All papers examples

All papers examples

Disciplines

- MLA

- APA

- Master's

- Undergraduate

- High School

- PhD

- Harvard

- Biology

- Art

- Drama

- Movies

- Theatre

- Painting

- Music

- Architecture

- Dance

- Design

- History

- American History

- Asian History

- Literature

- Antique Literature

- American Literature

- Asian Literature

- Classic English Literature

- World Literature

- Creative Writing

- English

- Linguistics

- Law

- Criminal Justice

- Legal Issues

- Ethics

- Philosophy

- Religion

- Theology

- Anthropology

- Archaeology

- Economics

- Tourism

- Political Science

- World Affairs

- Psychology

- Sociology

- African-American Studies

- East European Studies

- Latin-American Studies

- Native-American Studies

- West European Studies

- Family and Consumer Science

- Social Issues

- Women and Gender Studies

- Social Work

- Natural Sciences

- Anatomy

- Zoology

- Ecology

- Chemistry

- Pharmacology

- Earth science

- Geography

- Geology

- Astronomy

- Physics

- Agriculture

- Agricultural Studies

- Computer Science

- Internet

- IT Management

- Web Design

- Mathematics

- Business

- Accounting

- Finance

- Investments

- Logistics

- Trade

- Management

- Marketing

- Engineering and Technology

- Engineering

- Technology

- Aeronautics

- Aviation

- Medicine and Health

- Alternative Medicine

- Healthcare

- Nursing

- Nutrition

- Communications and Media

- Advertising

- Communication Strategies

- Journalism

- Public Relations

- Education

- Educational Theories

- Pedagogy

- Teacher's Career

- Statistics

- Chicago/Turabian

- Nature

- Company Analysis

- Sport

- Paintings

- E-commerce

- Holocaust

- Education Theories

- Fashion

- Shakespeare

- Canadian Studies

- Science

- Food Safety

- Relation of Global Warming and Extreme Weather Condition

Paper Types

- Movie Review

- Essay

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- GCSE Coursework

- Grant Proposal

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- Essay

- GCSE Coursework

- Grant Proposal

- Interview

- Lab Report

- Literature Review

- Marketing Plan

- Math Problem

- Movie Analysis

- Movie Review

- Multiple Choice Quiz

- Online Quiz

- Outline

- Personal Statement

- Poem

- Power Point Presentation

- Power Point Presentation With Speaker Notes

- Questionnaire

- Quiz

- Reaction Paper

- Research Paper

- Research Proposal

- Resume

- Speech

- Statistics problem

- SWOT analysis

- Term Paper

- Thesis Paper

- Accounting

- Advertising

- Aeronautics

- African-American Studies

- Agricultural Studies

- Agriculture

- Alternative Medicine

- American History

- American Literature

- Anatomy

- Anthropology

- Antique Literature

- APA

- Archaeology

- Architecture

- Art

- Asian History

- Asian Literature

- Astronomy

- Aviation

- Biology

- Business

- Canadian Studies

- Chemistry

- Chicago/Turabian

- Classic English Literature

- Communication Strategies

- Communications and Media

- Company Analysis

- Computer Science

- Creative Writing

- Criminal Justice

- Dance

- Design

- Drama

- E-commerce

- Earth science

- East European Studies

- Ecology

- Economics

- Education

- Education Theories

- Educational Theories

- Engineering

- Engineering and Technology

- English

- Ethics

- Family and Consumer Science

- Fashion

- Finance

- Food Safety

- Geography

- Geology

- Harvard

- Healthcare

- High School

- History

- Holocaust

- Internet

- Investments

- IT Management

- Journalism

- Latin-American Studies

- Law

- Legal Issues

- Linguistics

- Literature

- Logistics

- Management

- Marketing

- Master's

- Mathematics

- Medicine and Health

- MLA

- Movies

- Music

- Native-American Studies

- Natural Sciences

- Nature

- Nursing

- Nutrition

- Painting

- Paintings

- Pedagogy

- Pharmacology

- PhD

- Philosophy

- Physics

- Political Science

- Psychology

- Public Relations

- Relation of Global Warming and Extreme Weather Condition

- Religion

- Science

- Shakespeare

- Social Issues

- Social Work

- Sociology

- Sport

- Statistics

- Teacher's Career

- Technology

- Theatre

- Theology

- Tourism

- Trade

- Undergraduate

- Web Design

- West European Studies

- Women and Gender Studies

- World Affairs

- World Literature

- Zoology

Managed Portfolio Project, Research Paper Example

Hire a Writer for Custom Research Paper

Use 10% Off Discount: "custom10" in 1 Click 👇

You are free to use it as an inspiration or a source for your own work.

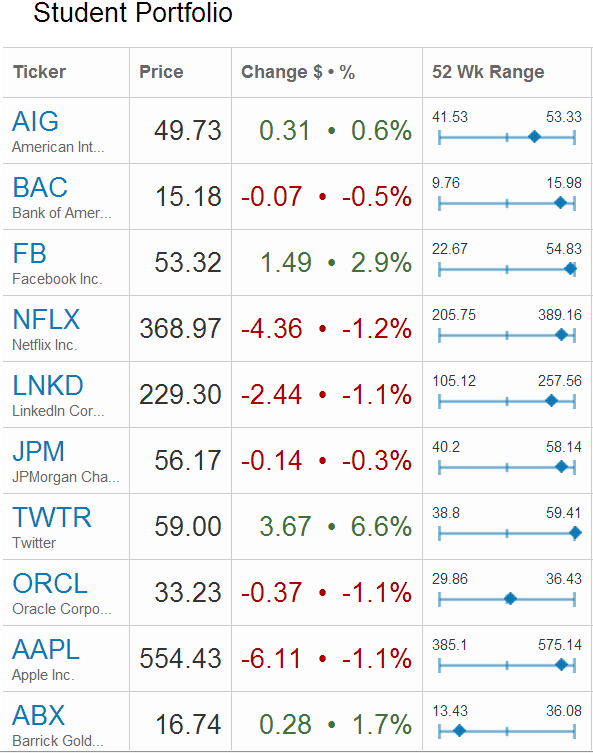

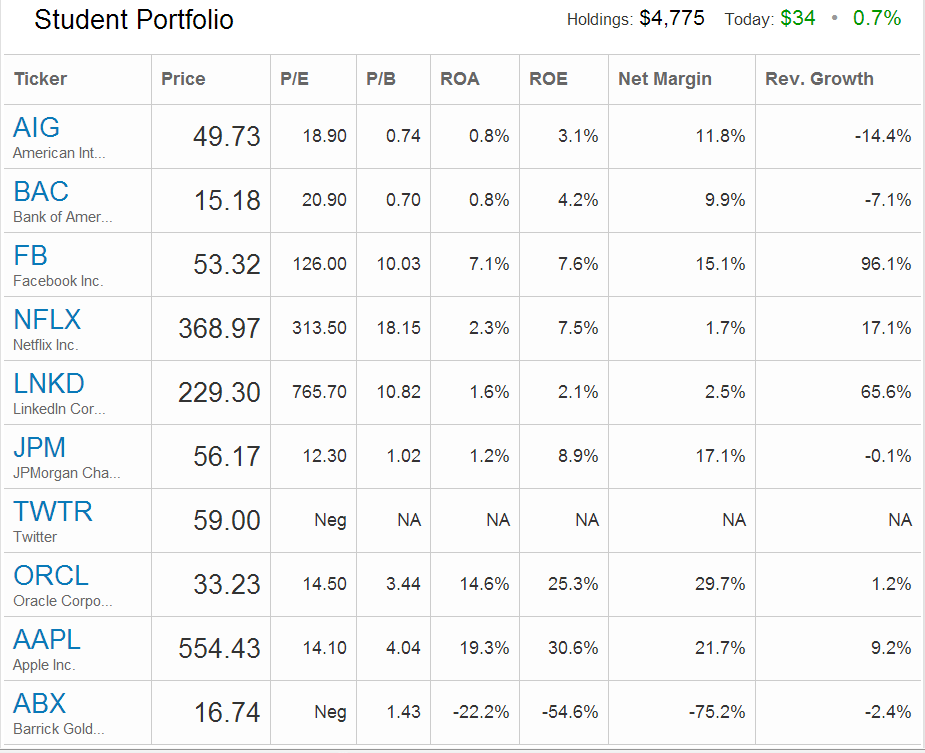

Investment Strategy & Stock Picks

All ten securities included in this investment portfolio were purchase on December 13th 2013 at the close of market for the current asking price. Out of a cash balance of $5,000, a total of $4,775 was invested with $225 left aside to cover miscellaneous fees. The ten securities chose for this student portfolio were American International Group (AIG), Bank of America (BAC), Facebook (FB), Netflix Inc. (NFLX), LinkedIn Corporation (LNKD), JPMorgan Chase & Co. (JPM), Twitter (TWTR), Oracle Corporation (ORCL), AAPL Inc (APPL), and Barrick Gold (ABX). These securities were selected for their diversity of industry and performance within their market share. The chart below breaks down how the money was allocated across the portfolio and what number shares per security were acquired with each respectinve investment. It also shows the price change for the day and the potential gain or loss for the day that was involved in the investment.

American International Group, Inc. (AIG)

American International Group, Inc. is an insurance provider covering products and services for U.S. and international consumers of commercial, institutional, and individual goods. The operate within two markets, specifically AIG Property Casualty, and AIG Life and Retirement.

An investment was made in AIG of $497.30 for the purchase of 10 shares at a pps of 49.73. At the time the stock showed a days gain of $3.10 due to a 0.6% rise. The company has a P/E of 18.90, a P/B of 0.74, an ROA of 0.8% and ROE of 3.1%, a net margin of 11.8% and revenue growth of negative 14.4%.

Bank of America (BAC)

Bank of America Corporation, delivers banking and financial products to individual consumers, small business as well as international investors, corporations, internationally and the U.S. government. According to Yahoo.Finance, “the company’s Consumer & Business Banking segment offers traditional and money market savings accounts, CDs and IRAs, checking accounts, and investment accounts and products, as well as credit and debit cards; and lending related products and services, working capital management, and treasury solutions (Yahoo.Finance, n.p.).” An investment was made in Bank of America (BAC) of $15.18 for the purchase of 30 shares at a pps of 455.40. At the time the stock showed a day loss of $3.10 due to a 0.6% rise. The company has a P/E of 20.90, a P/B of 0.70, an ROA of 0.8% and ROE of 4.2%, a net margin of 11.8% and revenue growth of negative 14.4%.

Facebook, Inc (FB)

Facebook, Inc. provides social networking services worldwide. The company has built numerous tools that allow users to connect to one another and share data through computers and mobile devices. Yahoo Finance notes, “the company’s Facebook Platform is a set of development tools and application programming interfaces that enables developers to integrate with Facebook for creating social apps and Websites. As of December 31, 2012, it had 1.06 billion monthly active users and 618 million daily active users (Yahoo Finance, n.p.).” An investment was made in Facebook (FB) of 533.20 for the purchase of 10 shares at a pps of 53.32. At the time the stock showed a days gain of $1.49 due to a 2.9% rise. The company has a P/E of 126.00, a P/B of 10.03, an ROA of 7.1% and ROE of 7.6%, a net margin of 15.1% and revenue growth of negative 96.1.%.

Netflix (NFLX)

Netflix, Inc. provides media network services, specifically in regards to television and film. It allows subscribers to stream television shows and movies directly to their digital devices. This company was chosen because it is a leader and innovator within its industry. An investment was made in Netflix (NFLX) of $497.30 for the purchase of 10 shares at a pps of 368.97. At the time the stock showed a days gain of $3.10 due to a 0.6% rise. The company has a P/E of 313.50, a P/B of 18.15, an ROA of 2.3% and ROE of 7.5%, a net margin of 1.7% and revenue growth of negative 17.1%.

LinkedIn Corporation (LNKD)

LinkedIn Corporation functions online as a professional social network through which users can share their professional identity. The platform is commonly used as a tool for user to build and share their professional knowledge within their fields and as a source to gain employment. LinkedIn has been credit for declining unemployment rates, and it’s a succession proof industry as unemployment rises it increases users and as the economy rises ad space has shown a trend towards being more effective on the site among industry groups and research organizations. An investment was made in LinkedIn (LNKD) of $458.60 for the purchase of 2 shares at a pps of 229.30. At the time the stock showed a days gain of $3.67 due to a 6.6% rise. The company has a P/E of 765.70, a P/B of 10.82, an ROA of 1.6% and ROE of 2.1%, a net margin of 2.5% and revenue growth of negative 65.6%.

JPMorgan & Chase (JPM)

JPMorgan Chase & Co., is a financial holding company that provides a wide range of financial services throughout the globe. Yahoo Finance notes that “its Consumer and Community Banking segment provides deposits, investment products and services, lending, and cash management and payment solutions to consumers and small businesses; mortgage origination and servicing; and residential mortgages and home equity loans (Yahoo Finance, n.p.).”An investment was made in JPMorgan Chase & Co. (JPM) of $280.85for the purchase of 5 shares at a pps of 56.17. At the time the stock showed a days loss of -0.14 due to a 0.3% drop. The company has a P/E of 12.30, a P/B of 1.02, an ROA of 1.2% and ROE of 8.9%, a net margin of 17.1% and revenue growth of negative 0.1%.

Twitter, Inc. (TWTR)

Twitter, Inc. is a global social network platform that allows people to feed updates or status comments in the form of 140 character messages. According to Yahoo Finance, it also provides a wide range of products to users such as the ability to “create, distribute, and discover content; Vine, a mobile application available on the iOS and Android operating systems that enable users to create and distribute short looping videos; and #Music, a mobile application that helps users discover new music and artists based on Tweets (Yahoo Finance, n.p.).” An investment was made in Twitter Inc. (TWTR) of $590.00 for the purchase of 10 shares at a pps of 59.00. Since Twitter is a newly public company which just launched its IPO earlier this year, it has yet to have adequate enough time on the market to produce enough performance metrics for ratio analysis.

Oracle Corporation (ORCL)

Yahoo Finance notes that, “Oracle Corporation develops, manufactures, markets, hosts, and supports database and middleware software, applications software, and hardware systems. This includes a various software and hardware for B2B contracts. The company’s profile notes that it also deals in “intelligence, identity and access management, data integration, Web experience management, portals, and content management and social network software, as well as development tools and Java, a software development platform; and applications software comprising human capital and talent management (Yahoo Finance, n.p.).” An investment was made in Oracle Corporation of $332.30 for the purchase of 10 shares at a pps of 33.23. At the time the stock showed a days loss of $0.37 due to a 1.1% rise. The company has a P/E of 14.50, a P/B of 3.44, an ROA of 14.6% and ROE of 25.3%, a net margin of 29.7% and revenue growth of negative 1.2%.

Apple Inc. (AAPL)

Apple Inc. and the subsidiaries it owns outright develop leading mobile communication, personal computers, portable digital music players and a wide range of cutting edge technology. The company is specifically most known for its Smartphone, and Mac computer line, but has established a position in it market where it’s producing, manufacture, and market mobile communication and media devices, personal computers, and portable digital music players worldwide. An investment was made in Apple Inc. (AAPL) of $554.43 for the purchase of 1 share at a pps of $554.43. At the time the stock showed a days loss of $6.11 accounting for a 1.1% drop. The company has a P/E of 18.90, a P/B of 0.74, an ROA of 0.8% and ROE of 3.1%, a net margin of 11.8% and revenue growth of negative 14.4%.

Barrick Gold Corporation (ABX)

Barrick Gold Corporation deals in Gold and Copper production and sale. It’s one of the top commodity mining companies in its industry. An investment was made in Barrick Gold Corporation (ABX) of $334.80 for the purchase of 20 shares at a pps of 16.74. At the time the stock showed a days gain of $5.60 accounting for a ticker rise of 0.28 or 1.7%. The company has a P/B of 1.43, an ROA of -22.2% and ROE of 54.6%, a net margin of 75.8% and revenue growth of negative -2.4%.

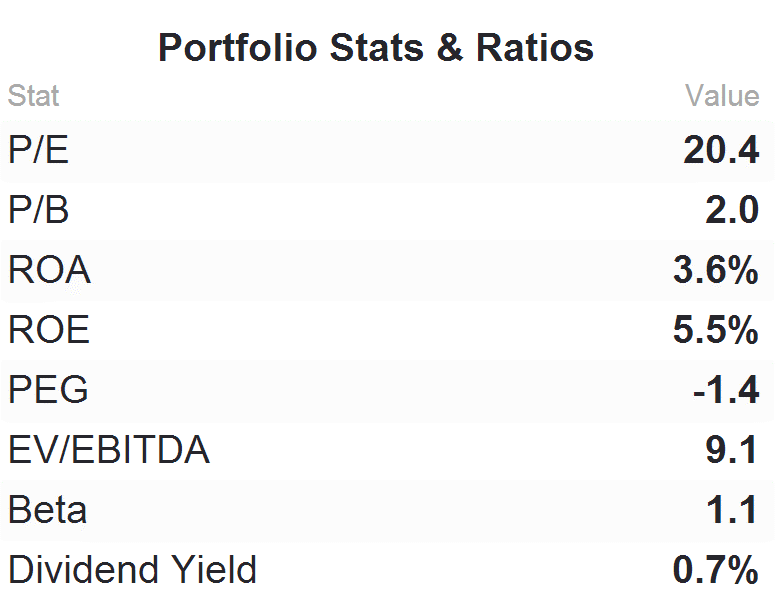

Portfolio Fundamental Analysis

The P/E, or Price Earnings ratio, assesses a company’s current share price in relation to its per share earnings. It’s calculated by dividing the market value per share by the earning per share (EPS). The above P/E ratio does not tell the entire story about the potential growth of this portfolio as investors usually compare P/E ratios of securities to one another, to identify which investments show the greatest potential growth. This P/e Ratio is healthy though, as Investopedia notes, “the average market P/E ratio is 20-25 times earnings” (Investopedia.com, n.p.). Companies that are losing money and in the negative in regards to revenue have no P/E ratio, so a P/E ratio in general is means the portfolio is profitable.

The P/B, or price to book ratio, is used to assess a portfolio or company’s stock market value in relation to its book value. This number is assessed by dividing the current closing pps by the book value reported in the latest quarterly report. Investors tend to view a company having a lower P/B ratio than its P/E ratio as the company being undervalued, but also potentially that the company has fundamental issues. Since this comparison is in relation to a portfolio of diverse top earners within their industry, it can be assumed the fundamentals are sound and the portfolio overall is undervalued with greater potential for continued profits.

The ROA, or return on assets, represents how profitable a company is in relation to its overall assets. It’s calculated by dividing a company’s net income by its total assets. Both debt and equity are classified as assets. It is debatable to whether or not a 3.6% ROA is a positive sign for this portfolio, since no one ratio can logically be used as a stand alone factor to identify whether or not a security or portfolio is a good investment, but it does demonstrate that the portfolio is profitable. The main problem is the ROA can fluctuate dramatically across securities depending on the asset class and the above diagram does not tell the entire story as to which securities are outperforming the others in terms of ROA and which ones are bringing the portfolio down. The portfolio fundamentals below demonstrate that Apple actually has an ROA that is outperforming the rest of the securities and Barrick Gold is underperforming. Considering that Barrick Gold is the top gold mining company in its industry, this could be a sign that the company is significantly undervalued, or that there might be something fundamentally wrong.

ROE, or return on equity, represents the amount of net income returned to the company in the form of a percentage. It’s calculated by dividing the net income by the shareholder equity. A very large ROE represents large growth. The chart below demonstrates that the ROE of Apple Inc. (30.6%) compared to the entire ROE of the portfolio (5.5%) is being significantly pulled down by either the rest of the portfolio or another security within the portfolio. At second glance of the chart below it is clear that Barracks (ABX) is the cause of this low ROE, as Barracks has an ROE of negative 54.6%. Again considering that Barracks is a gold mining company, which is a commodity, this could simply be a sign that the company is significantly undervalued, especially since it’s a market leader in it industry.

Conclusion

In conclusion, despite the fact that Apple Inc. is clearly the cash cow of the ten securities selected, the table below shows that Facebook (FB) has 96% revenue growth and LinkedIn (LNKD) has 65.5%. This demonstrates that they are trending upward much more aggressively than Apple or the lion share of the securities in the portfolio. This could be a sign that more funds need to be allocated to these securities, as they are much more affordably priced than Apple inc. Likewise, Barrack demonstrates that there could be a potential for increased ROA and revenue growth if it were removed or replaced, but its low performing technical indicators could also be a sign that it’s time to invest more heavily in gold. As years progress and the economy fluctuates, it is conceivable that when the economy dips, Barrack will rise in comparison while many of the other securities on this list may see down trends. The best recommendation based on the data revealed in the portfolio is to replace Barrack Gold from the selected securities. More funds should also be allocated to Apple Inc, Facebook, and LinkedIn as they show the most net revenue growth. Barrack Gold could be replaced with another tech company or since Barack was a commodity, Bitcoin would be a promising alternative to Gold as it is an aggressively growing commodity with a substantially developing market. In the appendix, more charts can be found relating to the data presented in this student stock portfolio analysis.

Work Cited

“Yahoo Finance – Business Finance, Stock Market, Quotes, News.” Yahoo Finance. N.p., n.d. Web. 12 Dec. 2013.

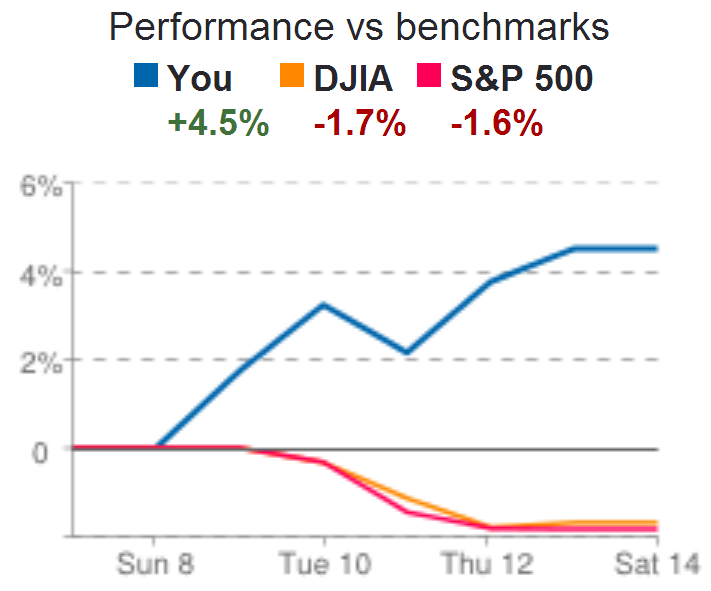

Appendix

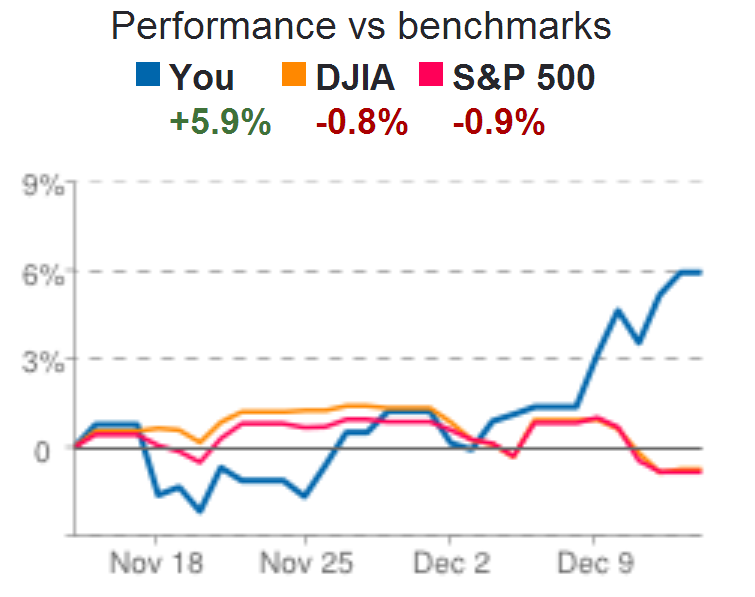

1 week Benchmark performance

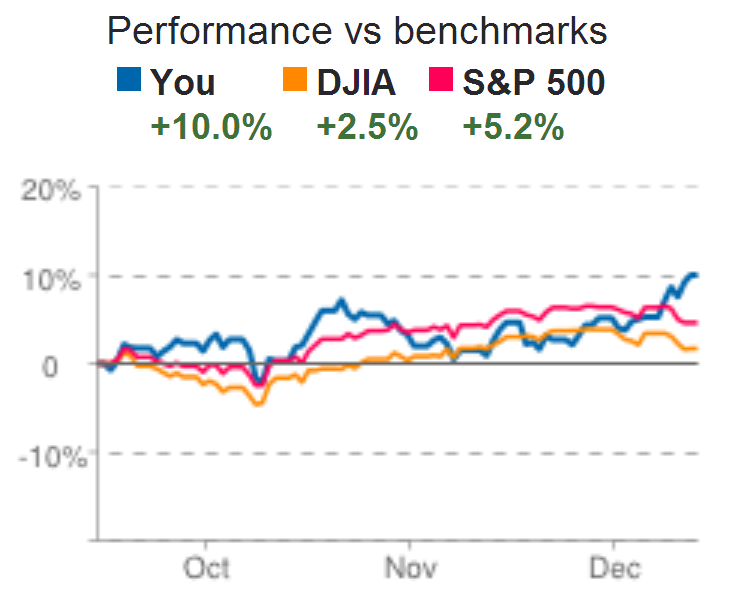

1 month

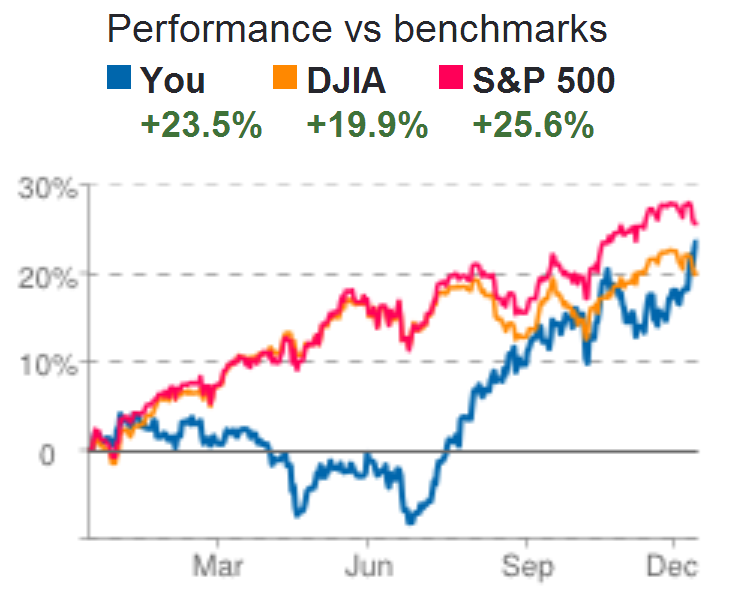

3 Months

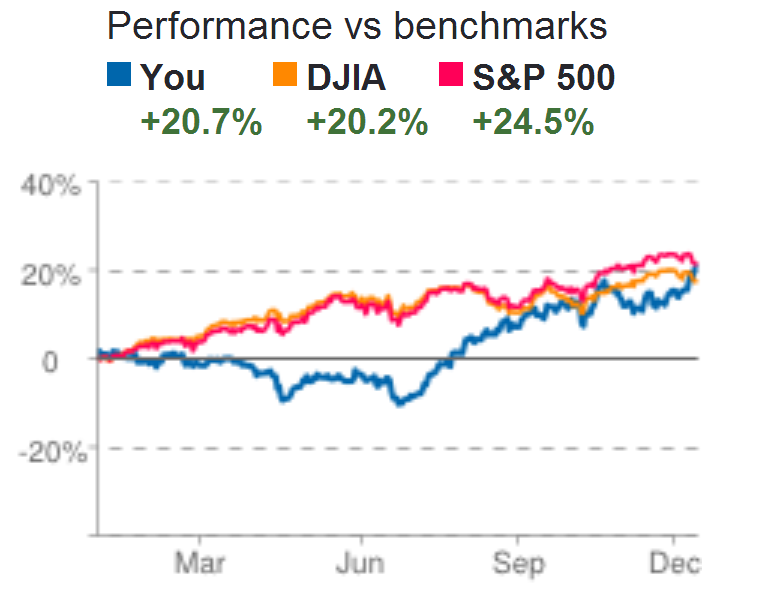

1 year

YTD

Stuck with your Research Paper?

Get in touch with one of our experts for instant help!

Time is precious

don’t waste it!

writing help!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee