasons Hotel, Inc. is right in choosing global strategy as its main strategy for expanding to international market. The researchers cite a study conducted by Four Seasons Hotels, Inc. once the acquisition of Regent was complete. The findings of this study reveal that Four Seasons’ image is strongest in North America and the United Kingdom, while Regent’s image is strongest in Asia and Australia. Compared to their perceived differences, the perceived similarities between Four Seasons and Regents were greater. The firm recognizes the importance of the strength of their brand names and capitalizes on them. In addition to this, the researchers highlight how the firm capitalizes on global potential branding. Global potential branding is an important marketing tool and a cornerstone of hotel chains’ strategies: “Brands are particularly important in establishing differentiation of hotel products. As hotel corporations attempt to capture global market share, they must create brand equity by capitalizing on established reputations and carrying over the positive image of brand names from country to country”. Other leading players in the travel and hospitality industry, such as Starwood Hotels and Resorts Worldwide, Inc., capitalize on global potential branding. This American hotel and Leisure Company acquired the Sheraton, the Four Points by Sheraton, and The Luxury Collection brands from ITT Sheraton in 1998. These brands have already established their reputation as hotels delivering quality services where they are located.

In relation to this, global strategy is the most cost-effective way of entry to expand in Pacific Asia than the other two strategies. At the time of the acquisition, Regents have already established itself as a brand in the locations Four Seasons Hotels, Inc. plan to expand. Note that one of the three principal underpinnings of Four Seasons is gradual expansion. However, this principle shifted when the opportunity arose to acquire Regents International.

Centralized purchasing, one of Four Seasons Hotels, Inc.’s management committee’s activity areas, is developed to ensure “standardized products, economies of scale, and control over quality and design. In return for a central-purchasing fee, the company provides all Four Seasons properties and some Regent properties with a central-purchasing system. A cost-constraint clause ensures that hotel owners are given the lowest possible procurement cost”.

The study the firm conducted also reveal that a multi-domestic strategy would waste resources the company would have used for researching about the target location’s market meant to inform the differentiation such strategy requires. The study reveals that regardless of the location of the hotel, executive travelers’ expectations of a luxury hotel do not vary.

Conclusion

The research was able to show through utilizing the theoretical framework used how Four Seasons Hotels, Inc. applied a global strategy in expanding outside North America. The research discusses how the firm manages its value chain in managing both brands. The researchers were also able to provide information explaining how global approach is utilized by the firm as its internationalization strategy for expanding outside North America. As this report discusses, there are three internationalization strategies firms can apply to expand: multi-domestic, global, and transnational. The research was able to show how the firm utilized a global strategy effectively in terms of efficiency and cost-effectiveness. The firm relied on the strength of the brands in their respective areas. The firm also used advertising to associate the brands to each other. In terms of expectations on luxury hotels, the study conducted by the firm reveals that regardless of location, expectations by the target market do not vary. However, acquiring Regents, an already established brand in Asia and Australia, made it easier [and thus, more efficient and cost-effective] for Four Seasons to make its entry to Asia than expanding to this new territory with a brand that is not well recognized in the area. The implication of the research is that it shows that players in the travel and hospitality industry offering luxury products and services can adopt global strategy, and that this strategy is the most of effective of the other available options. Expectations of the target market on luxury hotels do not vary regardless of the location. In expanding to foreign territory, firms may look into forging partnership or merging with firms that carry firmly established brands in their respective locations.

References

Cavusgil, S., Knight, G. & Reisenberger, J., 2008. International Business: Strategy, Management and the New Realities. 1st ed. Upper Sadle River, NJ: Pearson Education.

Hitt, M., Ireland, D. & Hoskisson, R., 2011. Strategic management: Competitiveness and globalization concepts. 9th ed. Canada: South-Western Cengage Learning.

Peng, M., 2006. Global Strategy. Cincinnati: South-Western Thomson.

Porter, M., 1985. Competitive Advantage. New York : The Free Press.

Richards, H., n.d. Porter’s value chain. [Online] Available at: http://www.ifm.eng.cam.ac.uk/dstools/paradigm/valuch.html [Accessed 29 April 2013].

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee