All papers examples

All papers examples

Disciplines

- MLA

- APA

- Master's

- Undergraduate

- High School

- PhD

- Harvard

- Biology

- Art

- Drama

- Movies

- Theatre

- Painting

- Music

- Architecture

- Dance

- Design

- History

- American History

- Asian History

- Literature

- Antique Literature

- American Literature

- Asian Literature

- Classic English Literature

- World Literature

- Creative Writing

- English

- Linguistics

- Law

- Criminal Justice

- Legal Issues

- Ethics

- Philosophy

- Religion

- Theology

- Anthropology

- Archaeology

- Economics

- Tourism

- Political Science

- World Affairs

- Psychology

- Sociology

- African-American Studies

- East European Studies

- Latin-American Studies

- Native-American Studies

- West European Studies

- Family and Consumer Science

- Social Issues

- Women and Gender Studies

- Social Work

- Natural Sciences

- Anatomy

- Zoology

- Ecology

- Chemistry

- Pharmacology

- Earth science

- Geography

- Geology

- Astronomy

- Physics

- Agriculture

- Agricultural Studies

- Computer Science

- Internet

- IT Management

- Web Design

- Mathematics

- Business

- Accounting

- Finance

- Investments

- Logistics

- Trade

- Management

- Marketing

- Engineering and Technology

- Engineering

- Technology

- Aeronautics

- Aviation

- Medicine and Health

- Alternative Medicine

- Healthcare

- Nursing

- Nutrition

- Communications and Media

- Advertising

- Communication Strategies

- Journalism

- Public Relations

- Education

- Educational Theories

- Pedagogy

- Teacher's Career

- Statistics

- Chicago/Turabian

- Nature

- Company Analysis

- Sport

- Paintings

- E-commerce

- Holocaust

- Education Theories

- Fashion

- Shakespeare

- Canadian Studies

- Science

- Food Safety

- Relation of Global Warming and Extreme Weather Condition

Paper Types

- Movie Review

- Essay

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- GCSE Coursework

- Grant Proposal

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article

- Article Critique

- Article Review

- Article Writing

- Assessment

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Case Study

- Coursework

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- Essay

- GCSE Coursework

- Grant Proposal

- Interview

- Lab Report

- Literature Review

- Marketing Plan

- Math Problem

- Movie Analysis

- Movie Review

- Multiple Choice Quiz

- Online Quiz

- Outline

- Personal Statement

- Poem

- Power Point Presentation

- Power Point Presentation With Speaker Notes

- Questionnaire

- Quiz

- Reaction Paper

- Research Paper

- Research Proposal

- Resume

- Speech

- Statistics problem

- SWOT analysis

- Term Paper

- Thesis Paper

- Accounting

- Advertising

- Aeronautics

- African-American Studies

- Agricultural Studies

- Agriculture

- Alternative Medicine

- American History

- American Literature

- Anatomy

- Anthropology

- Antique Literature

- APA

- Archaeology

- Architecture

- Art

- Asian History

- Asian Literature

- Astronomy

- Aviation

- Biology

- Business

- Canadian Studies

- Chemistry

- Chicago/Turabian

- Classic English Literature

- Communication Strategies

- Communications and Media

- Company Analysis

- Computer Science

- Creative Writing

- Criminal Justice

- Dance

- Design

- Drama

- E-commerce

- Earth science

- East European Studies

- Ecology

- Economics

- Education

- Education Theories

- Educational Theories

- Engineering

- Engineering and Technology

- English

- Ethics

- Family and Consumer Science

- Fashion

- Finance

- Food Safety

- Geography

- Geology

- Harvard

- Healthcare

- High School

- History

- Holocaust

- Internet

- Investments

- IT Management

- Journalism

- Latin-American Studies

- Law

- Legal Issues

- Linguistics

- Literature

- Logistics

- Management

- Marketing

- Master's

- Mathematics

- Medicine and Health

- MLA

- Movies

- Music

- Native-American Studies

- Natural Sciences

- Nature

- Nursing

- Nutrition

- Painting

- Paintings

- Pedagogy

- Pharmacology

- PhD

- Philosophy

- Physics

- Political Science

- Psychology

- Public Relations

- Relation of Global Warming and Extreme Weather Condition

- Religion

- Science

- Shakespeare

- Social Issues

- Social Work

- Sociology

- Sport

- Statistics

- Teacher's Career

- Technology

- Theatre

- Theology

- Tourism

- Trade

- Undergraduate

- Web Design

- West European Studies

- Women and Gender Studies

- World Affairs

- World Literature

- Zoology

Tax Research Memo, Case Study Example

Hire a Writer for Custom Case Study

Use 10% Off Discount: "custom10" in 1 Click 👇

You are free to use it as an inspiration or a source for your own work.

Relevant Facts: Altidore Inc. operates a calendar-year-end business that suffers from dramatic seasonal variation in taxable income. For example, it often operates at a net loss for the first two quarters of the year and then operates profitably for the last two quarters and, for as long as anyone can remember, finishes the year with taxable income. The new tax director has been asked to help calculate the deferred tax assets at the end of the first quarter. After looking at the quarterly loss, he claims that since there is no net income, there are no deferred tax assets because the effective tax rate is zero. (Carrybacks and carryforwards are not allowed in this jurisdiction.) Is the tax director correct in his assessment of the effective tax rate for calculating the deferred tax assets?

Specific Issues: Is the tax director correct in his assessment of the effective tax rate for calculating the deferred tax assets?

Conclusions: The tax director is correct in that there should not be anything added to their tax assets for this quarter.

Support: For one, since this jurisdiction does not allow for carrybacks and carryforwards for tax purposes the deferrable tax asset is the only way to lower the tax income in the future quarter. However, one criterion for the addition of deferrable tax assets is that there must be reason to believe that the probability of the next quarter showing taxable income is over fifty percent. Yet, this company traditionally shows profits only in the third and fourth quarters each year. This decision is being made with regards to the first quarter which obviously is not immediately followed by either of the two quarters that are usually profitable for the company. Deferrable tax assets are to be used to lessen the company’s taxable income, but in this situation the taxable income is too far out from the present situation. This extended gap leads to more variability between the present quarter and the profitable ones. This creates more uncertainty about the profitability of the quarter and therefore deferrable tax assets are not applicable yet

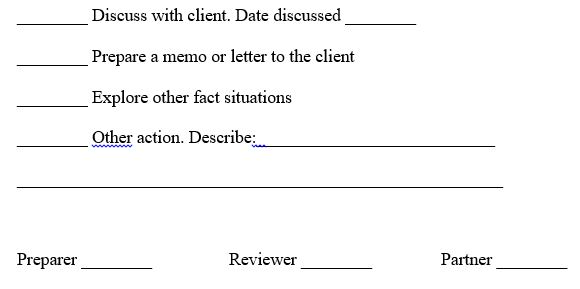

Actions to Be Taken

Stuck with your Case Study?

Get in touch with one of our experts for instant help!

Tags:

Time is precious

don’t waste it!

writing help!

Plagiarism-free

guarantee

Privacy

guarantee

Secure

checkout

Money back

guarantee