Real Estate Consulting in Practice, Assessment Example

Executive Summary

The current pace of globalization had an outstanding impact on strategic thinking and strategic plan implementation in the corporate world. Mostly driven by the innovations in technology, competition has become more intense in many industries. To a bigger extent, this led to strategic initiatives that focus on more aggressive market expansion and on fast attaining economies of scale and substantial efficiencies. These factors have given primacy of implementation and provided strong impetus to acquisition as an investment option in many cases.

The Hardware Retailer is seeking an opportunity to expand in Canada. There are three ways that company identifies. All of them must be evaluated and clearly understood in order to make a correct decision. First one includes seeing if expanding in Canada is going to bring positive changes and profit at all. This means that the real estate consultant is going to explain why expending in Canada is worth it. Second option involves renting a premises to open up a new store in the location company chooses. This decision company believes is the best for their future growth and expansion. Third option includes buying existing store in Canada and starting business. In the following paper real estate consultant is going to explain why last third option is the best one and why it is going to bring most significant results.

Having analyzed the Hardware Retailer real estate consultant believes that since the Hardware is a strong player on its domestic market it will efficiently lay out and plan the store opening in Canada to improve sales and provide the customers with the best attention. The company’s team possesses strong financial and business experience in order to guarantee best investment choice and the success of the project. The anticipated growth rate for Hardware Retailer is steady with the potential to grow along with the enhancement in suburban downtown. According to financial forecasts Hardware Retailer will generate positive cash flow during first year of operations as well as acquire net profit of operations.

To back up the approach of purchasing existing real estate premises for the future store real estate consultant provides macroeconomic analysis that is supporting his/her choice and suits best for the client. According to economists’ forecasts regardless approaching rescission in the US, Canada will not be that much harmed. It will be influenced, but not to the degree that will lead the country into the recession itself. Predictions say that the effects will only be temporary and small. However real estate prices have currently dropped. Therefore, now is the best time to make a real estate store purchase that will be paid off within next five years and will lead to outstanding results. It is favorable that Hardware retailer takes advantage of on this good and timely opportunity.

There are several objectives of Hardware Retailer. In review real estate consultant will consider all aspects that will help the company make proper and efficient steps into expending its stores outside of US.

- To identify four most suitable cities for opening up a store in Canada by October 2009

- To select the best city with the highest purchasing rate by February 2009

- Identify alternatives of acquiring the premises in Canada by early 2010

- To select the most suitable (minimal cost, high demand) location in the city by March 2010

- Explore possible market growth and provide financial background by September 2009

Evaluation criteria for the decision making process will involve providing background information on the population of the cities selected, analyzing per capita income of the citizens in the area. Consultant will also provide essential real estate pricing in the selected locations since this factor is going to play one of the most important roles in future decision making. Another criterion of evolution involves whether or not the cities are close to the US border since this can minimize transportation costs. Important is also to understand if the site is far from boarder, Hardware Retailer has an option of engagement of the local suppliers at the reasonable costs. Real estate consultant will also back up his/her decision in accordance with the proper approach of evaluation and the methodology.

Hardware Retailer’s mission is to develop a hardware store in Canada. The store will provide good service and variety of hardware and home improvement products in the friendly environment. Hardware Retailer will supply residents, property managers, local businesses, contractors, and suburban customers. The company will appeal to customers because of its great service, friendly personnel, wide product variety and the ability to always professionally react to any needs of the customers.

Keeping in mind that the client wants to minimize the start up costs and obtain the best deal on the real estate in Canada, it is essential to provide Hardware Retailer with the relevant information that will guarantee best decision for the company. Currently Hardware Retailer sees the opportunity to rent the existing store and operate there. However consultant believes that the best suitable solution for opening up a store in Canada is by means of purchasing the existing store and developing it in accordance with the company’s policy and standards. Hardware Retailer has taken a decision to carefully evaluate the aspects necessary for a long-term and thorough process of entering another market that will lead it into business success. In order to make the decision the company has to have following items ready and on hand to achieve strong results.

- Industry must be healthy, rather resistant to economic changes, and provides the retailer ability to have influence over results of the stores.

- Store location must be easy for consumers to find with great infrastructure around.

- The market must be potential in order to provide Hardware Retailer with the profit.

- All participants (top management/personnel) must have strong business skills and be competitive and qualified.

- Hardware Retailer can have a partner or national hardware operator (if necessary).

Among their keys to success company identifies the following:

Industry: Despite of uncertain economic climate, Canadians still keep on spending their money at various retail stores. Nonetheless, they are conscious of the hard economic conditions in the country and use to buy only the most necessary products. Good service is the distinctive feature of local hardware stores. They are ranked hard because of the best checkout proposed to the clients. “Kitchen and bath retailer, Home Outfitters, will add five new Canadian locations bringing its national count to 67 stores. Canada’s housing market is emerging from its winter hibernation. Demand for landscaping products is expected to rise 6.1 per cent per year to $7.5 billion in 2013.” (Home Improvement Retailing) Canadians are cutting down their expenditures, even though there is no official statement of recession. After several years of untypical economic growth in real estate market, people are more kin on saving some of their assets. Situation in the stock market is that Canadians start to shift around their assets. People want to reduce some of the risks. Canadians try to avoid unstable stocks and choose flexible investments that might have a better chance to resist the recession. Real estate proves again to be a solid investment that brings money to homeowners. In its turn, government is also providing Canadians with the lowered interest rates in order to help people purchase property and afford existing mortgages and loan payments.

Location: The new stores will be located in Victoria, BC; Coquitlam, BC; Burlington, ON; and Vaughan Mills, ON. Places have nearby parking lots and are in downtown areas. Consultant will prepare the evaluation of the site and will provide the necessary information in order to make the right and best possible decision for Hardware Retailer expansion into the foreign market.

Products: Since locations are in downtown areas there will be a varied product mix. For instance, home furnishings and electronics, building supplies and gardening tools, pharmacies and personal care products, sporting and leisure, automotive and gasoline are among them.

Commercial Customers: Hardware Retailer Store will focus on establishing itself as the main hardware products source for business and customers in downtown. The company will also emphasize building contacts with the companies around.

Service: Service is one of the top elements of success in retail business. The store will be simple to get to and easy to identify/use once inside. Personnel skills will be beneficial in earning the public benevolence.

Company Summary

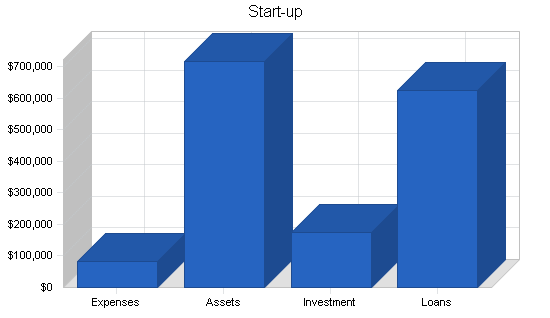

Start-up Expenses

he start-up costs of Hardware Retailer store will mostly include inventory, equipment and furniture. It is necessary to invest benefits, cash and labor. The company will acquire a loan to be paid back in seven years. Also some amount is reserved in budget for leasehold improvements.

According to the Canadian Real Estate Association, country is entering the 2nd year of a two-year decrease in sales activity. In 2008 sales were cut down by 17.1 % and are estimated to decline by additional 16.9 % in 2009, before moving back up in 2010. However, the association also adjusted its forecast in May. CREA informs that April’s sales went up by 11.9 % from the month before – the biggest month over month increase in the past five years. According to the sales forecasts of the association, they will be 14.7% lower than in 2008 and will increase by 7.2% in 2010.

Expenses table

Start up requirements

| Start-up Expenses | USD |

| The Tool Room Rental Training | 1,200 |

| Salaries for Fixture Set-up | 14,716 |

| Regular Merchandise Set-up | 32,000 |

| Paint and Tool Shop | 12,500 |

| Set-up Salaries | 22,916 |

| Other | 0 |

| Total Start-up Expenses | 83,332 |

| Start-up Assets | USD |

| Cash Required | 96,164 |

| Start-up Inventory | 344,000 |

| Other Current Assets | 30,400 |

| Long-term Assets | 246,104 |

| Total Assets | 716,668 |

| Total Requirements | 800,000 |

Market Research

Firm positive per capita income tendency in Canada, its economic stability and strong employment level in 2008 resulted in solid customer spending and retail sales. However, there is still remaining anxiety over the country’s economic performance since the slowing housing market converted into a slower growth rate at the retail level. Weaker economic tendency and the decline in customers’ expenditures occurred in electronics, garden centers, DIY, furniture and home improvement. These areas suffered since customers decreased their purchases of large and expensive items.

“Canadian retail sales in 2008 advanced at their slowest pace since 1996, in large part as a result of lower sales at new car dealers and an overall sales decline in the fourth quarter. (Statistics Canada) Retailers were estimated to sell $426.0 billion in goods and services in 2008, which was about 3.4% up from the previous year. That was much lower compared to 2006, when the growth rate of 5.8 % took place. In terms of the items sold, total retail sales increased by approximately 2.6%, which is considered to be the lowest growth rate since 2003. The reduction in retail sales volume was primarily caused by a 4.5% degrease in sales amounts at new car dealers. Overall, retails sales (new car dealers retails sales are not included) grew by 5.2 % in 2008, which is by 1.2 % lower that those in the previous year. Total number of the employees hired for the retail industry reached the point of 1.9 million in 2008 showing the similar slowdown of retail sales growth. For instance, the number of the employees grew by 3.2% in 2008, compared to 3.9% in 2007. “The retail industry accounted for 13.0% of total employment in 2008. Sales gains moderated in most provinces. Only retailers in Quebec and New Brunswick posted sales increases that were higher in 2008 than they were in 2007.” (Statistics Canada)

This study presents a statistical profile of the retail trade industry’s performance on a province-by-province basis for 2008 using data from the Monthly Retail Trade Survey. Foreign retailers, including US, see Canada as a good opportunity for growth despite the fact that Canadian retailing is a bit limited in terms of expansion and is highly developed. What was attractive to the US retailers during 2000-2008 was strong country economy and consumer spending as well as rather low Canadian dollar. For instance, when Bath & Body Works entered Canada, they did not find country economic slowdown to be the major challenge. Increase of store networks and arising competition is good for the customers because it weakens already existing retailers and influences overall growth.

It is not a secret that there is rising tendency of American investors to start up various types of business affairs outside of the United States due to market saturation inside the country. Moreover, even some foreign investors are willing to expand their offices and stores to developing counties, such as China, Korea, Japan, etc. (Toronto Real Estate)

International retailing is rapidly expanding with numerous retailers moving across borders and countries in their desire acquire more market share and take advantage of global economies of scale. Some companies make such decision in order not to be left behind in the race for top foreign space, market opportunities and partners, and of course since their main rivals are entering foreign markets. In 2008 alone many world’s top retailers have begun the international expansion path. For instance, Royal Ahold, Dutch supermarket chain, has acquired supermarkets in Poland, four competitor chains in Spain, two in Argentina and one more in America. Leading hypermarket of France that is represented in 20 markets opened stores in Columbia, Czech Republic, Chile and Indonesia. It is also possible that soon company will enter Japan. It became known recently that Zara has also announced its plans to enter the Canadian market. Over the past 3 years about 15 US retailers have appeared in Canada and the trend shows that the number will be increasing.

Among world’s top retailers by sales revenues are the following companies:

| Name | Sales

(USD billions) |

Market Cap

(USD billions) |

| Wal-Mart (U.S.) | 139.2 | 207.7 |

| Carrefour/Promodes (France) | 49.2 | 48.1 |

| Metro AG (Germany) | 49.0 | 17.2 |

| Sears Roebuck (U.S.) | 41.3 | 15.2 |

| KMart Corp. (U.S.) | 33.7 | 6.6 |

| Dayton-Hudson (U.S.) | 30.9 | 26.9 |

| J.C. Penney (U.S.) | 30.7 | 10.4 |

| Home Depot Inc. (U.S.) | 30.2 | 94.8 |

| Ito-Yokado (Japan) | 29.3 | 31.7 |

| Kroger (U.S.) | 28.2 | 20.1 |

Retailers in Canada showed a solid performance in 2008. In 2008, retailers sold an estimated $412.2 billion worth of services and goods, up 5.8% over 2007. Sales by home furnishings stores resulted into $6 billion (1.5% of total retail sales in Canada) and sales by home electronics and appliance stores increased by 10.5% to $12.3 billion. These numbers are strong indicators of healthy housing market.

Below is the chart of customer spending on hardware goods based on province where they live

| Geography

|

2008 (USD mil) | % change |

| Canada | 412.206 | 5.3 |

| Newfoundland and Labrador | 6.613 | 9.1 |

| Prince Edward Island | 1.603 | 8.2 |

| Nova Scotia | 11.641 | 3.3 |

| New Brunswick | 9.387 | 5.6 |

| Quebec | 90.451 | 3.8 |

| Ontario | 146.442 | 4.0 |

| Manitoba | 14.160 | 7.5 |

| Saskatchewan | 12.972 | 10.9 |

| Alberta | 61.105 | 8.1 |

| British Columbia | 56.370 | 6.1 |

| Yukon Territory | 500 | 9.6 |

| Northwest Territories | 682 | 12.7 |

| Nunavut | 280 | 7.7 |

Profit margins increased in all industry sectors in 2008. Canadian retailers reported a 3.9% increase in operating profits to $4.1 billion, according to Statistics Canada. Operating revenue went up 0.5% in Quarter3 2008. Among the provinces, retailers of Saskatchewan improved sales by 12.9% in 2008. Alberta became fourth in 2008 with a 9% growth. The record growth rate of 9.4% experienced by retailers in Manitoba and Newfoundland & Labrador was the result of solid economic growth. On the other hand Canada’s top three cities saw their sales increase less than the national average. Among cities are Toronto, Montreal and Vancouver, retail sales in Toronto (+5.4%), followed by Vancouver (+5.3%), with Montreal reporting a 3.2% sales growth. Below is the retail by sector table according to the North American Retail Hardware Association (North America Retail Hardware Association)

From the chart it is seen that the two selected regions by Hardware Retailer show good customer’s spending. It is obvious that Ontario region is ahead of British Columbia and thus guarantees to client stronger sales and profit. Among other reasons, strong purchasing power is a big plus that will influence the final decision of the client. If ranked from 1 to 13 regions, Ontario is taking first place on buyers’ abilities and British Columbia is on 4th .

| Retail Sales by Sector | 2008 (USD mil) | % change |

| Total all stores | 421.209 | 5.8 |

| Total home furnishings and electronics | 29.861 | 8.4 |

| Total building supplies and garden | 26.626 | 7.6 |

| Pharmacies and personal care stores | 28.358 | 8.8 |

| Total apparel | 23.840 | 5.2 |

| Total general merchandise | 48.624 | 4.5 |

| Total sporting, leisure and miscellaneous | 21.383 | 5.3 |

| Beer wine and liquor stores | 16.036 | 0 |

| Total food and convenience stores | 75.416 | 3.5 |

| Total automotive and gasoline | 142.065 | 6.4 |

Planning

In order to open up a store in Canada Hardware Retailer needs to see a clear picture of investment opportunities with accordance to the pricing of the property in the cities that company has identified. Here below are the charts that demonstrate the ups and downs of the property prices over the past 10 years.

| Year | Burlington, ON | Vaughan Mills, ON |

| 1999 | 640631 | 1940813 |

| 2000 | 650556 | 2001721 |

| 2001 | 714029 | 2109982 |

| 2002 | 756333 | 2315710 |

| 2003 | 812294 | 2420831 |

| 2004 | 885134 | 2603219 |

| 2005 | 954312 | 2697057 |

| 2006 | 959873 | 2708480 |

| 2007 | 1001924 | 2760450 |

| 2008 | 1015303 | 2847243 |

| 2009 | 946601 | 2691156 |

| Year | Coquitlam, BC | Victoria, BC |

| 1999 | 41020 | 112570 |

| 2000 | 42809 | 114920 |

| 2001 | 47711 | 134003 |

| 2002 | 50866 | 142652 |

| 2003 | 54317 | 154237 |

| 2004 | 58402 | 160158 |

| 2005 | 60815 | 165907 |

| 2006 | 62720 | 166518 |

| 2007 | 66540 | 172353 |

| 2008 | 70242 | 177478 |

| 2009 | 62611 | 167749 |

According to the data evaluated above Hardware Retailer can observe that the tendency of the pricing is moving upward. In year 2008 there was the top increase observed over the past 10 years. In year 2009 the property price has dropped by 5.8% compared to year 2008. Therefore, now is the good timing to make a deal of property purchase. Keeping in mind that client is looking forward to achieving break even as the earliest occasion, consultant is recommending the client to purchase the store located in Burlington, ON. Eventhough this option is not least costly, consultant had above provided evidence on purchasing power that the Ontario region has a much stronger purchasing rate then British Columbia.

Location of the sites also vividly shows that Burlington, ON is in good geographical location since it is close to the border to US. This factor will allow Hardware Retailer to organize smooth transportation infrastructure of goods and products to Canada may they select to do so. Burlington is also close to big city of Toronto and with the right low cost strategy Hardware Retailer has a chance to win over some of the clients.

It is essential that the real estate consultant provides information about the potential risks to the client. If organizations are attempting to manage the corporate real estate risk, then they need a framework to identify the sources of risk in a similar way to that developed for strategic business risk. There are three general categories of risk associated with corporate property: financial risk, property market risk and business risk.

Few companies can forecast their on-going workplace costs with any degree of confidence and consequently this exposes them to financial risks. Additionally, they do not know when they are likely to require more or less accommodation and therefore this adds another layer of financial risk as both the cost of entry and exit from space are unknown. The financial risks are both direct and indirect. They potentially influence both the short-run cash flow events and have long-run impact on total enterprise value. In this element of risk the focus relates to the impact of real estate on both the income statement and the balance sheet. Some examples of these risks include:

- the resulting impact on the income statement of a decision to use floating rate debt for capital investment programs if unanticipated inflation occurs;

- a lowering of the firm’s valuation multiple due to the presence of substantial real estate on the balance sheet;

- the impact on the firm’s financial ratios or credit rating due to a change in the accounting treatment of long-term leasehold obligations.

Related to the general financial risk is the property market risk to which Hardware Retailer is exposed. Firstly, as an owner-occupier both in terms of the rate of return and the volatility of those returns. As a tenant, they are also exposed to the property market both at the time of initially signing a deal, and at every review period. Some examples of the impact of property risk are:

- deteriorating location quality due to a shift in external generators such as transport nodes or neighborhood or a shift in the types of sub-market occupancies;

- divestiture of assets resulting in a charge against book value due to market value decline;

- tax obligations created by the sale of appreciated assets.

The last type of risk is that linked back to the business. Business risks for the Hardware Retailer include:

- deterioration of retail sales due to evolution of retail formats;

- legal and financial liability;

- lack of flexibility in the physical structure hampering business operations.

All three of these types of risks need to be reviewed in order to assess the overall risk profile of the assets.

Risk management is essential for the Hardware Retailer in order to guarantee the smooth entering of the foreign market. It is important to take care of the three steps: identify material sources of risk, monitor and measure it, and devise approaches to control and manage risks. It is a rather ongoing process that requires risk managers involved to work closely with real estate consultant on the daily basis. In order to deal with risks it is essential to take care of firm level risks, portfolio-level and product risks.

Property risks shown below refer to the real estate itself. They are separated into three categories related to investment style.

| Risk Item | What is it | How to Measure it | How to Manage it | |

| Real Estate Risks | Value-add and Opportunistic Risk | Related to construction, lease-up, cycle timing | Increase related to higher risk investment styles, similar to “venture capital” activities | Effective acquisition analysis, ongoing property construction management and improvement, style guidelines, etc. |

| Core Real Estate-Tenant Credit Risk | Credit risk including bond-like risk of credit tenants and higher risk of non-credit rated | Spread on investment grade and non-investment bond weighted to tenant work and lease duration | Efficient lease management | |

| Core Real Estate-Equity | Related to rent growth, expenses, down time, cap rate uncertainties and “event risk” related to ownership | Spread between real estate equity returns and corporate debt | Efficient property management and accurate acquisition and disposition analysis, effective market selection | |

| Capital Market Risks | Availability and Pricing of Capital | Risk to real estate cap rates from generalized “risk-pricing” environment | Cap rate spread over Treasuries compared with corporate debt and spreads over Treasuries | Timing and monitoring leverage decisions to take advantage of cycle low interest rates |

| Real Rate | Riskless rate varies over the business cycle and will affect real estate cap rates | Presented by coupon on TIPs | Monitoring and timing leverage decisions to take advantage of cycle low interest rates | |

| Inflation | Expected inflation, affects slope of the Treasury curve and indirectly affects real estate cap rates | Spread between Fed funds and 10-year Treasury | Monitoring | |

| Other Risks | Country Risk | Related to political and economic, currency stability, legal framework, property rights, corruption and transparency | Institutional investor rankings, world Bank, IMF and rating agency analyses | Risk modeling, strategic decisions, limits |

| Illiquidity | Related to the time delay, availability of buyers, transactions costs | Monitoring the flow of transactions on the property type and geographic basis | Asset-liability management, cash and liquidity management | |

| Ownership Structure Risk | Related to partners, property types, environmental problems, etc. | Proxies to measure these risks are not readily available | Limits, due diligence requirements | |

Hardware Retailer company is a privately-held corporation, where 100% owned by its founder and president.

Company is offering retail hardware among them electrical supplies, plumbing, tools and rental, hardware, housewares, paint, automotive, tools, lawn and garden, building supplies and rental. It will work to establish the proper product mix. Initial order will take into consideration the all the necessary aspects. In order to professionally manage the business company will pay close attention to the departments organization to ensure wide assortment and will take away the goods that are not being sold. It also will find more floor space and will increase overall profits. Company will closely listen and evaluate needs of customers in case if necessary.

Market Analysis Summary

There are several existing market segments: property managers, downtown businesses, downtown residents, contractors, commercial sales and suburban customers.

| Potential Customers (growth) | 2004 | 2005 | 2006 | 2007 | 2008 |

| Downtown Residents | 450,000 | 450,000 | 450,000 | 450,000 | 450,000 |

| Property Managers | 297,000 | 297,000 | 297,000 | 297,000 | 297,000 |

| Contractors | 255,000 | 255,000 | 255,000 | 255,000 | 255,000 |

| Downtown Businesses | 180,000 | 180,000 | 180,000 | 180,000 | 180,000 |

| Suburban Commuters | 110,000 | 110,000 | 110,000 | 110,000 | 110,000 |

| Commercial Sales | 38,930 | 38,930 | 38,930 | 38,930 | 38,930 |

| Total | 1,330,930 | 1,330,930 | 1,330,930 | 1,330,930 | 1,330,930 |

Competitors

In the competition with the local rivals, company must be ready that the market newcomer will receive strong retaliation from the local businesses as well as the multinational giants. By strategically responding and anticipating to the competitive threats, company will succeed. Among steps to neutralize the competitor can be acquiring the leading player. Here company can use approach similar to Wal-Mart acquiring Wertkauf. According to Wal-Mart direction board, acquisition of Werkauf was an important stage in gaining new clients on European market. “Wertkauf stores have 4,900 workers and annual sales of about 2.5 billion marks ($1.4 billion). They combine a large supermarket with a wide assortment of nonfood goods, similar to the approach used in 350 Wal-Mart superstores.” (The New York Times) Wertkauf’s stores like Wal-Mart used high-quality personnel and locations and were larger than the average German hypermarket.

In order to evaluate the steps and the company itself, it can be a good idea to observe such companies as J.C. Penney, Kmart and Sears in the US, and Carrefour and Metro outside of it. For instance, case with J.C. Penny shows that at the very beginning company had minimal global presence outside of the US. As for Sears, its non-US outlets (all in Canada) were accountable for 8 % of the company’s total 1997 sales revenues of $41 billion. Additionally international sales as a percentage of Sears’ total sales stayed more or less stable from 1995 to 1998.

Retailing is a local business and it highly depends on how good a retailer will cater to local culture and taste. It is important to compete against existing competitor, adapt to local real estate and regulatory issues as well as HR, distribution network and many other issues.

When identifying possible competitors, it is important to pay attention to Preston Hardware. “Preston Hardware excels at having the selection, the quality, the style, the design and the colors of the Swedish, Italian or Parisian bathroom vanity or whirlpool the hard-to-find-import buyer has her heart set on.” (Preston Hardware) Rona Inc., home improvement retailer, is another possible competitor. This corporation has already acquired Castorma-Dubois in Canada (2003) and Totem Building Supplies (2005). “In fashion, Groupe Jacob Inc. acquired the anne.x chain from La Senza Corp. in 2004 and Y.M. Inc. bought Suzy Shier in 2003 and Bluenotes in 2004. After deep restructuring plans, several other fashion retailers such as Boutiques San Francisco, Comark (Cardigan Holdings) and Saan (Gendis Inc.) sold totally or partially their holdings to private groups of investors.” (RONA) Canadian retailer Loblaw in 2006 has been awarded International Retailer of the Year. Teradata Corporation, the global leader in enterprise data warehousing, in 2008 announced that Giant Tiger, a family-owned retailer with 184 locations in Canada, has selected Teradata to provide an enterprise data warehouse (EDW) to assist Giant Tiger in executing their business intelligence strategy. (Teradata)

Strategy and Implementation Summary

Hardware Retailer company will build a reputation of great customer service. It will establish a relationship-oriented business with the goal to make consumer dependable on the stock items and have solutions to all their needs. Company will focus on proper and full market segmentation as well as ensure knowledge-intensive business. Marketing strategy will include national advertising during peak periods. Also company will organize various events to acquire most customers. Hardware Retailer will place information about the store in the Yellow Pages. Company will make sure it is reliable, progressive, knowledgeable, and convenient for its consumers.

SWOT Analysis

Strengths

- Strong relations with suppliers that provide credit planning, flexibility, and reply to particular product requirements.

- Outstanding and stable personnel, offering personalized customer service.

- Strong merchandising and product arrangement.

- High loyalty among repeated consumers.

Weaknesses

- Owner is still climbing the “retail experience curve.”

- Location is in traditional area.

- Challenges of the seasonality of the business.

Opportunities

- Rising market with a significant percentage of company’s target market

- Strategic alliances that provide sources for referrals and joint marketing activities.

- Changes in design trends will bring home renovations and will generate sales.

- Internet potential for selling products to other markets.

Threats

- Small decline in economy has influenced store sales.

- Expansion of national discount stores into the local market.

- Competition from a national store; or a store with greater financing or product resources could enter the market.

- Price pressure because of competition.

In its sales strategy company plans to offer a convenient solution that residents need through targeted advertising, direct mail, signage, and word of mouth. The direct sales force will consist of seasoned sales people. They will focus will be on property managers and downtown businesses to create an awareness of the store. Company’s immediate goal is to achieve strong sales in the first year.

Management Summary

Hardware Retailer company will be managed by the president on a day-to-day basis. The company will have three key employees who will be responsible for all of the financial affairs, inventory management, cash management, manage the cashier staff, advertising, marketing, etc. The personnel plan will include at least 2 managers, 1 cashier, and 2 specialists per store. Employee hiring will start in January, training will begin in February and work in March.

| 2008 USD | 2009 USD | 2010 USD | 2011 USD | 2012 USD | |

| President | 55,000 | 60,000 | 65,000 | 70,000 | 75,000 |

| General Manager | 40,000 | 45,000 | 50,000 | 55,000 | 55,000 |

| Asst. Gen. Manager | 35,000 | 40,000 | 45,000 | 45,000 | 45,000 |

| Cashiers | 27,876 | 28,852 | 29,861 | 30,907 | 31,988 |

| Specialists | 90,348 | 99,383 | 109,321 | 113,147 | 117,107 |

| Other | 0 | 0 | 0 | 0 | 0 |

| Total People | 17 | 20 | 20 | 21 | 21 |

| Total Payroll | 248,224 | 273,234 | 299,183 | 314,054 | 324,096 |

Financial Plan

| Sum (USD) | |

| Start-up Expenses to Fund | 83,332 |

| Start-up Assets to Fund | 716,668 |

| Total Funding Required | 800,000 |

| Assets | |

| Non-cash Assets from Start-up | 620,504 |

| Cash Requirements from Start-up | 96,164 |

| Additional Cash Raised | 0 |

| Cash Balance on Starting Date | 96,164 |

| Total Assets | 716,668 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | 0 |

| Long-term Liabilities | 625,000 |

| Accounts Payable (Outstanding Bills) | 0 |

| Other Current Liabilities (interest-free) | 0 |

| Total Liabilities | 625,000 |

| Capital | |

| Planned Investment | |

| President | 50,000 |

| Investor 1 (if necessary) | 75,000 |

| Investor 2 (if necessary) | 50,000 |

| Additional Investment Requirement | 0 |

| Total Planned Investment | 175,000 |

| Loss at Start-up (Start-up Expenses) | (83,332) |

| Total Capital | 91,668 |

| Total Capital and Liabilities | 716,668 |

| Total Funding | 800,000 |

Key Financial Indicators

Projected Sales: Projections are based on numbers calculated based on demographics and potential on the market. Sales will constantly boost as the store gains experience, in addition to the steady expansion anticipated in the home improvement category nationwide.

Gross Margins: Gross Margin can rise in years 2-5, however for this analysis; it was set constant at 42% on inventory sales. Generally, the rental and other income have driven the gross margin up by 2 points. Gross Margin on inventory is expected to increase as 44%.

Operating Expenses: This growth is mainly caused by an increase in salaries as the business gets established over the next five years. Operating expenses are expected to boost at a rate of 6-8% per year.

Inventory Turnover: Company will maintain just-in-time inventory levels. Inventory is projected to turn 4.3 times per year. The aim is to get inventory turns to exceed 5.0, through good purchasing decisions.

Break-even analysis determines approximate break-even sales. There will be a constant control in an attempt to minimize it. Sales are expected to be well in excess of this number for each month.

The company produces a net positive cash flow in its first year. It is assumed that accounts payable will be repaid in 45 days. Long-term debt is on a 7-year amortization. Dividends will be paid in December of each year. The assumption is that 50% of profits are paid out to shareholders and investors.

Cash Flow

| 2008 USD | 2009 USD | 2010 USD | 2011 USD | 2012 USD | |

| Cash Received | |||||

| Cash from Operations | |||||

| Cash Sales | 1,476,903 | 1,840,977 | 2,214,233 | 2,343,370 | 2,484,097 |

| Subtotal Cash from Operations | 1,476,903 | 1,840,977 | 2,214,233 | 2,343,370 | 2,484,097 |

| Additional Cash Received | |||||

| Non Operating (Other) Income | 0 | 0 | 0 | 0 | 0 |

| Sales Tax, VAT, HST/GST Received | 0 | 0 | 0 | 0 | 0 |

| New Current Borrowing | 0 | 0 | 0 | 0 | 0 |

| New Other Liabilities (interest-free) | 0 | 0 | 0 | 0 | 0 |

| New Long-term Liabilities | 0 | 0 | 0 | 0 | 0 |

| Sales of Other Current Assets | 0 | 0 | 0 | 0 | 0 |

| Sales of Long-term Assets | 0 | 0 | 0 | 0 | 0 |

| New Investment Received | 0 | 0 | 0 | 0 | 0 |

| Subtotal Cash Received | 1,476,903 | 1,840,977 | 2,214,233 | 2,343,370 | 2,484,097 |

| Expenditures | 2008 USD | 2009 USD | 2010 USD | 2011 USD | 2012 USD |

| Expenditures from Operations | |||||

| Cash Spending | 248,224 | 273,234 | 299,183 | 314,054 | 324,096 |

| Bill Payments | 998,841 | 1,425,983 | 1,708,161 | 1,769,180 | 1,857,604 |

| Subtotal Spent on Operations | 1,247,065 | 1,699,218 | 2,007,343 | 2,083,234 | 2,181,700 |

| Additional Cash Spent | |||||

| Non Operating (Other) Expense | 0 | 0 | 0 | 0 | 0 |

| Sales Tax, VAT, HST/GST Paid Out | 0 | 0 | 0 | 0 | 0 |

| Principal Repayment of Current Borrowing | 0 | 0 | 0 | 0 | 0 |

| Other Liabilities Principal Repayment | 0 | 0 | 0 | 0 | 0 |

| Long-term Liabilities Principal Repayment | 66,629 | 72,159 | 78,148 | 84,634 | 91,659 |

| Purchase Other Current Assets | 0 | 0 | 0 | 0 | 0 |

| Purchase Long-term Assets | 0 | 0 | 0 | 0 | 0 |

| Dividends | 21,311 | 61,442 | 104,935 | 118,596 | 137,125 |

| Subtotal Cash Spent | 1,335,005 | 1,832,818 | 2,190,426 | 2,286,464 | 2,410,483 |

| Net Cash Flow | 141,898 | 8,158 | 23,807 | 56,907 | 73,614 |

| Cash Balance | 238,062 | 246,22 | 270,027 | 326,934 | 400,548 |

Profit and Loss table

| 2008 USD | 2009 USD | 2010 USD | 2011 USD | 2012 USD | |

| Sales | 1,476,903 | 1,840,977 | 2,214,233 | 2,343,370 | 2,484,097 |

| Direct Cost of Sales | 818,091 | 1,019,293 | 1,223,152 | 1,284,310 | 1,348,525 |

| Other Costs of Goods | 0 | 0 | 0 | 0 | 0 |

| Total Cost of Sales | 818,091 | 1,019,293 | 1,223,152 | 1,284,310 | 1,348,525 |

| Gross Margin | 658,812 | 821,683 | 991,081 | 1,059,061 | 1,135,572 |

| Gross Margin % | 44.61% | 44.63% | 44.76% | 45.19% | 45.71% |

| Expenses | |||||

| Payroll | 248,224 | 273,234 | 299,183 | 314,054 | 324,096 |

| Account Name | 0 | 0 | 0 | 0 | 0 |

| Depreciation | 48,021 | 48,021 | 48,021 | 48,021 | 48,021 |

| Advertising Expense-Circulars | 15,136 | 18,867 | 22,693 | 24,016 | 25,458 |

| Advertising Expense-Newspapers | 3,397 | 4,234 | 5,093 | 5390 | 5,713 |

| Advertising Expense-Yellow Pages | 2,604 | 2,604 | 2,604 | 2,604 | 2,604 |

| Advertising Expense-National | 7,68 | 9,573 | 11,514 | 12,186 | 12,917 |

| Lease | 114,638 | 125,424 | 134,933 | 144,442 | 153,951 |

| Utilities | 9000 | 9250 | 9500 | 9750 | 10000 |

| Telephone | 4,431 | 5,523 | 6,643 | 7030 | 7,452 |

| Accounting and Legal | 6,384 | 7,661 | 9,193 | 11,032 | 13,238 |

| Store and Office Supplies | 14,769 | 18410 | 18,821 | 19,919 | 21,115 |

| Insurance | 10,032 | 10,338 | 10,648 | 10,967 | 11,296 |

| Delivery Vehicle Expense | 6000 | 6000 | 6000 | 6000 | 6000 |

| Payroll Taxes | 22,321 | 24,591 | 26,926 | 28,265 | 29,169 |

| Employee Benefits | 16,428 | 18,071 | 19,426 | 20,883 | £22,449 |

| State Property Tax Expense | 2500 | 2500 | 2500 | 2500 | 2500 |

| Travel | 2,871 | 3000 | 3200 | 3500 | 4000 |

| Other | 16,548 | 17,052 | 18600 | 20400 | 21600 |

| Total Operating Expenses | 550,984 | 604,353 | 655,497 | 690,957 | 721,579 |

| Profit Before Interest and Taxes | 107,828 | 217330 | 335,584 | 368,104 | 413,992 |

| EBITDA | 155,849 | 265,351 | 383,605 | 416,125 | 462,013 |

| Interest Expense | 47,148 | 41,783 | 35,771 | 29260 | 22,208 |

| Taxes Incurred | 18,204 | 52,664 | 89,944 | 101,653 | 117,535 |

| Other Income | |||||

| Interest Income | 0 | 0 | 0 | 0 | 0 |

| Other Income Account Name | 0 | 0 | 0 | 0 | 0 |

| Total Other Income | 0 | 0 | 0 | 0 | 0 |

| Other Expense | |||||

| Account Name | 0 | 0 | 0 | 0 | 0 |

| Other Expense Account Name | 0 | 0 | 0 | 0 | 0 |

| Total Other Expense | 0 | 0 | 0 | 0 | 0 |

| Net Other Income | 0 | 0 | 0 | 0 | 0 |

| Net Profit | 42,476 | 122,883 | 209,869 | 237,191 | 274,249 |

| Net Profit/Sales | 2.88% | 6.67% | 9.48% | 10.12% | 11.04% |

Balance sheet

| 2008 USD | 2009 USD | 2010 USD | 2011 USD | 2012 USD | |

| Assets | |||||

| Current Assets | |||||

| Cash | 238,062 | 246220 | 270,027 | 326,934 | 400,548 |

| Inventory | 334000 | 416,144 | 499,373 | 528,497 | 560,235 |

| Other Current Assets | 30400 | 30400 | 30400 | 30400 | 30400 |

| Total Current Assets | 602,462 | 692,765 | 799800 | 885,831 | 991,183 |

| Long-term Assets | |||||

| Long-term Assets | 246,104 | 246,104 | 246,104 | 246,104 | 246,104 |

| Accumulated Depreciation | 48,021 | 96,042 | 144,063 | 192,084 | 240,105 |

| Total Long-term Assets | 198,083 | 150,062 | 102,041 | 54020 | 5,999 |

| Total Assets | 800,545 | 842,827 | 901,841 | 939,851 | 997,182 |

| Liabilities and Capital | 2008 USD | 2009 USD | 2010 USD | 2011 USD | 2012 USD |

| Current Liabilities | |||||

| Accounts Payable | 129,341 | 182340 | 214,569 | 218,617 | 230,482 |

| Current Borrowing | 0 | 0 | 0 | 0 | 0 |

| Other Current Liabilities | 0 | 0 | 0 | 0 | 0 |

| Subtotal Current Liabilities | 129,341 | 182340 | 214,569 | 218,617 | 230,482 |

| Long-term Liabilities | 558,371 | 486,212 | 408,064 | 323430 | 231,771 |

| Total Liabilities | 687,712 | 668,552 | 622,633 | 542,047 | 462,253 |

| Paid-in Capital | 175000 | 175000 | 175000 | 175000 | 175000 |

| Retained Earnings | -104,643 | -123,609 | -105,66 | -14,387 | 85,679 |

| Earnings | 42,476 | 122,883 | 209,869 | 237,191 | 274,249 |

| Total Capital | 112,833 | 174,274 | 279,209 | 397,804 | 534,928 |

| Total Liabilities and Capital | 800,545 | 842,827 | 901,841 | 939,851 | 997,182 |

| Net Worth | 112,833 | 174,274 | 279,209 | 397,804 | 534,928 |

Works Cited

Home Improvement Retailing. 2009. Ace Net Income Up. Industry News. May 18, 2009. <http:/ /www.hirmagazine.com/home_improvement_news.html>.

North America Retail Hardware Association. 2009. National Hardware Show Remains Industry’s Annual Gathering. May 20, 2009. < http:/ /www.nrha.org/ >.

Preston Hardware. 2009. About Preston. May 19, 2009. <http:/ /www.prestonhardware.com/>.

RONA. 2009. RONA. May 20, 2009. <http:/ /www.rona.ca/>.

Statistics Canada. 2009. Cyclical Changes on Output and Employment. Recent Releases from Daily. May 18, 2009. <http:/ /www.statcan.gc.ca/start-debut-eng.html>.

Stores. Business. May 20, 2009. <http:/ /www.nytimes.com/1997/12/19/business/company-news-wal-mart-says-it-is-buying-germany-s-wertkauf-stores.html>.

Teradata. 2009. Get A Comprehensive View of Your Customers as You’ve Never Seen Before. May 19, 2009. <http:/ /www.teradata.com/t/>.

The New York Times. 1997. Company News; Wal-Mart Says it is Buying Geman Wertkauf Toronto Real Estate. 2009. Checking Toronto Real Estates Property. May 19, 2009. <http:/ /www.torontorealestatedirect.com/>.

Time is precious

don’t waste it!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee